BGC Group (BGC) Valuation Check After Recent Share Price Pullback

BGC Group (BGC) has quietly slipped about 4% over the past month and 13% in the past 3 months, even though its underlying business continues to grow and may give investors an intriguing setup.

See our latest analysis for BGC Group.

Zooming out, BGC’s recent pullback sits within a year where the share price return has drifted modestly lower, even as its multi year total shareholder return remains strongly positive. This suggests momentum has cooled, but the longer term story is still constructive.

If BGC’s setup has you thinking about where else growth and re rating potential might emerge, now is a good moment to broaden your search and discover fast growing stocks with high insider ownership

With the share price easing back even as revenue keeps growing and Wall Street’s target sits far higher than today’s level, the key question is simple: is BGC now a mispriced opportunity or is future growth already reflected?

Most Popular Narrative: 38.8% Undervalued

With BGC Group last closing at $8.87 versus a narrative fair value of $14.50, the spread implies investors may be heavily discounting its long term earnings power.

Ongoing growth in data network and post trade services, bolstered by businesses like Lucera and Fenics Market Data, creates potential for new, higher margin recurring revenue streams as trading moves further into digital market infrastructure and as demand for analytics and compliance solutions increases, supporting margin expansion and topline diversification.

Want to see what powers that upside gap? The narrative leans on rapid revenue expansion, surging margins, and an earnings step change that could reset expectations. Curious?

Result: Fair Value of $14.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several risks could challenge that upside, particularly if trading volatility fades or if acquisition synergies and cost reductions fail to materialize as expected.

Find out about the key risks to this BGC Group narrative.

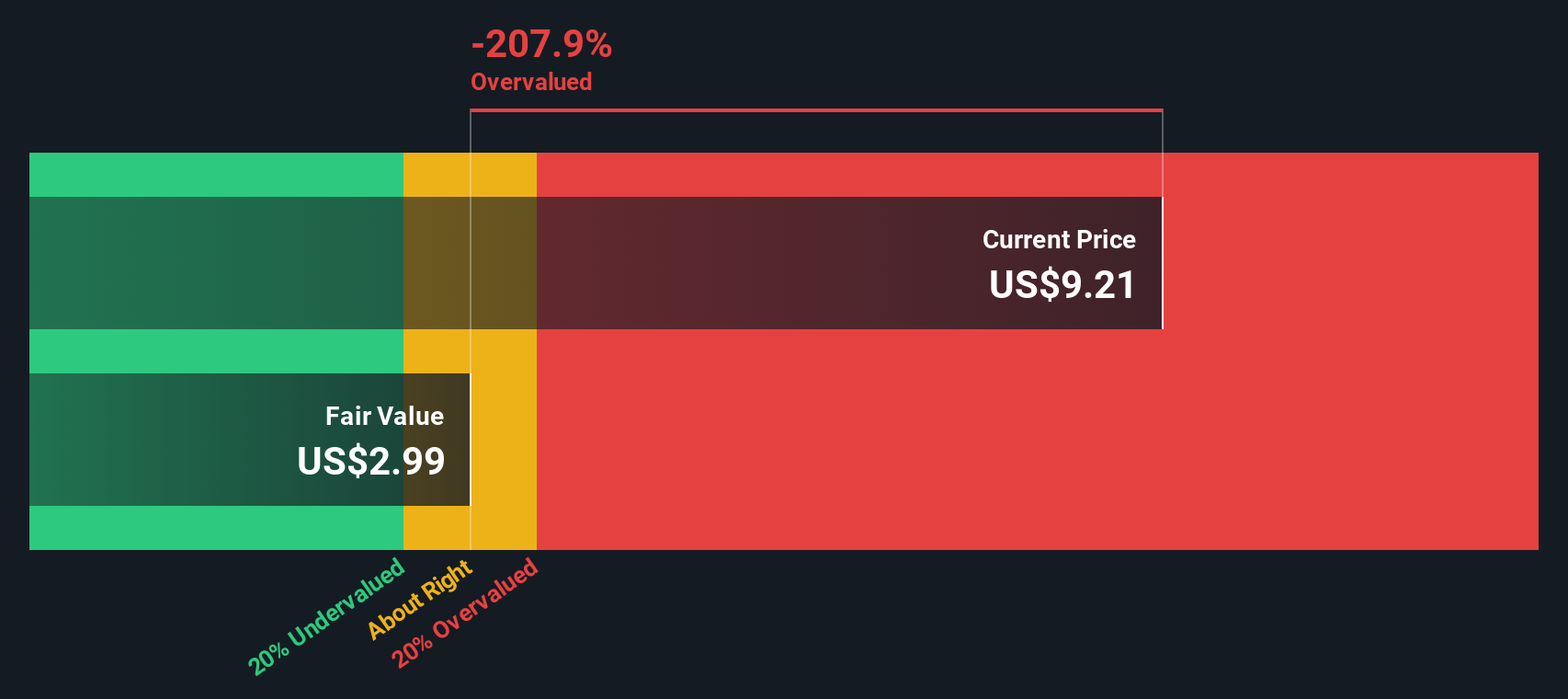

Another View: DCF Sends a Very Different Signal

Our DCF model paints a starkly different picture, suggesting BGC is trading well above its fair value around $2.95, which would make the stock look overvalued rather than cheap. Which narrative feels more realistic for the next few years of cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BGC Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BGC Group Narrative

If you see the story differently or want to test your own assumptions using the same data, you can build a full narrative in just minutes, Do it your way

A great starting point for your BGC Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing move?

Set yourself up for smarter opportunities by using the Simply Wall Street Screener to uncover targeted stock ideas you might regret overlooking later.

- Capture potential growth stories early by scanning these 3596 penny stocks with strong financials that pair smaller share prices with improving fundamentals and room for market re rating.

- Capitalize on powerful technology trends by filtering for these 26 AI penny stocks positioned at the intersection of innovation, data, and scalable software driven business models.

- Identify value focused opportunities by reviewing these 900 undervalued stocks based on cash flows where current prices differ from underlying cash flow strength and long term earnings potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com