Vastned (ENXTBR:VASTB) One‑Off Driven Earnings Surge Tests Bullish Growth Narrative

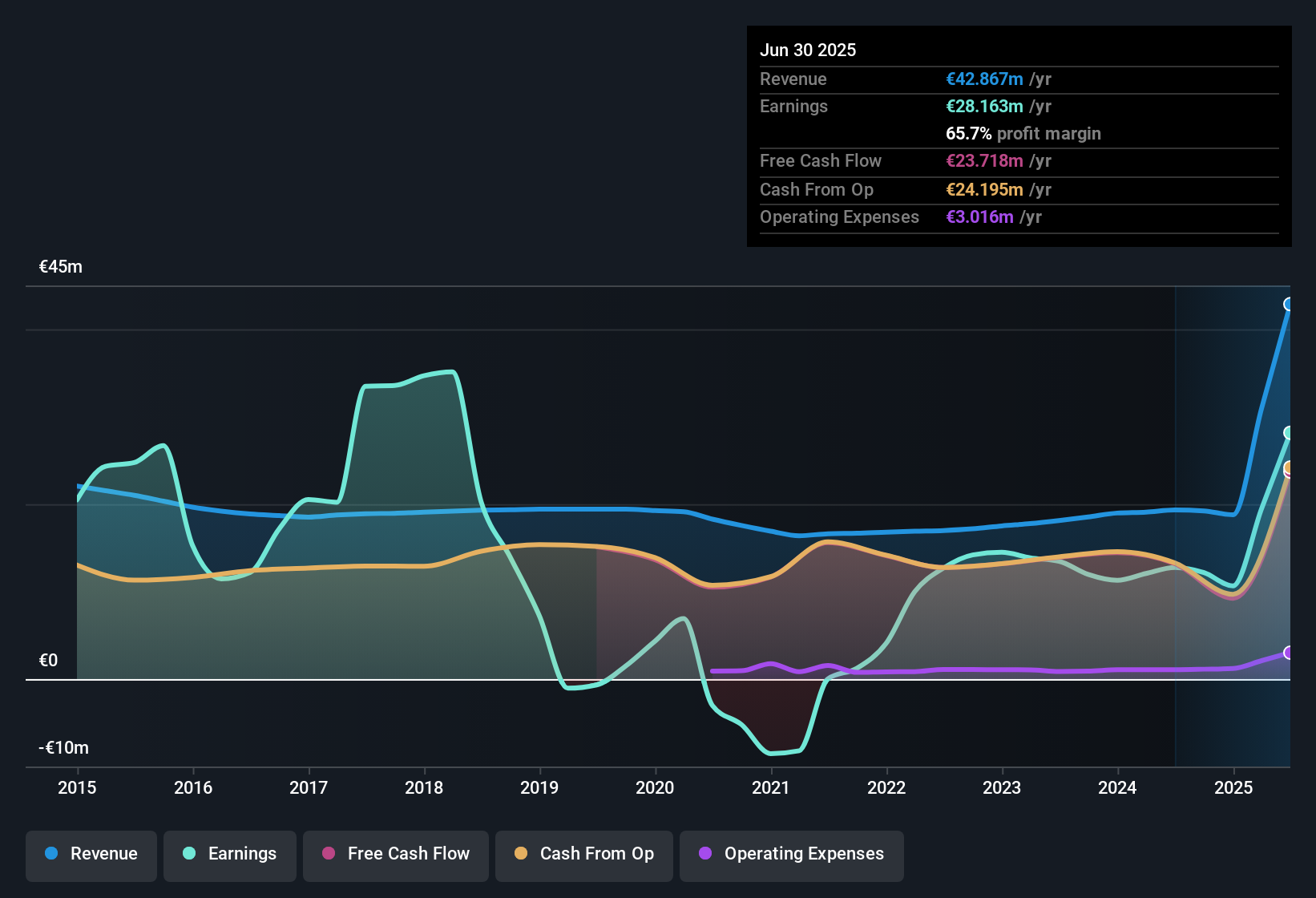

Vastned (ENXTBR:VASTB) has put solid numbers on the table for Q3 2025, with recent quarterly revenue sitting at about €16.9 million and EPS at roughly €0.81, backed by trailing twelve month revenue of €42.9 million and EPS of €2.65. The company has seen revenue move from €4.9 million in Q2 2024 to €16.9 million in Q2 2025, while EPS shifted from €0.87 to €0.81 over the same quarters. This sets the stage for investors to focus on how much of the headline growth is sustainable versus one off. Overall, margins look healthy enough to keep the story interesting, but the quality and durability of those margins will be front of mind this quarter.

See our full analysis for Vastned.With the headline figures in place, the next step is to line these results up against the prevailing narratives around Vastned, highlighting where the latest numbers support the consensus view and where they start to push back on it.

Curious how numbers become stories that shape markets? Explore Community Narratives

Revenue Jumps to €16.9m, Helped by One Offs

- Over the last twelve months, total revenue is €42.9 million with a net profit margin of 65.7 percent, and that profitability includes a sizeable €16.4 million one off gain.

- What is surprising for a bullish take is that while reported earnings grew about 120.8 percent over the past year and revenue is forecast to grow roughly 14.7 percent per year, part of that strength relies on the €16.4 million one off rather than purely on the recurring €16.9 million quarterly revenue run rate.

- This means the strong trailing EPS of €2.65 and the 65.7 percent margin are inflated by a gain that is not expected to repeat.

- At the same time, the forward looking story is still constructive, with earnings forecast to grow around 8.2 percent per year even without assuming another similar gain.

P/E Premium at 17.7x Versus Peers

- Vastned trades on a price to earnings ratio of 17.7 times, above both the European retail REITs industry average of 16.2 times and a peer average of 13.8 times, while the current share price of €30.80 sits slightly above a DCF fair value of about €30.50.

- Critics highlight that paying a premium multiple only makes sense if growth and cash generation really back it up, and the numbers here create a mixed picture.

- On the supportive side, forecast earnings growth of roughly 8.2 percent per year and forecast revenue growth of about 14.7 percent per year can justify some premium versus peers with slower outlooks.

- On the other hand, a fair value estimate that is marginally below the market price and the presence of a €16.4 million one off gain mean part of the recent 120.8 percent earnings jump is not a repeatable driver of that P/E.

Dividend at 5.52 Percent, but Coverage Looks Stretched

- The stock offers a dividend yield of about 5.52 percent, yet the payout is not well covered by free cash flow and interest payments are not well covered by earnings, with shareholders also experiencing substantial dilution over the past year.

- Bears argue that this combination of weak coverage and past dilution is a red flag for the income story, and the supporting figures underline why they focus on balance sheet resilience.

- Dividend strain is evident because cash generation lags the dividends being paid, so investors are relying on future growth and asset strength rather than current free cash flow to sustain that 5.52 percent yield.

- At the same time, limited earnings coverage of interest costs and the fact that earnings include a €16.4 million one off make it harder to treat the recent 120.8 percent earnings growth as a solid base for long term payouts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Vastned's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Vastned’s premium valuation, reliance on a large one off gain, weak dividend coverage, and stretched balance sheet all raise questions about durability.

If you want more reliable income backed by healthier fundamentals, use our these 1914 dividend stocks with yields > 3% to quickly find alternatives with stronger coverage and potentially more sustainable payouts than Vastned currently offers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com