American Tower (AMT): Valuation Check After Barclays Downgrade Versus Strong Q3 Earnings and Upgraded Guidance

American Tower (AMT) just got hit with a downgrade that puts 2026 growth risks and EchoStar rent exposure under the microscope, even though its latest quarter and updated guidance painted a much stronger near term picture.

See our latest analysis for American Tower.

At around $179.55, American Tower’s recent 7 day and 30 day share price gains have been overshadowed by a weaker 90 day share price return and a negative 1 year total shareholder return. This suggests momentum is fading as investors reassess 2026 risk despite fresh dividends and new debt financing.

If you are weighing AMT’s risk reward trade off, it might also be worth scanning fast growing stocks with high insider ownership to see which other names the market is rewarding for stronger growth and aligned insiders.

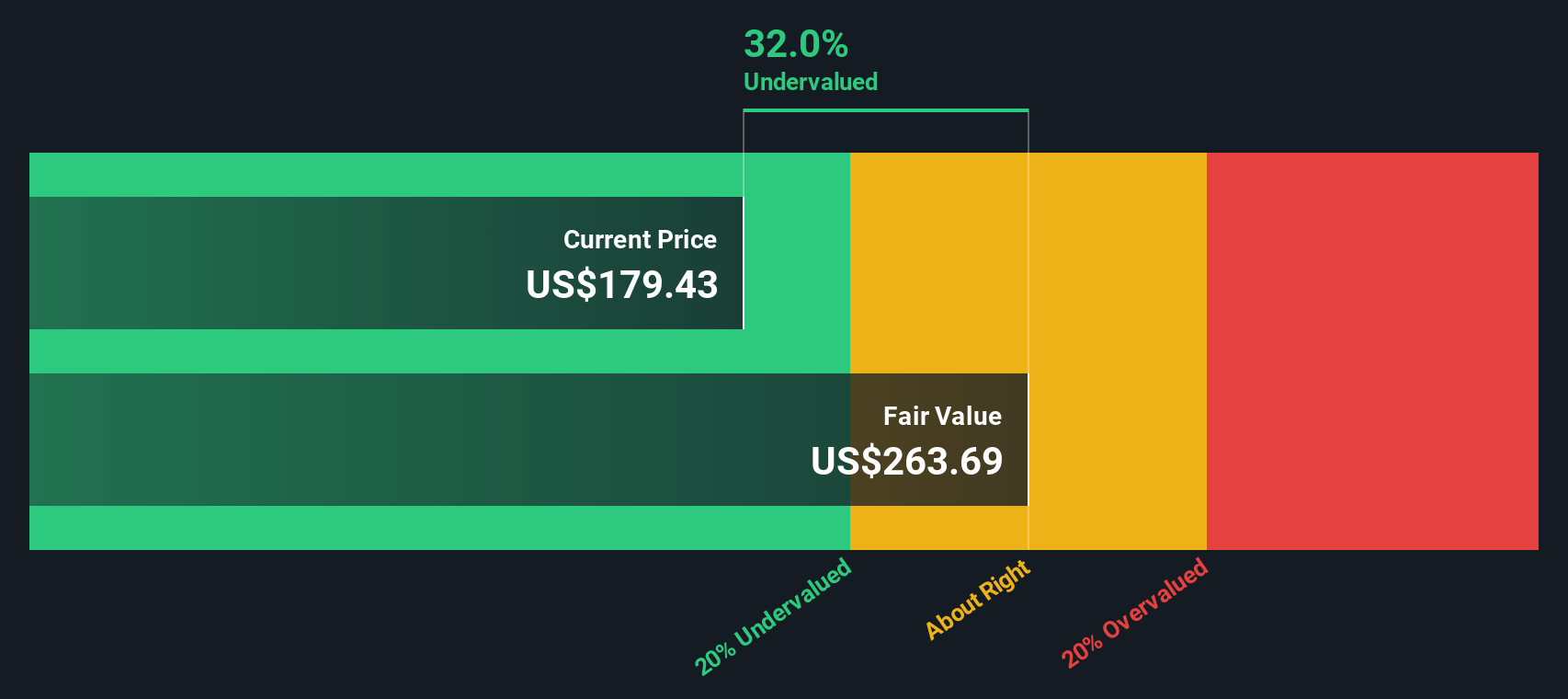

With shares still trading at a sizeable discount to analyst targets despite solid earnings, rising dividends and fresh debt refinancing, is American Tower quietly undervalued here, or is the market correctly pricing in the 2026 growth risks?

Price-to-Earnings of 28.6x: Is it justified?

On a last close of $179.55, American Tower screens as undervalued versus peers when judged on earnings, despite recent share price underperformance.

The key lens here is the price to earnings multiple, which compares the company’s share price to the profits it generates for each share.

AMT trades on a 28.6x price to earnings ratio, cheaper than the peer average of 40x and below the estimated fair price to earnings ratio of 32.9x. This suggests the market is not fully pricing its earnings strength. It still sits slightly richer than the broader US Specialized REITs industry on 27.9x, which implies investors are willing to pay a modest premium versus the sector while still discounting it against closer peers.

Explore the SWS fair ratio for American Tower

Result: Price-to-Earnings of 28.6x (UNDERVALUED).

However, lingering concerns around 2026 growth, EchoStar rent exposure and structurally weaker multi year share returns could still justify today’s valuation discount.

Find out about the key risks to this American Tower narrative.

Another Take: Our DCF View

On our numbers, the SWS DCF model is even more generous than the earnings multiple. With American Tower at $179.55 and our fair value estimate at $263.01, the stock currently appears deeply undervalued. This raises the question of whether the market is missing something or whether the model is too optimistic on long term growth and cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Tower for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Tower Narrative

If you see the story differently and want to dig into the numbers yourself, you can build a custom view in minutes. Do it your way.

A great starting point for your American Tower research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity. Use the Simply Wall St Screener to uncover fresh, data backed ideas that could reshape your portfolio’s next leg higher.

- Capture potential mispricings by scanning these 900 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Explore structural technology trends by targeting these 26 AI penny stocks positioned in the artificial intelligence space.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that aim to deliver reliable, above market yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com