Taking Stock of DuPont (DD) After the Qnity Electronics Spin-Off: What Does the New Valuation Signal?

The recent spin off of DuPont de Nemours (DD) Electronics into Qnity Electronics in November has refocused the stock, with investors now weighing what a leaner and more specialized DuPont might deliver next.

See our latest analysis for DuPont de Nemours.

Since the Qnity spin off, DuPont’s share price return has been choppy, with a steep year to date pullback contrasting with a solid multi year total shareholder return. This suggests that longer term momentum has not fully broken.

If this portfolio reshuffle has you thinking more broadly about where growth and resilience might show up next, it could be worth exploring fast growing stocks with high insider ownership.

With DuPont now trading slightly below analyst targets despite years of strong total returns, investors face a key question: Is the post spin off lull a temporary mispricing, or is the market already baking in the next leg of growth?

Most Popular Narrative: 14.1% Undervalued

With DuPont de Nemours last closing at $40.61 against a narrative fair value of $47.25, the prevailing view frames the current pricing as a discount that hinges on execution in a narrower, higher margin portfolio.

DuPont's accelerated growth in Electronics, particularly from AI-driven applications, advanced packaging, and high-performance computing, positions the company to capture outsized revenue expansion as node migrations and broader electronics market recovery unfold through 2025 and beyond. Persistent strength and strategic investment in Healthcare & Water, driven by surging global demand for clean water solutions and healthcare products, leverages favorable demographic, sustainability, and infrastructure trends to drive above-peer organic revenue growth and margin stability.

Curious how modest top line assumptions still lead to a richer earnings profile and a premium future multiple for a chemicals name, not a software giant? The narrative leans heavily on a sharper mix shift, fatter margins, and a bold view on where DuPont’s earnings power could land a few years from now, but keeps the exact trajectory under the hood. Want to see which specific earnings and margin path is being used to justify that higher fair value and what kind of rerating it implies?

Result: Fair Value of $47.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering PFAS liabilities and heavy exposure to China mean legal or geopolitical shocks could quickly derail the margin and rerating story that investors are banking on.

Find out about the key risks to this DuPont de Nemours narrative.

Another Angle on Valuation

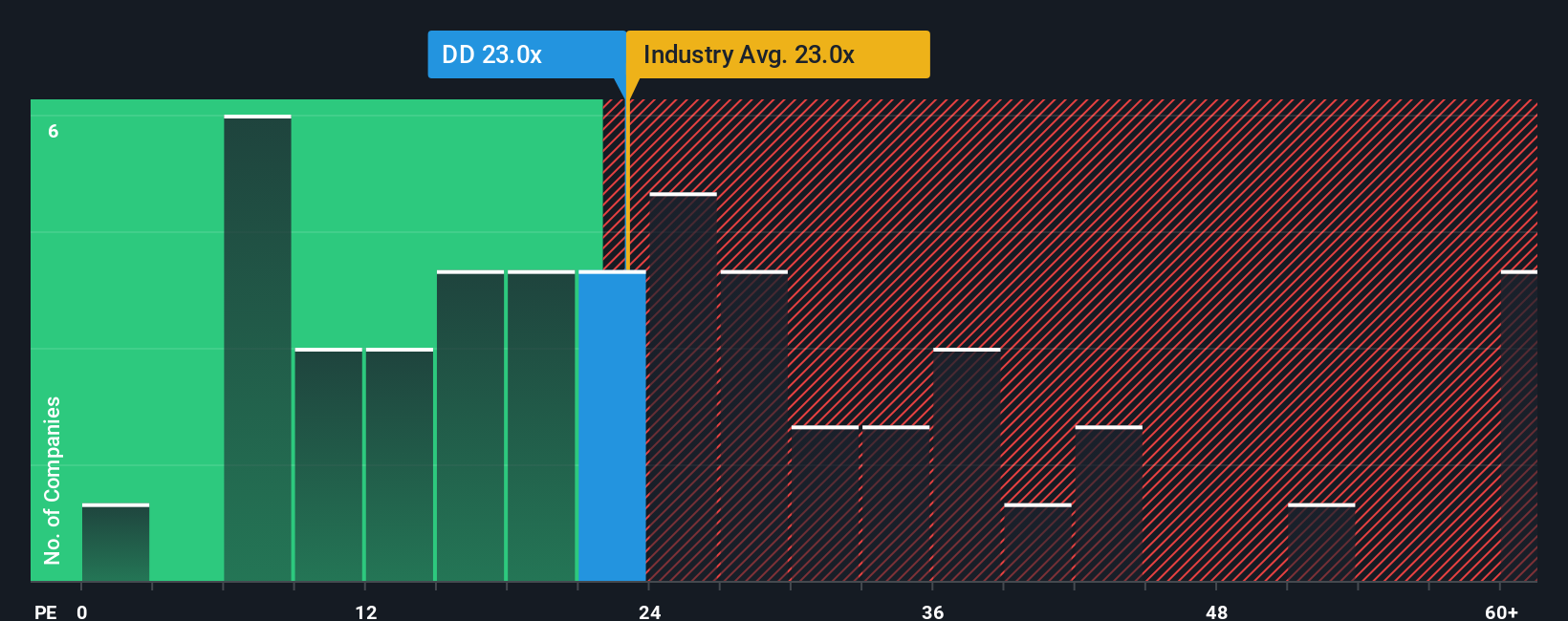

On earnings, DuPont looks only slightly stretched, trading at 23.4 times versus a fair ratio of 22.6 times and almost identical to the US Chemicals average of 23.4 times. That leaves little safety margin, so is the upside narrative worth this thin valuation cushion?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DuPont de Nemours Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can create a tailored narrative in just a few minutes: Do it your way.

A great starting point for your DuPont de Nemours research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winners by scanning focused stock ideas on Simply Wall St that match the kind of edge you are seeking.

- Capture early stage upside by targeting quality names among these 3595 penny stocks with strong financials that already back their promise with solid balance sheets and improving fundamentals.

- Position your portfolio at the heart of the productivity boom by zeroing in on these 26 AI penny stocks poised to benefit as AI adoption accelerates worldwide.

- Accelerate your hunt for mispriced opportunities by filtering for these 900 undervalued stocks based on cash flows where market expectations still lag behind the strength of their cash flow outlooks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com