Assessing Azenta (AZTA) Valuation After Meros’ New Stake and Margin Expansion Progress

Meros Investment Management’s new stake in Azenta (AZTA), worth about 4.6 million dollars and 2% of its U.S. equity book, has put fresh attention on the company after its latest year end results.

See our latest analysis for Azenta.

The Meros stake and Azenta’s margin progress seem to be turning sentiment, with a roughly 18% 1 month share price return to 35.60 dollars, standing in contrast to a weaker 1 year total shareholder return. This suggests momentum is tentatively rebuilding from a low base.

If Azenta’s story has you rethinking healthcare exposure, it could be worth exploring other life sciences and medical names through our curated healthcare stocks and seeing what else fits your strategy.

With margins climbing and a respected hedge fund stepping in, Azenta now trades only modestly below analyst targets. This raises the key question: is this a genuine entry point, or is future growth already priced in?

Most Popular Narrative Narrative: 10.6% Undervalued

Compared to the last close at 35.60 dollars, the most popular narrative argues Azenta’s fair value sits meaningfully higher, hinging on specific growth and margin shifts.

The ongoing trend of life sciences digitization and automation is reflected in Azenta's improved operational execution and introduction of more automated solutions. These efficiency gains, alongside investments in R&D and product management, are producing significant gross margin and EBITDA margin expansion, pointing to further net margin improvements with scale.

Curious how modest headline growth expectations can still justify a premium valuation multiple, rising margins, and richer sector style pricing power over time, read on.

Result: Fair Value of $39.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent budget constraints and delayed equipment orders, along with softness in legacy sequencing services, could easily derail margins and temper the recent optimism.

Find out about the key risks to this Azenta narrative.

Another Way to Look at Valuation

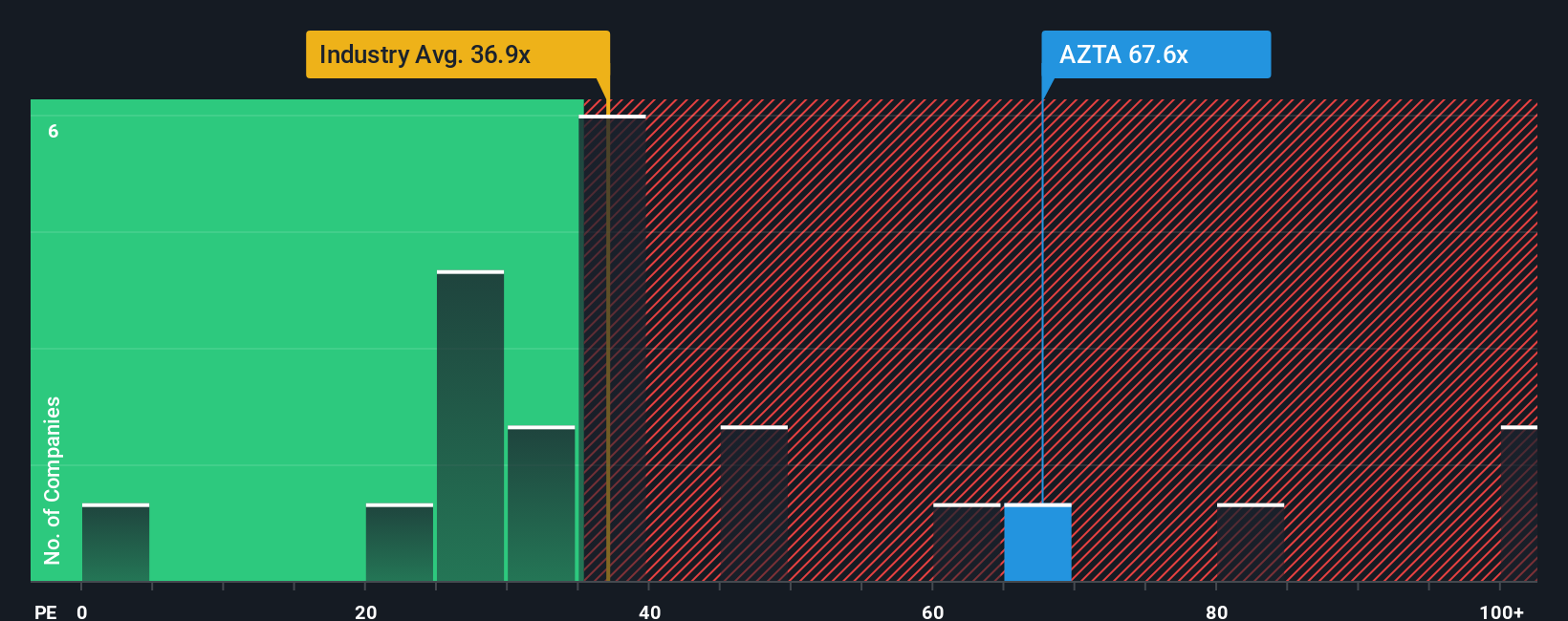

While the narrative sees roughly 11% upside to fair value, our ratio lens is far less generous. Azenta trades on a steep 66.9 times earnings, almost double the industry at 34.1 times and far above its 18.2 times fair ratio. This implies meaningful de rating risk if optimism fades.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Azenta Narrative

If this view does not fully align with your own or you prefer independent analysis, you can quickly craft a personalized narrative in just minutes, Do it your way.

A great starting point for your Azenta research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop at a single opportunity, use the Simply Wall Street Screener to uncover fresh stocks that fit your strategy before the market fully catches on.

- Capture potential mispricings early by scanning these 900 undervalued stocks based on cash flows that may offer attractive upside before sentiment shifts.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned to benefit from accelerating adoption of intelligent technologies.

- Lock in dependable income streams by reviewing these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s yield without sacrificing quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com