Nayax (TASE:NYAX) Valuation Check After Strong 1-Month Share Price Momentum

Nayax (TASE:NYAX) has been quietly reshaping payments for unattended retail, and its recent share performance is starting to reflect that shift, with gains over the past month standing out despite mixed shorter term moves.

See our latest analysis for Nayax.

That backdrop makes the recent 12.84% 1 month share price return look more like momentum building than a blip, especially with a 33.52% year to date share price return and 45.89% 1 year total shareholder return reinforcing a solid longer term trend.

If Nayax has you rethinking where growth could come from next, it is worth exploring high growth tech and AI stocks as another way to spot potential winners in similar themes.

Still, with solid double digit growth and an intrinsic value estimate suggesting the shares trade at a discount, investors must ask: Is Nayax quietly undervalued, or are markets already pricing in its next wave of expansion?

Most Popular Narrative: 5.6% Undervalued

With Nayax last closing at ₪145 and the most followed narrative pointing to fair value around ₪153.68, the story hinges on how fast recurring revenue and margins can scale from here.

Growth in ecosystem lock in, driven by the embedding of Nayax's payment platforms inside OEM devices and diversification of value added services (including SaaS, embedded banking, and business management), is likely to lift ARPU, reduce customer churn, and drive scalable operating leverage, supporting sustainable margin expansion and earnings growth.

Curious how this ecosystem lock in, steep earnings ramp, and richer margins combine into that fair value math? Want to see the projections powering this call?

Result: Fair Value of $153.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory scrutiny and intensifying competition in digital payments could compress margins and slow the recurring revenue growth that underpins that undervaluation case.

Find out about the key risks to this Nayax narrative.

Another Lens on Valuation

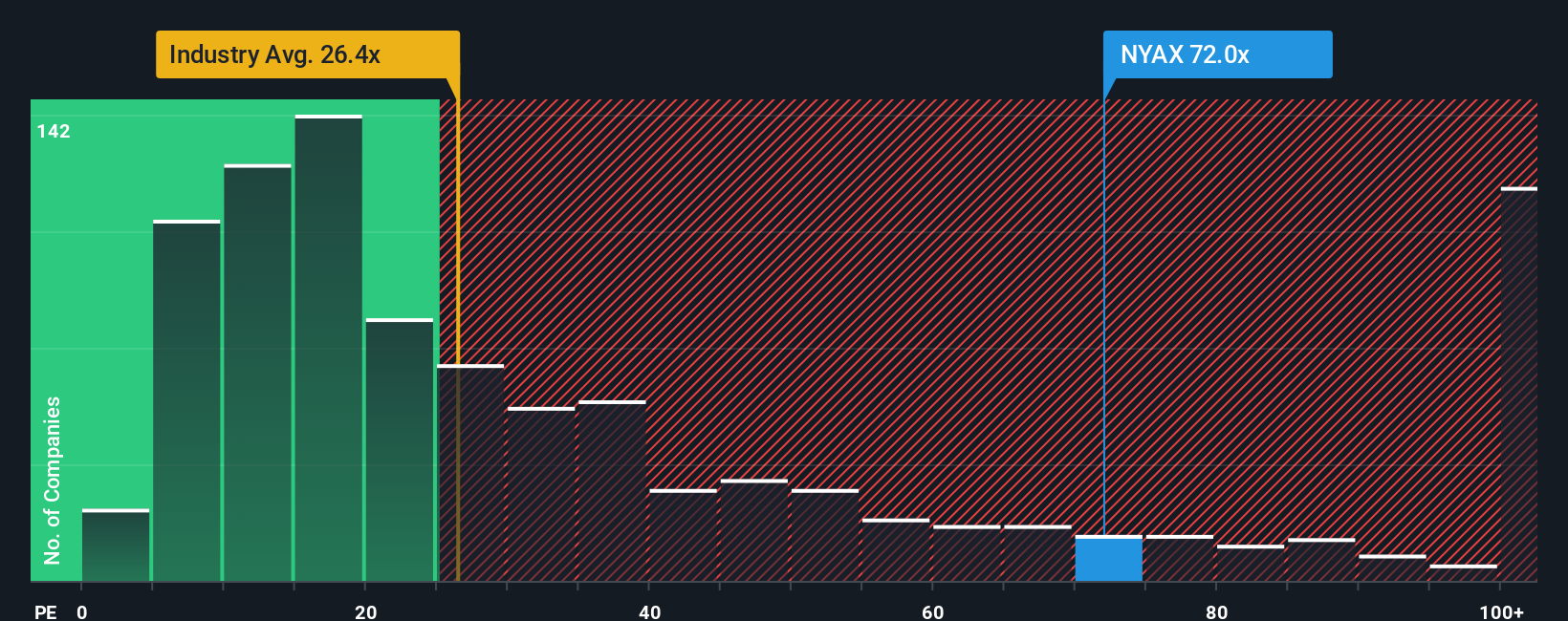

On earnings based measures, Nayax looks anything but cheap. Its price to earnings ratio of 69.1x compares with 26.5x for the wider Asian electronics space and 34.3x for peers, and is even above its own 54.3x fair ratio. This raises questions about how much good news is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nayax Narrative

If this perspective does not fully match your view or you would rather dig into the numbers yourself, you can shape a fresh narrative in just a few minutes, Do it your way.

A great starting point for your Nayax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Nayax, expand your opportunity set now using the Simply Wall St Screener so you do not miss the next standout investment story.

- Capture powerful growth potential early by scanning these 26 AI penny stocks that focus on automation, data analytics, and intelligent software across global markets.

- Strengthen your income strategy by reviewing these 15 dividend stocks with yields > 3% that aim to combine sustainable payouts with resilient business models across sectors.

- Position yourself ahead of shifting market narratives by analysing these 80 cryptocurrency and blockchain stocks at the forefront of blockchain infrastructure, digital payments, and decentralized applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com