Undiscovered Gems In Asia To Watch December 2025

As global markets anticipate potential interest rate cuts from the Federal Reserve, small-cap stocks in Asia are garnering attention amid a backdrop of mixed economic signals, such as contracting manufacturing activity and expanding services sectors. In this environment, identifying promising stocks often involves looking for companies that demonstrate resilience and adaptability to shifting economic landscapes while maintaining strong fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Allmed Medical ProductsLtd | 13.03% | -2.37% | -30.93% | ★★★★★★ |

| Gem-Year IndustrialLtd | NA | -3.47% | -34.40% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Quality Reliability Technology | 18.75% | 0.46% | -43.08% | ★★★★★★ |

| Suzhou Sepax Technologies | 1.11% | 20.70% | 32.08% | ★★★★★★ |

| SEC Electric Machinery | NA | -5.40% | -44.23% | ★★★★★★ |

| CHANGE HoldingsInc | 60.04% | 28.69% | 12.70% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Kung Sing Engineering | 15.19% | 10.12% | -35.75% | ★★★★★☆ |

| Anfu CE LINK | 70.49% | 7.92% | -8.47% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Guomai Technologies (SZSE:002093)

Simply Wall St Value Rating: ★★★★★★

Overview: Guomai Technologies, Inc. provides a range of services including internet of things technology, consulting and design, science park operation and development, as well as education services in China with a market cap of CN¥13.34 billion.

Operations: Guomai Technologies generates revenue primarily from its services in internet of things technology, consulting and design, science park operation and development, and education. The company has reported a net profit margin of 12.5% in its recent financial period.

Guomai Technologies, a nimble player in the IT sector, showcases impressive growth with earnings rising 32% over the past year, outpacing the industry average of -13%. The company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio was 2.9%. With a price-to-earnings ratio of 61.6x compared to the industry’s 111.4x, it appears attractively valued. Recent results for nine months ending September 2025 show net income climbing to CNY195.96 million from CNY148.11 million last year, indicating strong momentum and high-quality earnings that could continue driving future growth prospects.

Beijing China Sciences Runyu Environmental Technology (SZSE:301175)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing China Sciences Runyu Environmental Technology Co., Ltd. operates in the environmental technology sector and has a market cap of CN¥8.68 billion.

Operations: The company generates revenue primarily from its environmental technology services, with a focus on innovative solutions. It has a market cap of CN¥8.68 billion.

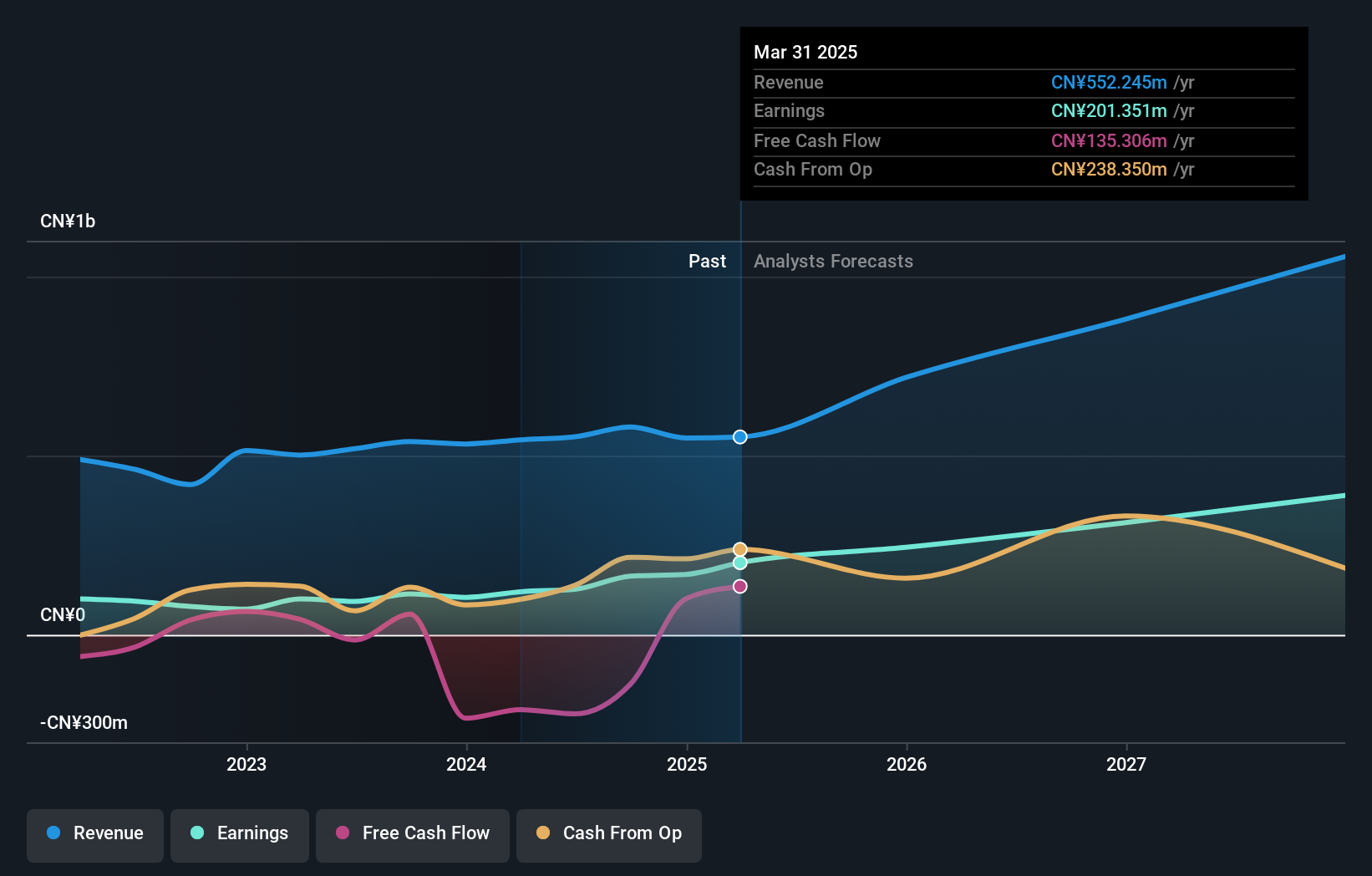

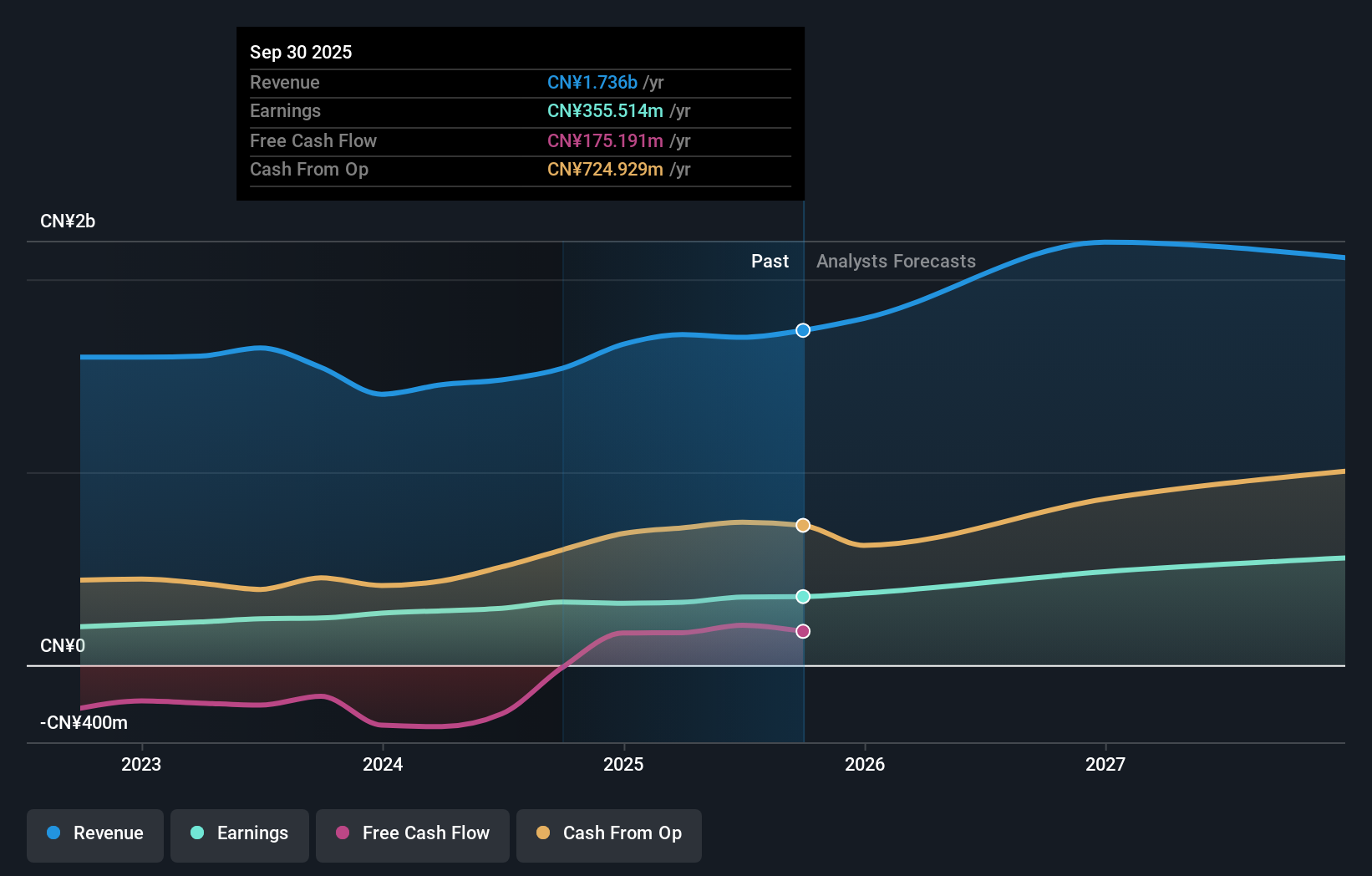

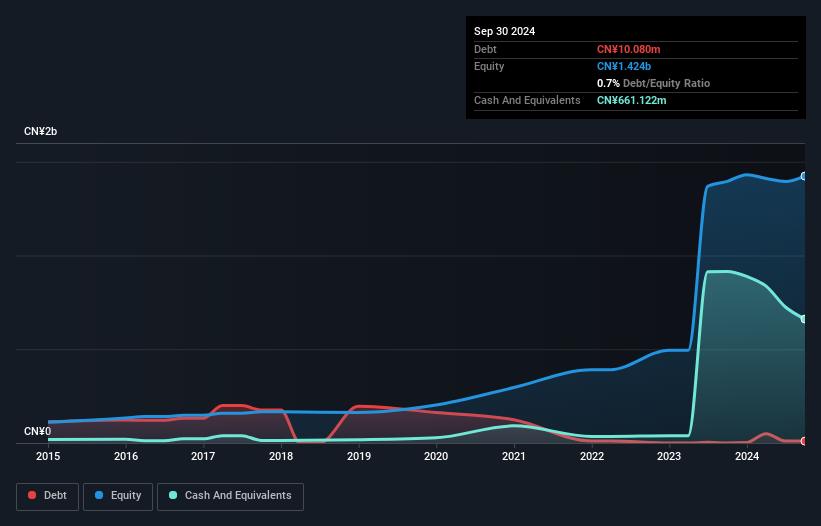

Beijing China Sciences Runyu Environmental Technology, a promising player in the environmental sector, reported earnings growth of 8.8% over the past year, outpacing the industry average of 0.09%. The company has seen its debt-to-equity ratio improve from 90% to 72.5% over five years, though its net debt to equity remains high at 48.4%. With a price-to-earnings ratio of 24.4x below the CN market average of 44x and free cash flow turning positive recently at CNY175 million in September, it seems well-positioned for future growth despite carrying significant debt levels.

Hengbo HoldingsLtd (SZSE:301225)

Simply Wall St Value Rating: ★★★★★★

Overview: Hengbo Holdings Co., Ltd. specializes in the research, development, production, and sale of internal combustion engine air intake and HEV intake systems for automobiles, motorcycles, and general machinery with a market cap of approximately CN¥11.20 billion.

Operations: Hengbo Holdings generates revenue primarily from its Auto Parts & Accessories segment, amounting to CN¥982.33 million. The company's financial performance is highlighted by a notable trend in its net profit margin, which provides insights into profitability relative to revenue.

Hengbo Holdings, a relatively small player in the auto components sector, reported impressive earnings growth of 13.3% over the past year, outpacing the industry average of 8%. The company's financial health seems robust with more cash than total debt and a significantly reduced debt-to-equity ratio from 49.1% to just 0.2% over five years. However, its free cash flow remains negative, which could be a concern for potential investors. Recent changes to its articles of association might indicate strategic shifts or governance enhancements that could impact future operations positively or negatively.

- Navigate through the intricacies of Hengbo HoldingsLtd with our comprehensive health report here.

Assess Hengbo HoldingsLtd's past performance with our detailed historical performance reports.

Next Steps

- Click here to access our complete index of 2487 Asian Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com