Asian Dividend Stocks To Watch In December 2025

As global markets navigate the complexities of interest rate expectations and economic slowdowns, Asian indices have shown resilience, with technology and AI sectors driving gains despite broader concerns. In this environment, dividend stocks in Asia present a compelling opportunity for investors seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.79% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.68% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| NCD (TSE:4783) | 4.36% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.74% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.61% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.42% | ★★★★★★ |

Click here to see the full list of 1022 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

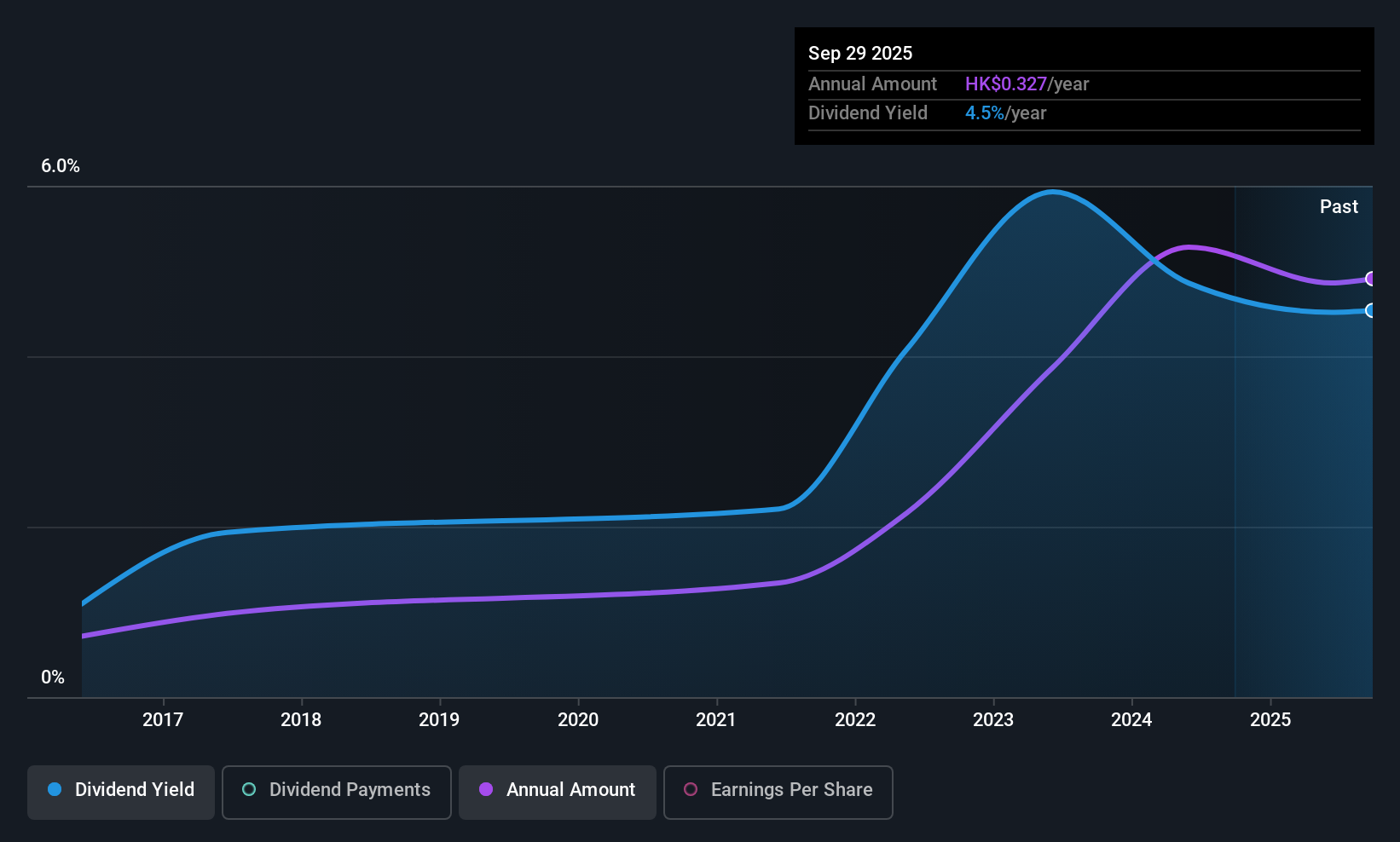

First Tractor (SEHK:38)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Tractor Company Limited specializes in the manufacturing and sale of agricultural and power machinery, with a market cap of HK$14.08 billion.

Operations: First Tractor Company Limited generates revenue from its core operations in the manufacturing and sale of agricultural machinery and power machinery.

Dividend Yield: 4.2%

First Tractor's dividend is supported by earnings and cash flows, with payout ratios at 50.7% and 72.8% respectively, indicating sustainability despite a volatile track record over the past decade. The dividend yield of 4.17% lags behind top-tier payers in Hong Kong but is balanced by a favorable price-to-earnings ratio of 9.9x compared to the market average of 12.3x, suggesting good relative value for investors seeking income opportunities in Asia's industrial sector.

- Dive into the specifics of First Tractor here with our thorough dividend report.

- Our valuation report unveils the possibility First Tractor's shares may be trading at a discount.

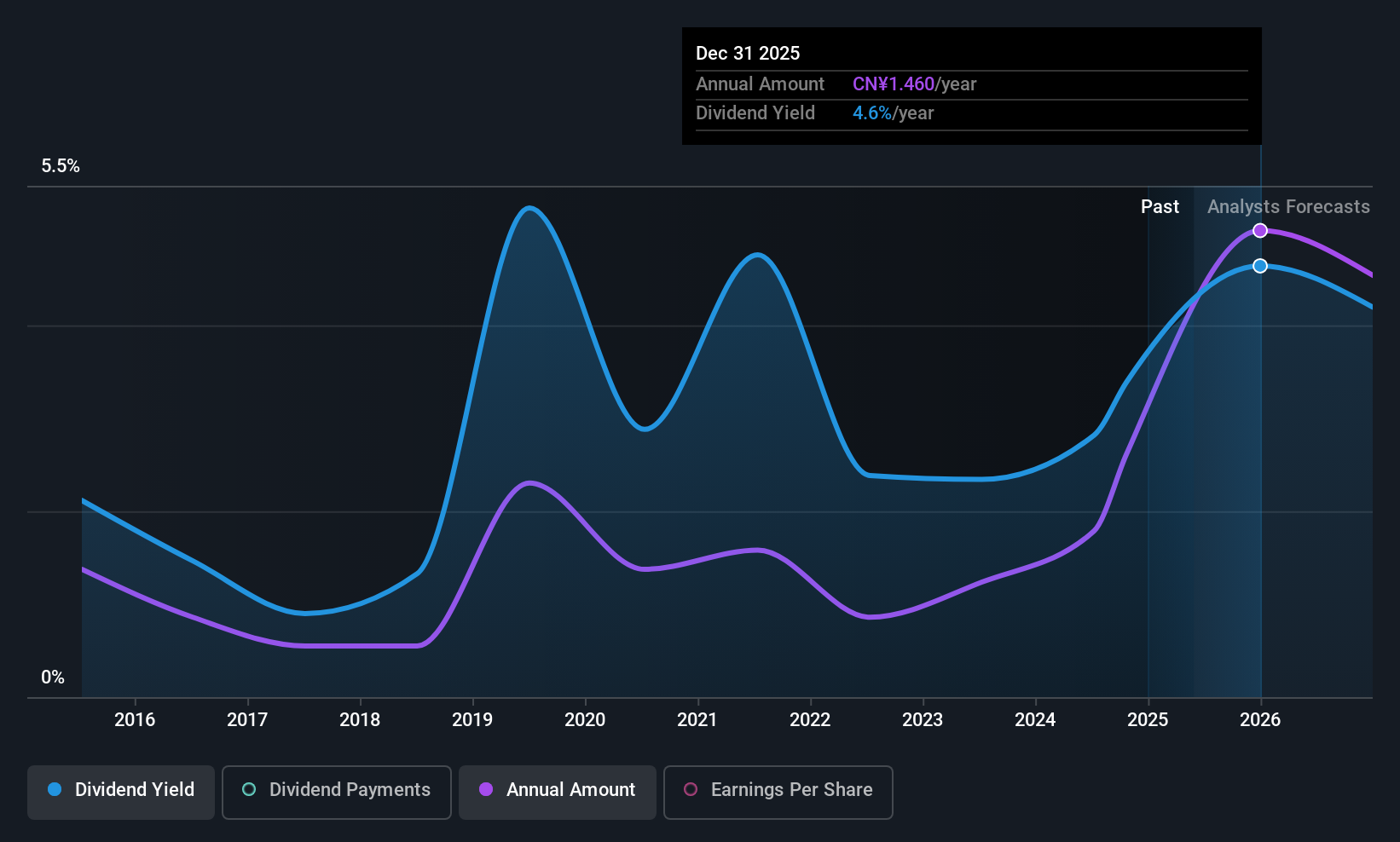

Neway Valve (Suzhou) (SHSE:603699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Neway Valve (Suzhou) Co., Ltd. is engaged in the research, development, production, and sale of industrial valves both within China and internationally, with a market cap of CN¥38.40 billion.

Operations: Neway Valve (Suzhou) Co., Ltd. generates revenue of CN¥7.39 billion from its operations in the valve industry.

Dividend Yield: 3.1%

Neway Valve (Suzhou) has seen dividend growth over the past decade, though payments have been volatile and unreliable. Despite a high payout ratio of 92%, dividends are covered by cash flows with a reasonable cash payout ratio of 58.9%. The current yield of 3.07% ranks in the top quarter of CN market dividend payers, yet sustainability concerns persist due to inadequate earnings coverage. Trading at a price-to-earnings ratio of 26.6x, it offers good relative value compared to peers and industry averages.

- Navigate through the intricacies of Neway Valve (Suzhou) with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Neway Valve (Suzhou) is trading behind its estimated value.

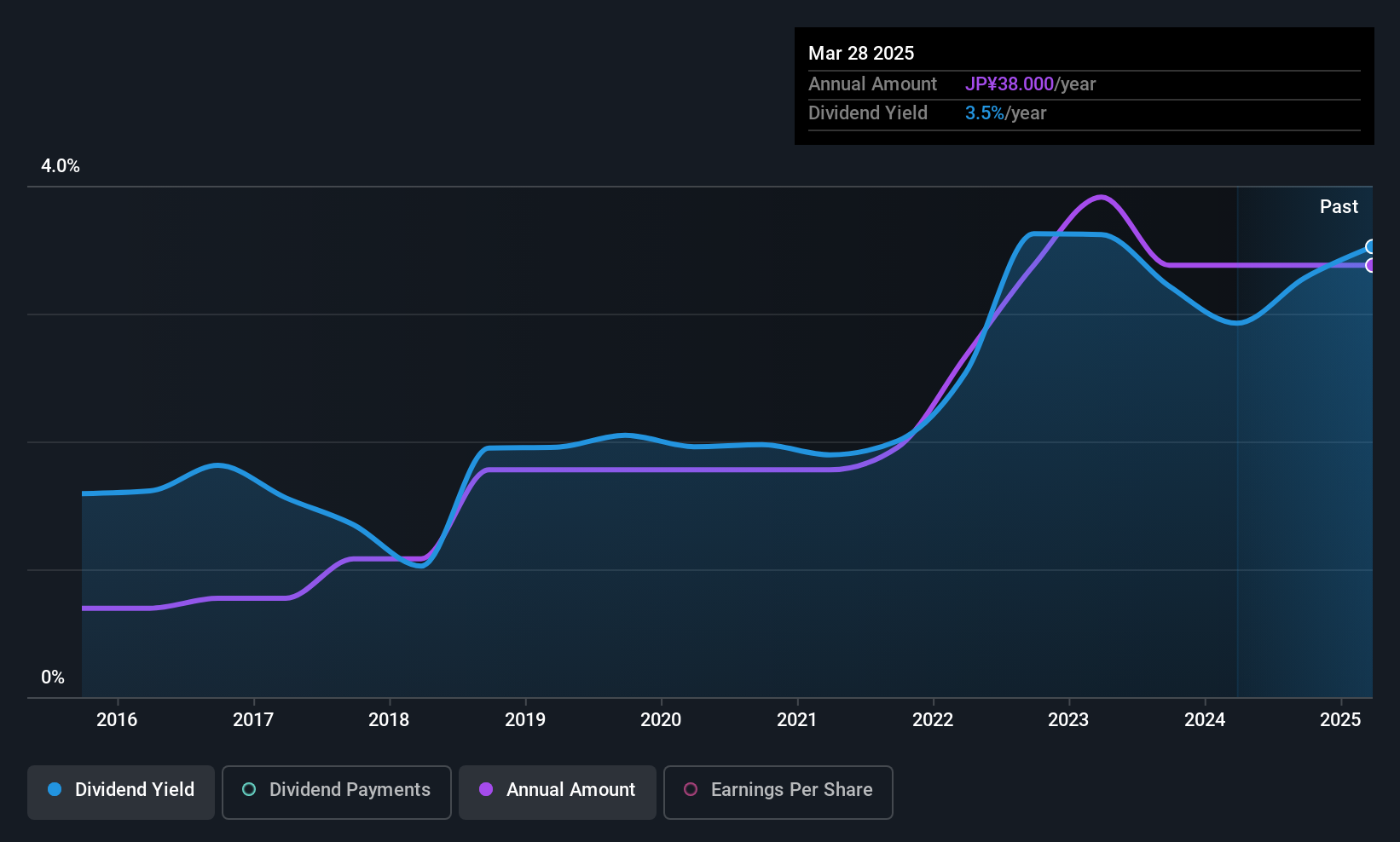

GEOLIVE Group (TSE:3157)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GEOLIVE Group Corporation, with a market cap of ¥19.68 billion, operates in Japan through its subsidiaries by selling building materials, plywood, housing equipment, and DIY products.

Operations: GEOLIVE Group Corporation generates revenue primarily from its Housing Material Sales segment, which accounts for ¥174.62 million.

Dividend Yield: 3.2%

GEOLIVE Group's dividend payments have been volatile and unreliable over the past decade, despite growth during this period. The dividends are well covered by earnings (payout ratio: 23.5%) and cash flows (cash payout ratio: 34.6%), suggesting sustainability in the near term. With a price-to-earnings ratio of 8.1x, GEOLIVE is valued attractively compared to the JP market average of 14.1x, although its dividend yield of 3.24% trails behind top-tier payers in Japan at 3.66%.

- Click to explore a detailed breakdown of our findings in GEOLIVE Group's dividend report.

- In light of our recent valuation report, it seems possible that GEOLIVE Group is trading beyond its estimated value.

Where To Now?

- Click through to start exploring the rest of the 1019 Top Asian Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com