Asian Growth Companies With High Insider Ownership

In the current economic landscape, Asian markets have been navigating a mix of challenges and opportunities, with China's manufacturing sector showing signs of contraction while technology and AI sectors continue to drive investor enthusiasm. Amidst these conditions, growth companies with high insider ownership can offer unique insights into potential long-term value creation, as insiders often have a vested interest in the success of their businesses.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 93.1% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's explore several standout options from the results in the screener.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

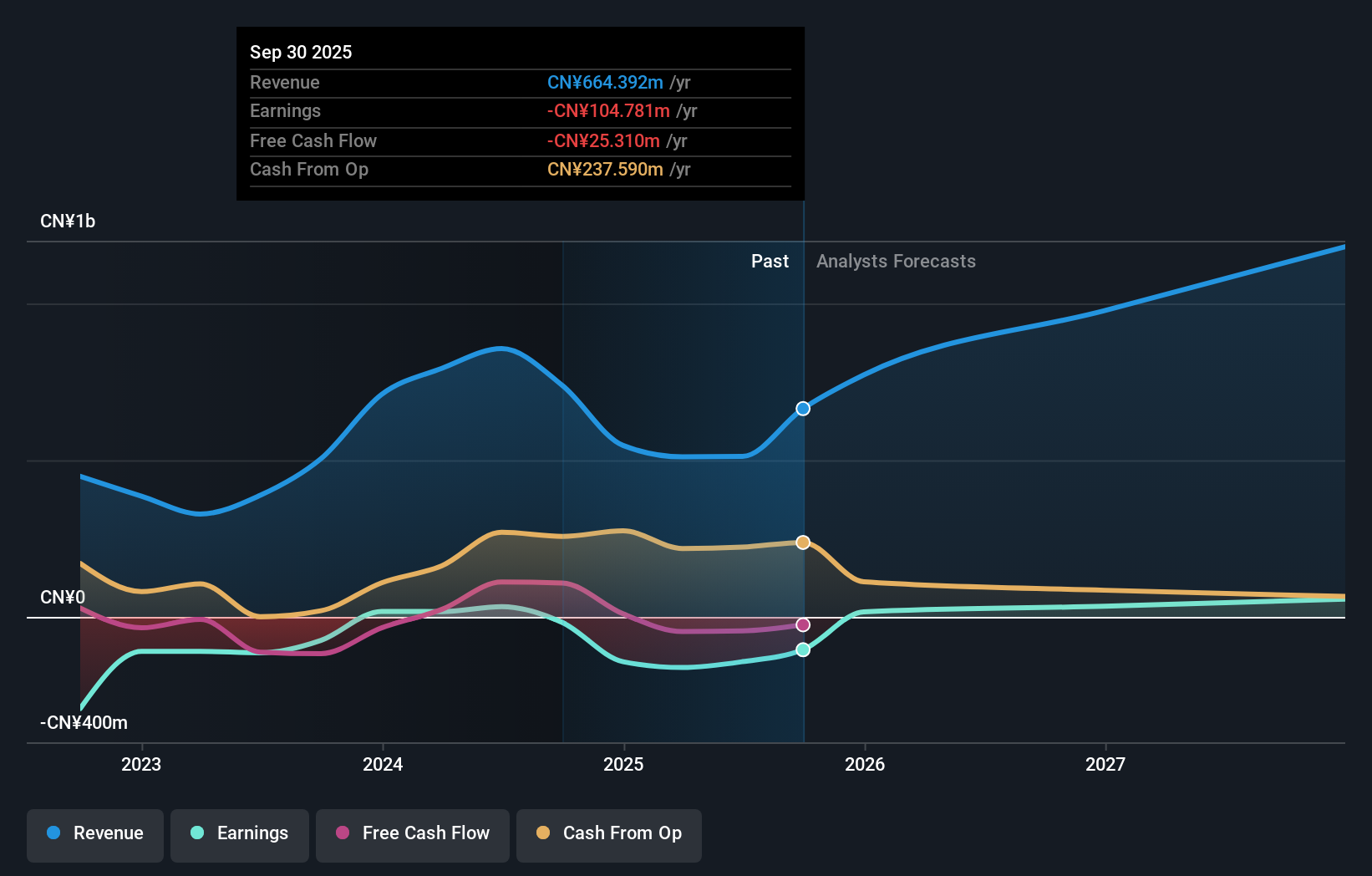

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning business, with a market cap of HK$49.58 billion.

Operations: Kingdee's revenue is primarily derived from its enterprise resource planning business, with total revenues amounting to CN¥null.

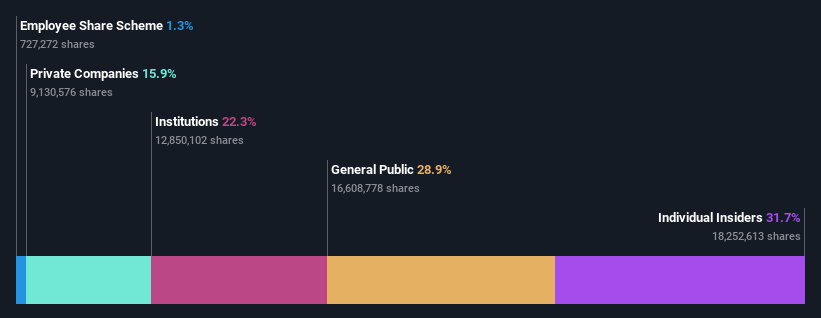

Insider Ownership: 19.9%

Kingdee International Software Group shows potential as a growth company with high insider ownership. Earnings are forecast to grow 45.42% annually, and the company is expected to become profitable within three years, outpacing average market growth. Revenue is projected to increase by 14% per year, surpassing the Hong Kong market rate. While there has been substantial insider buying over the past three months, analysts agree on a 35.4% stock price rise potential despite low forecasted return on equity at 6%.

- Delve into the full analysis future growth report here for a deeper understanding of Kingdee International Software Group.

- The analysis detailed in our Kingdee International Software Group valuation report hints at an inflated share price compared to its estimated value.

Shanghai Skychem Technology (SHSE:688603)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Skychem Technology Co., Ltd. focuses on the research, development, production, and sales of functional wet electronic chemicals with a market cap of CN¥10.04 billion.

Operations: The company generates revenue from its specialty chemicals segment, totaling CN¥441.56 million.

Insider Ownership: 39.1%

Shanghai Skychem Technology demonstrates strong growth potential with earnings forecasted to rise 37.3% annually, outpacing the Chinese market's average. Revenue is expected to grow at 25.5% per year, also surpassing market rates. Despite high volatility in share price and a low projected return on equity of 12.8%, recent financial results show increased sales and net income for the first nine months of 2025 compared to the previous year, highlighting its upward trajectory.

- Take a closer look at Shanghai Skychem Technology's potential here in our earnings growth report.

- According our valuation report, there's an indication that Shanghai Skychem Technology's share price might be on the expensive side.

Hwa Create (SZSE:300045)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hwa Create Corporation is engaged in the research, development, manufacturing, and sale of satellite navigation as well as radar and communication products and technologies, with a market cap of CN¥16.37 billion.

Operations: The company's revenue is derived from its operations in satellite navigation and radar and communication products and technologies.

Insider Ownership: 32.9%

Hwa Create shows promising growth potential with revenue forecasted to grow at 24.6% annually, surpassing the Chinese market average. Recent financial results reveal a significant turnaround, with sales reaching CNY 563.98 million and net income of CNY 9.39 million for the first nine months of 2025, compared to a net loss previously. Despite low projected return on equity and no recent insider trading activity, its profitability outlook strengthens its position as a growth-focused company in Asia.

- Click here to discover the nuances of Hwa Create with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Hwa Create is trading beyond its estimated value.

Make It Happen

- Gain an insight into the universe of 637 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com