SpaceX and Anduril Are Teaming Up with 1 Little-Known Stock. Should You Buy Its Shares Today?

Velo3D (VELO) shares ended more than 30% higher today after the metal additive manufacturing specialist announced strategic partnerships with both SpaceX and Anduril.

The rally pushed VELO’s relative strength index (14-day) into the overbought territory (71.33), signaling a potential pullback in the near-term.

What SpaceX and Anduril Deals Mean for Velo3D Stock

SpaceX already operates 25 Velo3D machines in total, with the company’s management indicating expansion is likely in 2026.

According to VELO’s chief executive, Arun Jeldi, discussion are ongoing for additional equipment purchases, indicating sustained demand for the company’s additive manufacturing capabilities.

Meanwhile, Velo3D has teamed up with Anduril “to get more contracts together,” as per its press release on Wednesday morning.

This signals a deepening partnership with a leading defense technology firm that could accelerate revenue growth over time.

In short, the SpaceX and Anduril deals position VELO stock favorably within the evolving defense manufacturing landscape – which is shifting from conventional “exquisite systems” toward more adaptable and rapidly deployable technologies that require advanced 3D printing capabilities.

Fundamentals Warrant Buying VELO Shares Here

Velo3D shares are worth owning for the firm’s “Rapid Production Solutions” strategy that targets high-margin recurring revenue from defense and space applications as well.

The campaign is already showing early success, helping revenue come in at a better-than-expected $13.64 million in Q3, with the management guiding for positive EBITDA in the first half of 2026.

More broadly, the metal additive manufacturing space is seeing robust growth, with the global 3D printing market for titanium powder projected to grow from $214 million in 2023 to $1.40 billion by 2032.

This further strengthens the case for VELO stock for the long term.

What’s the Consensus Rating on Velo3D?

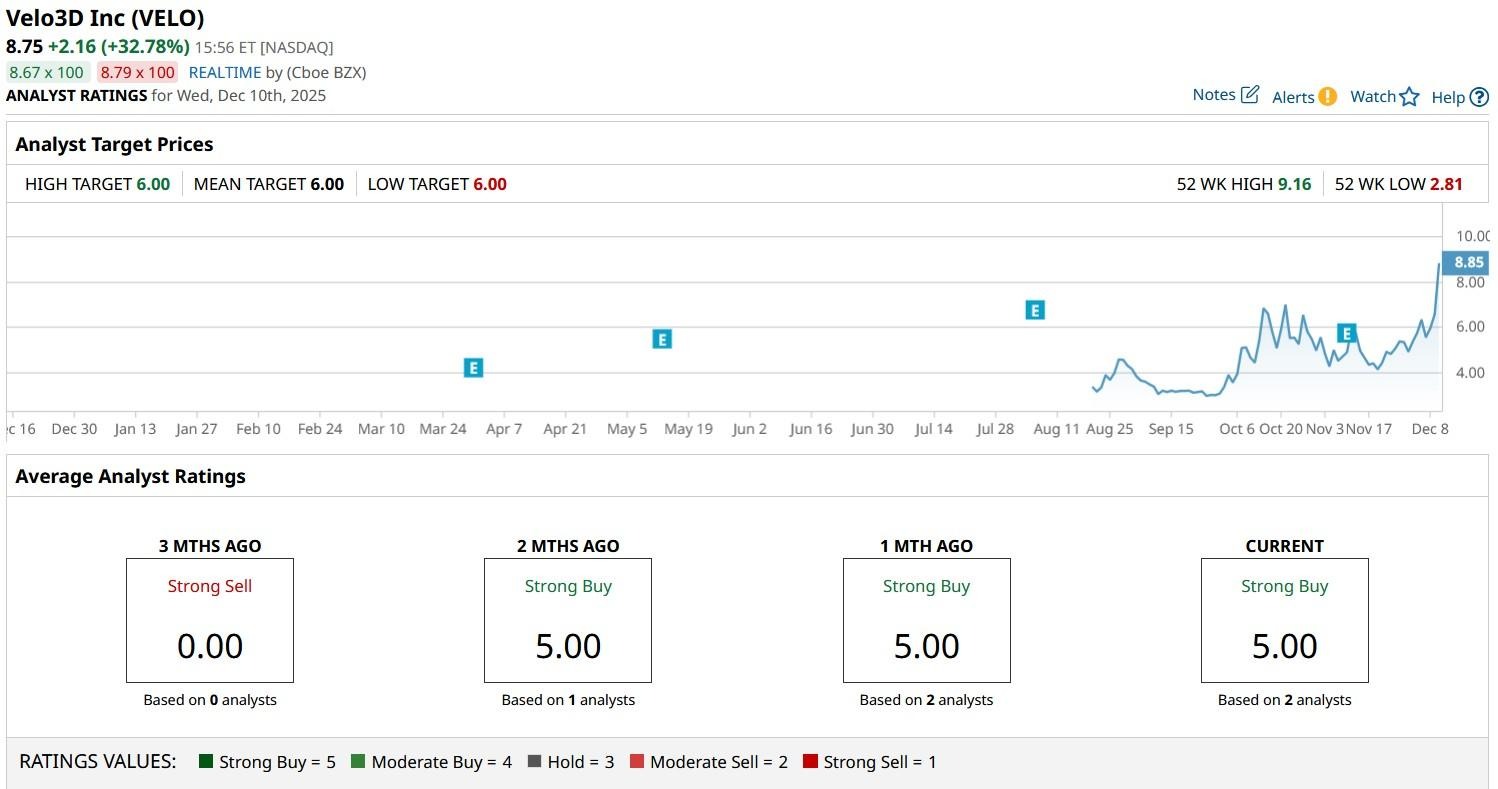

Investors could also take heart in the fact that Wall Street firms currently have a consensus “Strong Buy” rating on Velo3D stock.

And while the mean target currently sits at $6 only, analysts may choose to upwardly revise their estimates for VELO shares following the SpaceX and Anduril partnerships on Wednesday.