NiSource (NI): Taking Stock of Valuation After a Strong Multi‑Year Share Price Run

NiSource (NI) has been quietly grinding higher this year, and its recent pullback after a strong run has some investors asking whether this regulated utility is offering a reasonable entry point.

See our latest analysis for NiSource.

At around $41.44, NiSource’s recent pullback follows a strong year to date share price return, with the 1 year total shareholder return near 16 percent and the 5 year total shareholder return comfortably more than doubling investors’ money. This suggests that momentum is still broadly constructive.

If NiSource’s steady climb has you thinking about what else might be quietly compounding, now is a good time to explore fast growing stocks with high insider ownership.

With solid multi year returns, steady earnings growth and a modest discount to analyst targets, the key question now is whether NiSource still trades below its true value or if the market already reflects its future growth.

Most Popular Narrative: 10.6% Undervalued

With NiSource last closing at $41.44 against a narrative fair value near $46.36, the dominant view sees modest upside still on the table.

Strong visibility into multi year, rate based capital expenditure ($19.4B base plan, plus $2B+ in upside/incremental projects) positions NiSource for 6 to 8% annual EPS growth and compound growth in regulated revenue.

Want to know what makes that growth engine tick? The narrative leans on disciplined reinvestment, rising margins, and a richer future earnings multiple. Curious which assumptions really drive that premium?

Result: Fair Value of $46.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this outlook could be challenged if regulators delay key rate approvals or if long term demand for NiSource’s gas infrastructure weakens faster than expected.

Find out about the key risks to this NiSource narrative.

Another View: Market Ratios Tell A Different Story

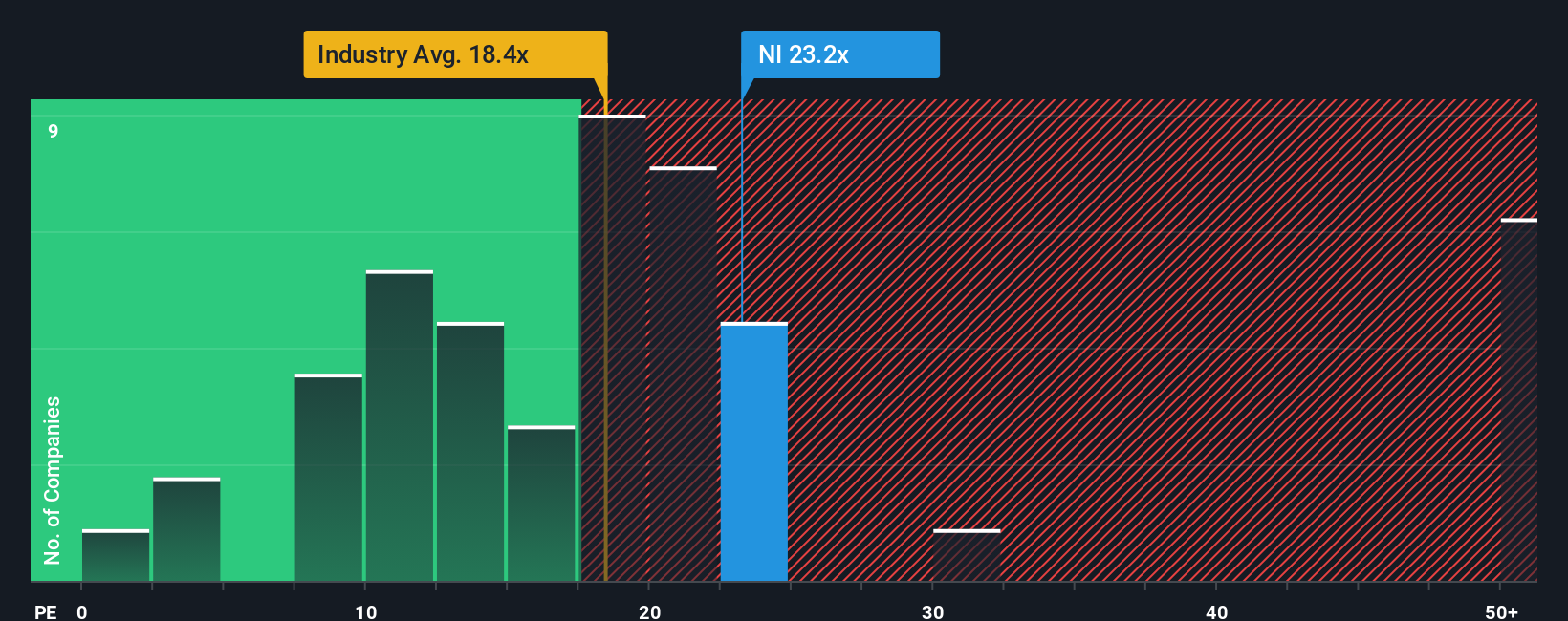

While the narrative fair value points to upside, NiSource’s 22.1 times price to earnings ratio sits above the global integrated utilities average of 17.9 times, and only slightly below its fair ratio of 22.9 times. That leaves less margin for error if growth or regulation disappoints. Does it really justify a bigger premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NiSource Narrative

If you see NiSource differently or prefer to dig into the numbers yourself, you can build a personalized view in minutes, Do it your way.

A great starting point for your NiSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity, your next great idea could be waiting in a corner of the market that most investors are still ignoring.

- Capture potential mispricing by scanning these 900 undervalued stocks based on cash flows that may be trading below their long term cash flow potential.

- Ride innovation at the edge of computing by targeting these 28 quantum computing stocks shaping tomorrow’s breakthroughs.

- Boost your income stream by focusing on these 15 dividend stocks with yields > 3% offering robust yields with room for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com