Stora Enso (HLSE:STERV) Valuation Check After €500m Early Bond Redemption and Capital Structure Shift

Stora Enso Oyj (HLSE:STERV) is shaking up its balance sheet by choosing to redeem its €500 million bond early through a make whole process, with repayment scheduled for 19 December 2025.

See our latest analysis for Stora Enso Oyj.

The early bond redemption comes as the stock shows improving momentum, with an 8.24% 90 day share price return and a 1 year total shareholder return of 8.29%, though longer term total returns remain underwhelming.

If this shift in Stora Enso’s capital structure has you rethinking where growth and insider conviction might align, now could be a smart time to explore fast growing stocks with high insider ownership

With the balance sheet set for a tidy up and the share price already up this year, is Stora Enso still trading below its intrinsic value, or is the market already pricing in a full recovery and future growth?

Most Popular Narrative: 8% Undervalued

With Stora Enso last closing at €10.32 against a narrative fair value of about €11.21, the story leans toward upside if execution delivers.

The strategic review and potential value unlocking of Swedish forest assets including a proposed separation or listing could crystallize substantial hidden asset value, reduce debt, and enhance financial flexibility for future growth investments, supporting both book value and earnings quality. Heavy investments in automation, digitalization, and efficiency programs resulting in thousands of active cost and productivity initiatives are fostering long term margin expansion and superior fixed cost absorption versus structurally challenged peers, likely to benefit future earnings growth.

Curious how steady, mid single digit growth and a sharp margin rebound can justify a richer future earnings multiple than today, without tech like hype? Unpack the full roadmap behind this valuation call and see which financial levers do the heavy lifting.

Result: Fair Value of €11.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand and overcapacity, especially in packaging and European sawmills, could pressure pricing power and delay the expected margin recovery.

Find out about the key risks to this Stora Enso Oyj narrative.

Another Angle on Valuation

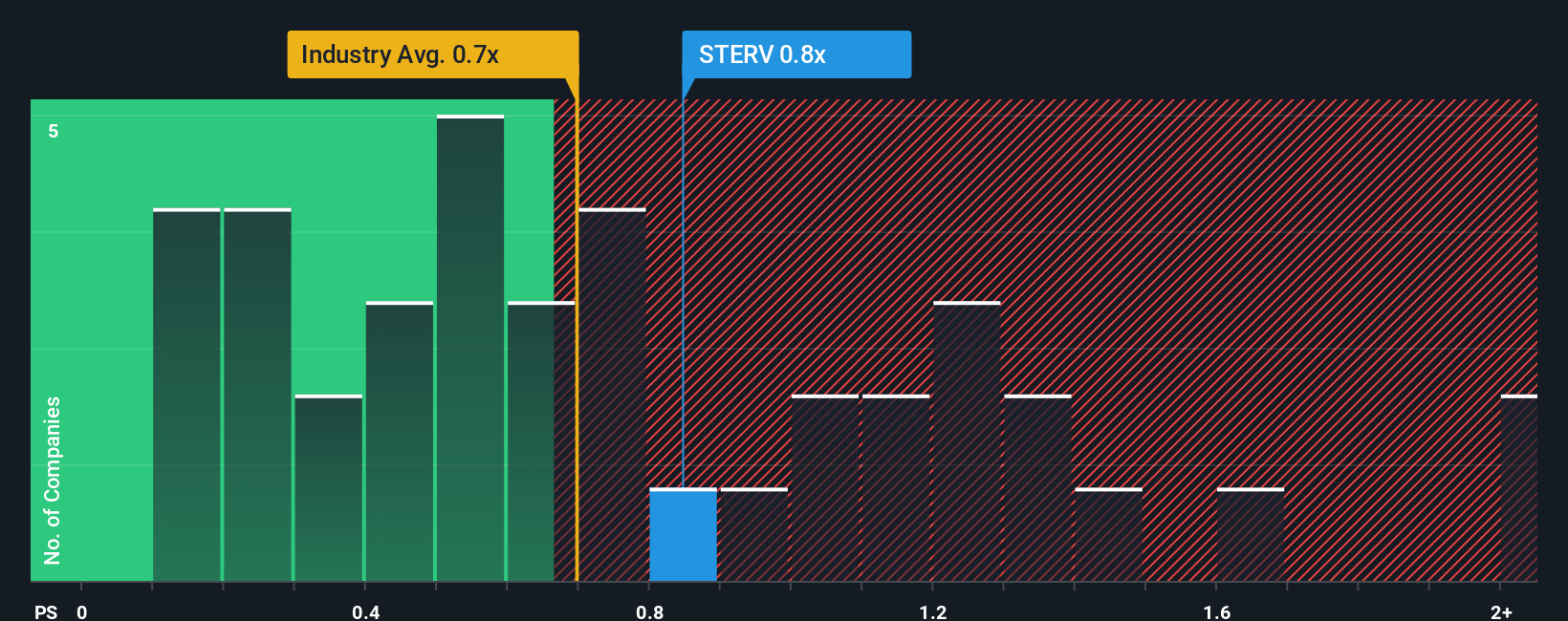

On a sales based lens, Stora Enso looks less clear cut. The current price to sales ratio is about 0.9 times, richer than both European forestry peers at roughly 0.6 times and a fair ratio of 1.8 times. This suggests limited margin for error if the recovery stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stora Enso Oyj Narrative

If this framing does not fully match your view, or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Stora Enso Oyj.

Looking for more investment ideas?

Before the next move in Stora Enso’s story, explore fresh opportunities by using our powerful Screener tools to target the type of returns you are seeking.

- Boost your income potential by targeting robust payouts with these 15 dividend stocks with yields > 3%, which focus on combining yield strength with solid fundamentals and consistent cash generation.

- Gain exposure to the next wave of innovation by zeroing in on these 26 AI penny stocks, positioned at the core of developments in artificial intelligence.

- Identify opportunities in overlooked value by scanning these 900 undervalued stocks based on cash flows, where the market may not yet fully reflect the cash flow characteristics of the companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com