Is WisdomTree’s 2025 Valuation Justified After Strong Multi Year Share Price Gains?

- If you are wondering whether WisdomTree is still a smart buy at around $11.69, you are not alone. This stock sits at the crossroads of growth, income, and structural change in asset management.

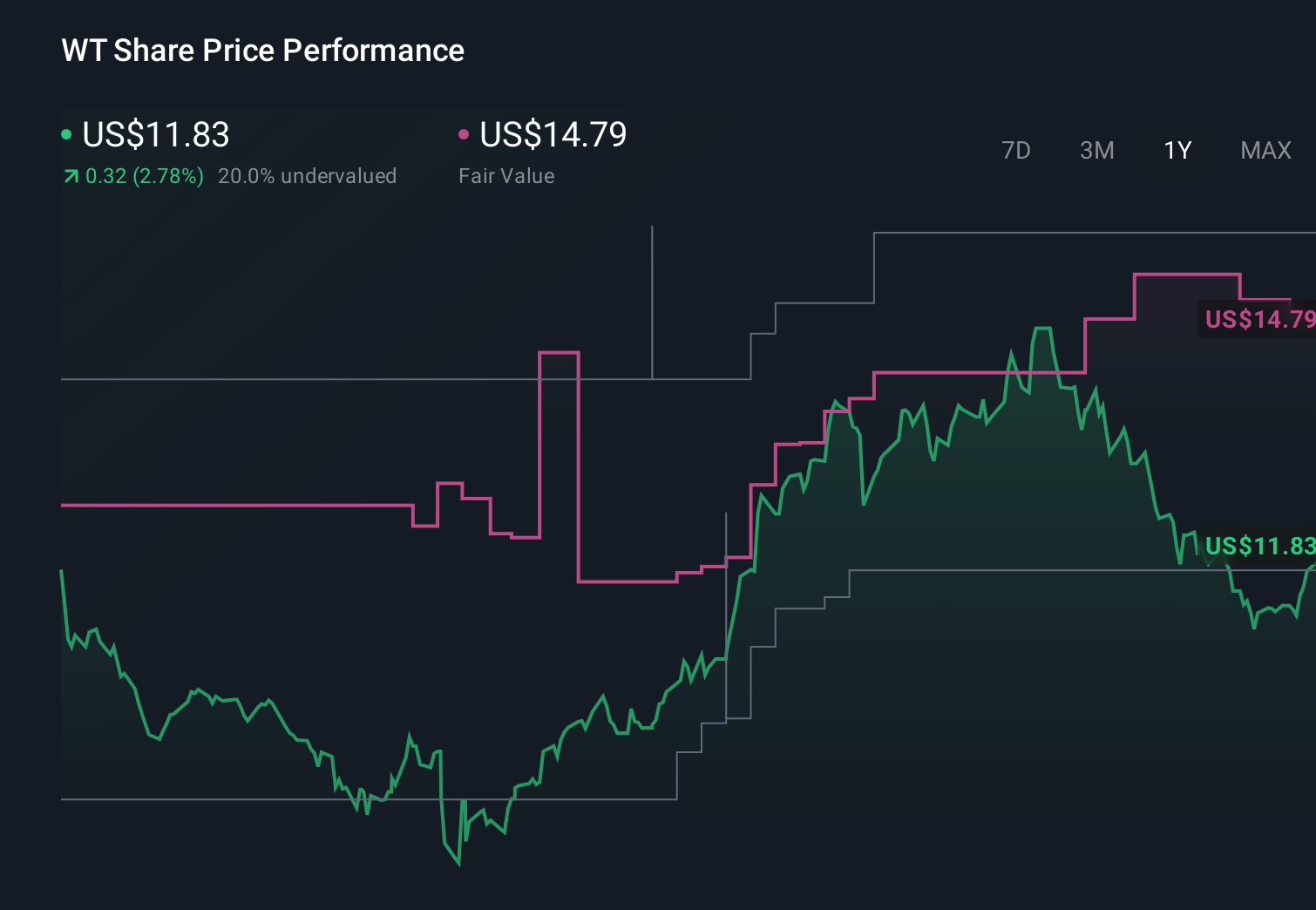

- After a 4.7% gain over the last week and a strong 15.6% return year to date, the stock has cooled slightly in the last month with a -0.3% move, while still sitting on hefty 3 year and 5 year gains of 125.2% and 162.2% respectively.

- Those moves have come as WisdomTree has leaned further into thematic and digital asset linked ETFs, expanded its product lineup, and continued to attract attention as investors reallocate toward lower cost, rules based strategies. At the same time, shifting sentiment around interest rates and risk assets has made flows into its funds more volatile, which helps explain the choppier near term performance.

- Right now WisdomTree scores a 3/6 valuation check score, suggesting it looks undervalued on some metrics but not all. Next we will unpack what different valuation approaches say about the stock and then circle back to a more holistic way to judge whether the current price really makes sense.

Find out why WisdomTree's 1.9% return over the last year is lagging behind its peers.

Approach 1: WisdomTree Excess Returns Analysis

The Excess Returns model looks at how much value WisdomTree creates above the basic return investors demand on its equity, then capitalizes those surplus profits into an intrinsic value per share.

For WisdomTree, the model assumes a Book Value of $2.74 per share and a Stable EPS of $0.48 per share, based on the median return on equity over the past five years. The Cost of Equity is estimated at $0.27 per share, implying an Excess Return of about $0.20 per share. That translates into an Average Return on Equity of 16.83%, modestly above the required return, with a Stable Book Value pegged at $2.83 per share from historical medians.

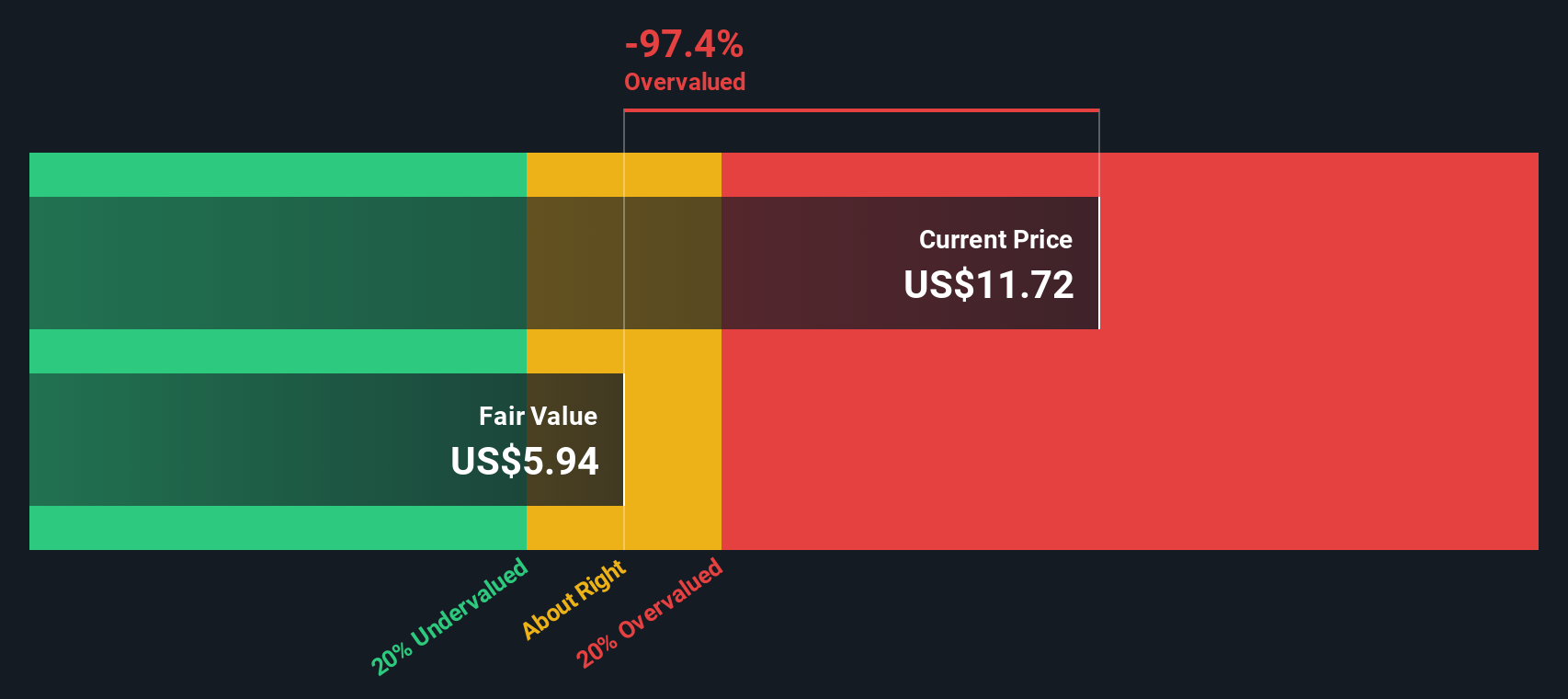

Once these excess returns are projected forward and discounted, the Excess Returns model arrives at an intrinsic value of about $6.0 per share, compared with the current price of around $11.69. This implies the shares are roughly 95.3% overvalued on this framework. It suggests that the expectations embedded in the market price are much richer than the model assumes.

Result: OVERVALUED

Our Excess Returns analysis suggests WisdomTree may be overvalued by 95.3%. Discover 900 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: WisdomTree Price vs Earnings

For a consistently profitable business like WisdomTree, the price to earnings (PE) ratio is a useful yardstick because it links what investors pay directly to the earnings the company is generating today. It is also intuitive, since most investors think about returns in terms of how many dollars of profit they get for each dollar invested.

What counts as a normal or fair PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher growth and lower risk can justify a higher multiple, while slower, more volatile earnings should usually trade on a lower PE.

WisdomTree currently trades on a PE of about 16.9x, which is below both the Capital Markets industry average of roughly 25.3x and the peer average of about 26.7x. Simply Wall St also estimates a Fair Ratio of around 15.1x, a proprietary view of what PE the stock should trade on, given its growth outlook, profitability, industry, market cap, and risk profile. Because this Fair Ratio explicitly adjusts for these fundamentals, it is more tailored than a simple comparison with peers or the broader industry. With the current PE modestly above the Fair Ratio, the shares look slightly expensive on this lens.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your WisdomTree Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which are simply the story you believe about a company, translated into numbers like future revenue, earnings, margins, and ultimately a fair value that you can compare with today’s price.

On Simply Wall St’s Community page, Narratives make this process accessible by linking three things together in one place: the company’s story, a forward-looking financial forecast, and the resulting fair value estimate. This allows you to quickly see whether your view implies WisdomTree is a buy, hold, or sell at the current market price.

Narratives update automatically when new information arrives, such as earnings reports or news about buybacks and new digital funds. This means your WisdomTree fair value adjusts in real time. You can also see how other investors’ Narratives differ. For example, some might think WisdomTree is worth around $12.25 per share based on more cautious assumptions, while others see a path to about $16.00 per share if its digital and alternative products scale more successfully.

Do you think there's more to the story for WisdomTree? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com