Assessing Sandoz (SWX:SDZ) Valuation After European Launch of Wyost and Jubbonti Biosimilars

Sandoz Group (SWX:SDZ) just kicked off a major European rollout of its Wyost and Jubbonti denosumab biosimilars, opening fresh exposure to a multibillion dollar cancer bone disease and osteoporosis market.

See our latest analysis for Sandoz Group.

The denosumab rollout lands at a strong moment for Sandoz, with a 30 day share price return of 9.77% and a 90 day share price return of 22.49% helping drive a 1 year total shareholder return of 60.6%. This suggests momentum is building as investors price in its biosimilar growth story.

If this launch has you rethinking healthcare exposure, it could be worth exploring other high quality healthcare stocks that may be riding similar structural tailwinds.

Yet with shares already rallying strongly and analysts’ targets sitting below the current price, the real question now is whether Sandoz still trades at an attractive discount or if the market has largely priced in its biosimilar-driven growth.

Price to Earnings of 139.7x: Is it justified?

At the last close of CHF59.1, Sandoz screens as richly valued on headline metrics, even as our fair value work flags a sizeable discount to intrinsic worth.

The preferred multiple here is the price to earnings ratio, which compares the current share price to annual earnings per share. For a mature, large cap pharmaceuticals group, this metric helps investors judge how much they are paying today for each unit of current profit, and whether that pricing anticipates a step change in future earnings power.

On this measure, Sandoz trades on a striking 139.7x price to earnings ratio, pointing to the market heavily front loading expectations of future profitability. That stands against an estimated fair price to earnings ratio of 33.1x from our modelling, a level the market could move towards if earnings ramp up as forecast and sentiment normalises.

Compared with the European pharmaceuticals industry average of 24.7x and a peer group average of 54.3x, Sandoz’s current 139.7x multiple is dramatically higher and implies investors are willing to pay several turns more than sector norms for its biosimilar driven growth story.

Explore the SWS fair ratio for Sandoz Group

Result: Price to Earnings of 139.7x (OVERVALUED)

However, investors should still weigh risks such as biosimilar pricing pressure and any slowdown in revenue or earnings growth that challenges current valuation assumptions.

Find out about the key risks to this Sandoz Group narrative.

Another View: Our DCF Signals a Discount

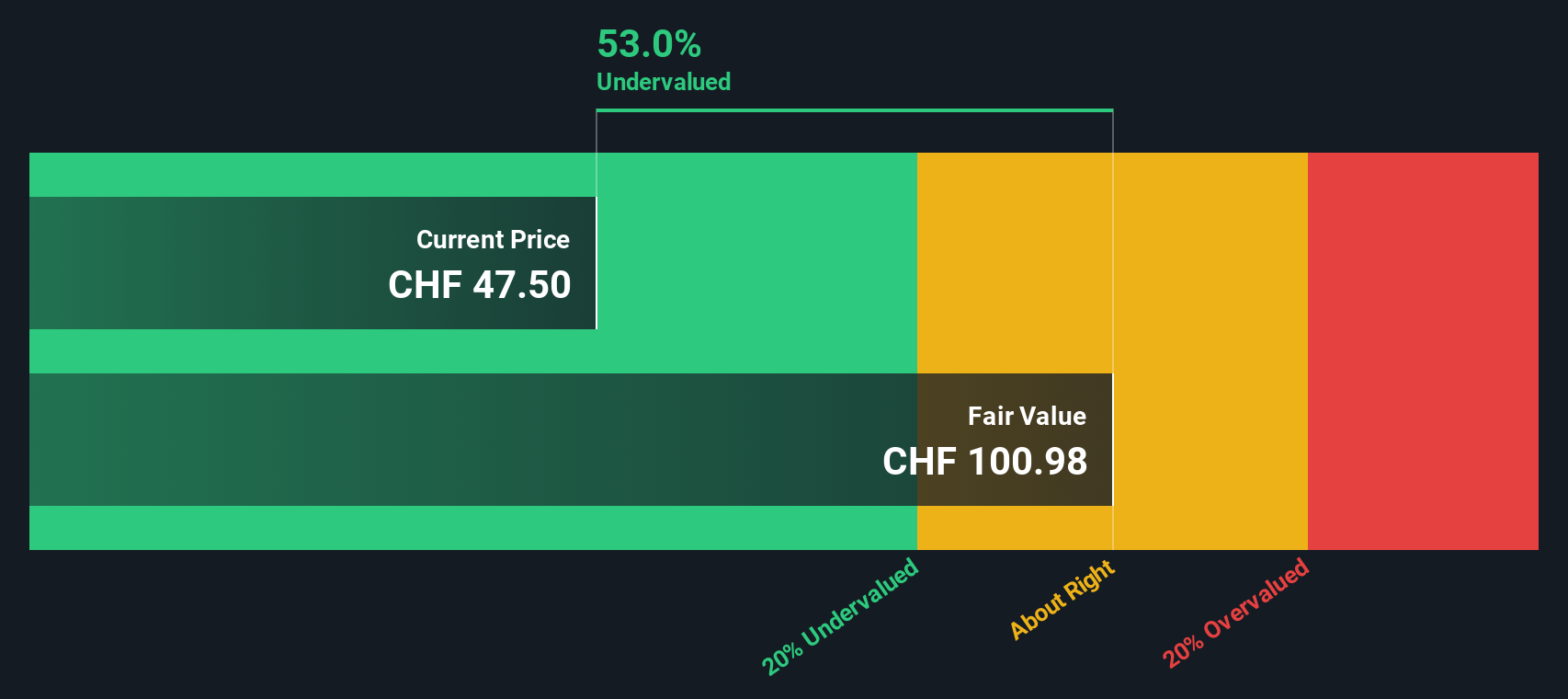

While the current 139.7x earnings multiple appears expensive, our DCF model presents a different perspective. With Sandoz trading around CHF59.1 versus an estimated fair value of CHF88.18, the shares appear roughly 33% undervalued. Is the market underestimating how far earnings can compound from here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sandoz Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sandoz Group Narrative

If you see the story differently, or prefer to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Sandoz Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before the next opportunity runs away from you, use the Simply Wall St Screener to uncover stocks that fit your strategy, risk profile, and return goals.

- Capture mispriced potential by scanning these 900 undervalued stocks based on cash flows that may offer different characteristics than today’s market favorites.

- Target steady income streams by reviewing these 12 dividend stocks with yields > 3% that can complement growth names like Sandoz in a balanced portfolio.

- Explore innovation trends by checking out these 26 AI penny stocks with exposure to companies focused on artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com