BlackLine (BL): Assessing Valuation After New Saudi Arabia Cloud Region Expansion

BlackLine (BL) just switched on a new locally hosted cloud region in Saudi Arabia, a calculated move that taps into the Kingdom’s modernization push while satisfying tight data residency and cybersecurity rules.

See our latest analysis for BlackLine.

That Saudi expansion comes as BlackLine’s 1 month share price return of 7.18% and 3 month gain of 5.97% hint at improving sentiment, even though its 1 year total shareholder return of negative 9.74% shows the longer term picture is still one of recovery rather than a breakout.

If this kind of strategic move has your attention, it could be a good moment to scan other high growth tech names and explore high growth tech and AI stocks for fresh ideas.

With revenue still growing above 10 percent annually, solid net income gains, and the shares trading at a meaningful discount to intrinsic value, is BlackLine a quiet buying opportunity, or has the market already priced in its next phase of growth?

Most Popular Narrative Narrative: 5.6% Undervalued

With the most popular narrative pointing to a fair value just above BlackLine’s last close of $58.38, the valuation hinges on specific long term growth levers.

The expansion of strategic integrations and partnerships with SAP, Snowflake, Oracle, and other leading ERPs is accelerating distribution and market penetration, supporting higher bookings and anticipated revenue growth into 2025 and beyond. BlackLine's shift to a value-based, unlimited-user pricing model and a focus on larger enterprise and mid-market clients is increasing net retention rates and improving margins through larger, longer-term contracts and higher account stickiness.

Want to see how steady revenue growth, shifting margins, and a punchy future earnings multiple all come together in one story? The full narrative reveals the exact growth path, profit profile, and valuation math that have to play out for this price target to make sense.

Result: Fair Value of $61.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected AI adoption and tougher competition from full suite ERP vendors could cap growth, pressure margins, and challenge that undervaluation thesis.

Find out about the key risks to this BlackLine narrative.

Another Lens on Valuation

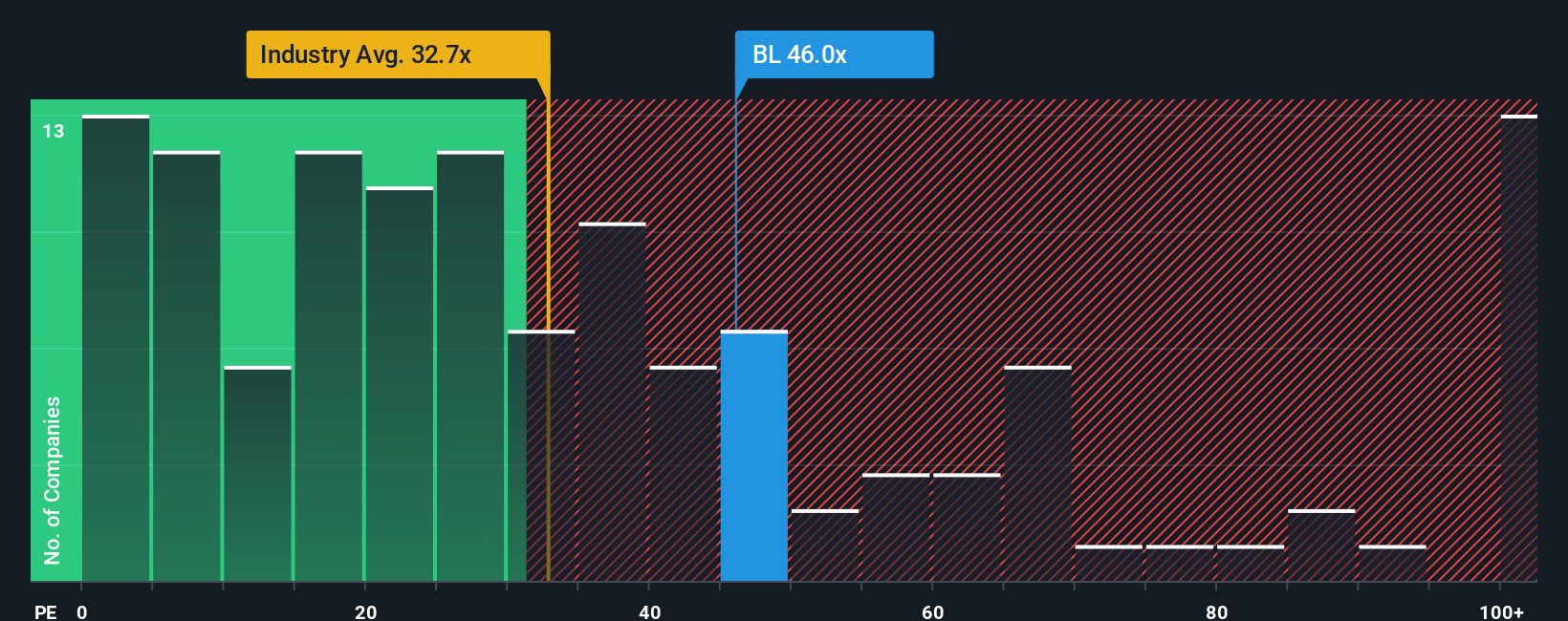

Step away from fair value models and BlackLine looks pricey. At 45.7 times earnings versus a fair ratio of 26.1 times and a 32.7 times industry average, the stock carries a rich valuation that could amplify downside if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BlackLine Narrative

If this view does not quite align with yours, or you simply prefer digging into the numbers yourself, you can build a custom take in just a few minutes, starting with Do it your way.

A great starting point for your BlackLine research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, give yourself the edge by lining up your next opportunity with focused stock lists built from real fundamentals, not hype.

- Capture potential bargains early by scanning these 900 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Ride structural growth trends by targeting these 30 healthcare AI stocks using artificial intelligence to support diagnostics, treatment pathways, and patient outcomes.

- Explore asymmetric upside potential by filtering for these 80 cryptocurrency and blockchain stocks that may benefit from expanding blockchain adoption and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com