Groupe Dynamite (TSX:GRGD) Same-Store Sales Surge Reinforces Bullish Growth Narratives

Groupe Dynamite (TSX:GRGD) has just posted another upbeat quarter, with Q2 2026 revenue of about CA$326 million, Basic EPS of CA$0.59 and net income of roughly CA$63.9 million, supported by a Same Store Sales Growth figure of 28.6% that underscores ongoing momentum in the core business. The company has seen revenue move from roughly CA$239 million in Q2 2025 to CA$326 million in Q2 2026, alongside EPS climbing from about CA$0.38 to CA$0.59. This sets up a narrative in which rising sales productivity and tighter execution are helping margins do the heavy lifting for investors.

See our full analysis for Groupe Dynamite.With the headline numbers on the table, the next step is to see how this earnings momentum lines up with the prevailing stories around Groupe Dynamite and whether the latest margin trends back up or challenge those narratives.

Curious how numbers become stories that shape markets? Explore Community Narratives

Same store growth powers trailing CA$1.08 billion sales

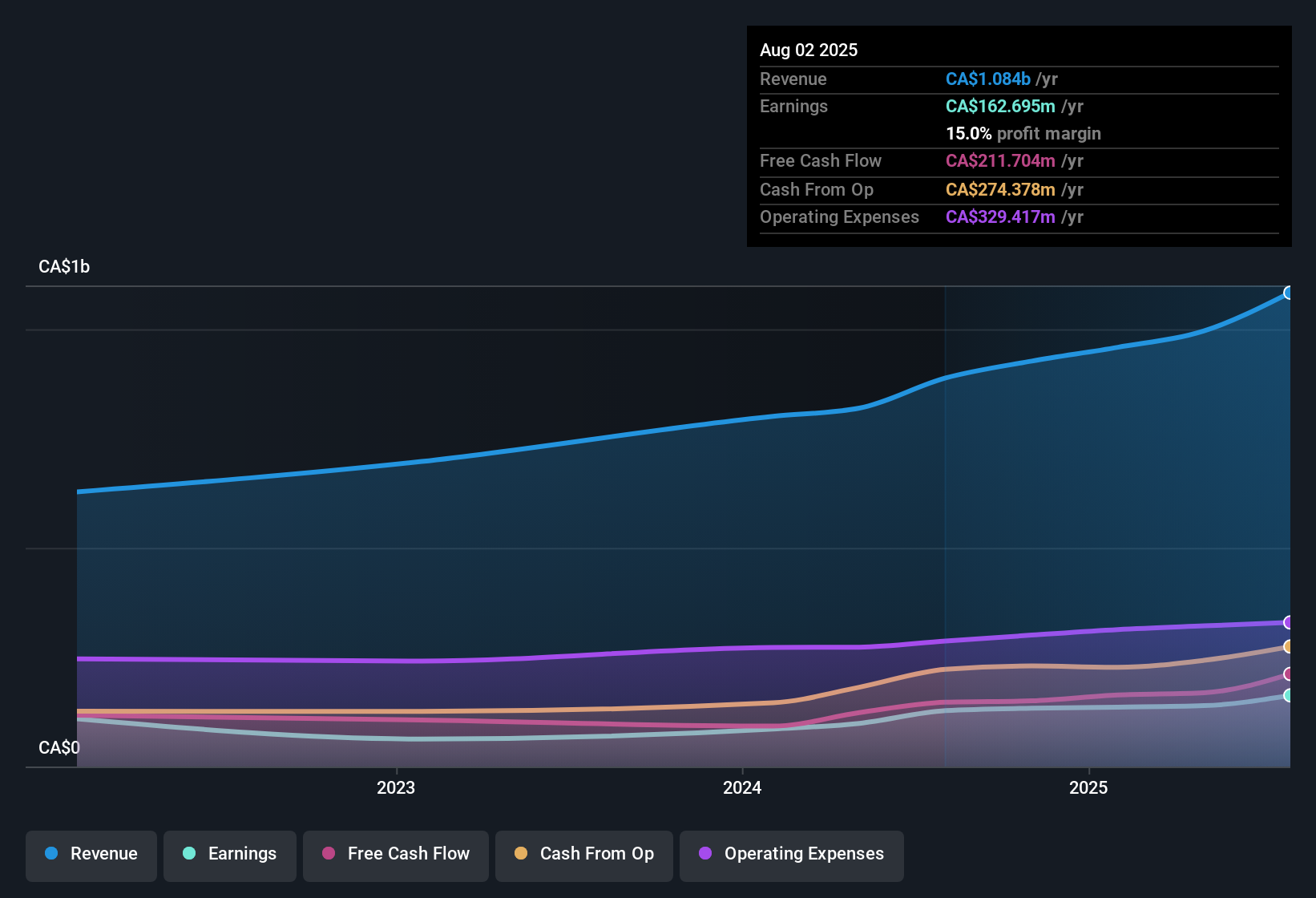

- On a trailing twelve month basis, revenue reached about CA$1,083.6 million, with Same Store Sales Growth as high as 28.6% in the most recent quarter compared with 10.1% to 16.4% in earlier quarters.

- What stands out for a more optimistic view is that this stronger store level performance lines up with earnings growing 27.6% over the last year and forecast revenue growth of about 10.4% per year, which supports a growth focused thesis but also raises the bar for keeping that Same Store Sales momentum going.

Margins hold steady at 15% despite faster expansion

- Trailing net profit margin sits at 15%, slightly above 14.4% a year earlier, alongside trailing twelve month net income of roughly CA$162.7 million.

- From a bullish angle, the combination of a 15% margin and trailing EPS of about CA$1.51, up from CA$1.26 a few quarters ago, supports the idea of high quality earnings. It also means any slip in margin from here would be noticed quickly because past five year earnings growth has already averaged 16.6% a year.

Fast growth meets rich 57x P/E valuation

- The shares trade around CA$86.16, implying a P/E of about 57.4 times against peer and industry averages near 22.5 and 20.1 times, even though the DCF fair value is estimated at about CA$76.81.

- Critics highlight that while forecast earnings growth of roughly 14.2% per year and revenue growth of 10.4% per year are both higher than the Canadian market at 12.2% and 5.1%, the gap between the current price and the DCF fair value, plus the premium P/E multiple, leaves less room for disappointment if growth or margins cool from recent double digit earnings gains.

Investors weighing this mix of above market growth, solid 15% margins and a 57.4x P/E may want a deeper dive into how those numbers stack up against different valuation scenarios and long term assumptions. 📊 Read the full Groupe Dynamite Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Groupe Dynamite's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive sales momentum and solid margins, Groupe Dynamite carries a stretched 57x P/E and trades above its DCF fair value, leaving little margin for error.

If that premium worries you, shift your focus to these 900 undervalued stocks based on cash flows and quickly zero in on companies where robust fundamentals still come with a real valuation cushion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com