J.Jill (JILL) Margin Compression Reinforces Cautious View Despite Deep P/E Valuation Discount

J.Jill (JILL) has just posted another steady quarter, with Q2 2026 revenue of about $154 million and basic EPS of $0.69 off net income of roughly $10.5 million, giving investors a clear snapshot of how the apparel retailer is navigating a softer same store sales backdrop. The company has seen quarterly revenue move in a relatively tight band between about $142 million and $162 million over the past six reported periods, while EPS has ranged from $0.15 to $1.17. This underscores a business that can generate meaningful profits even as same store sales growth figures, such as the recent 1% decline in Q2 2026, point to some pressure at the store level, so the latest results leave investors weighing resilient earnings power against signs that margins are being worked harder.

See our full analysis for J.Jill.With the headline numbers on the table, the next step is to see how this mix of solid profitability and modest sales pressure lines up with the prevailing narratives around J.Jill’s long term growth story and risk profile.

See what the community is saying about J.Jill

Margins Ease From 6.7% To 6.1%

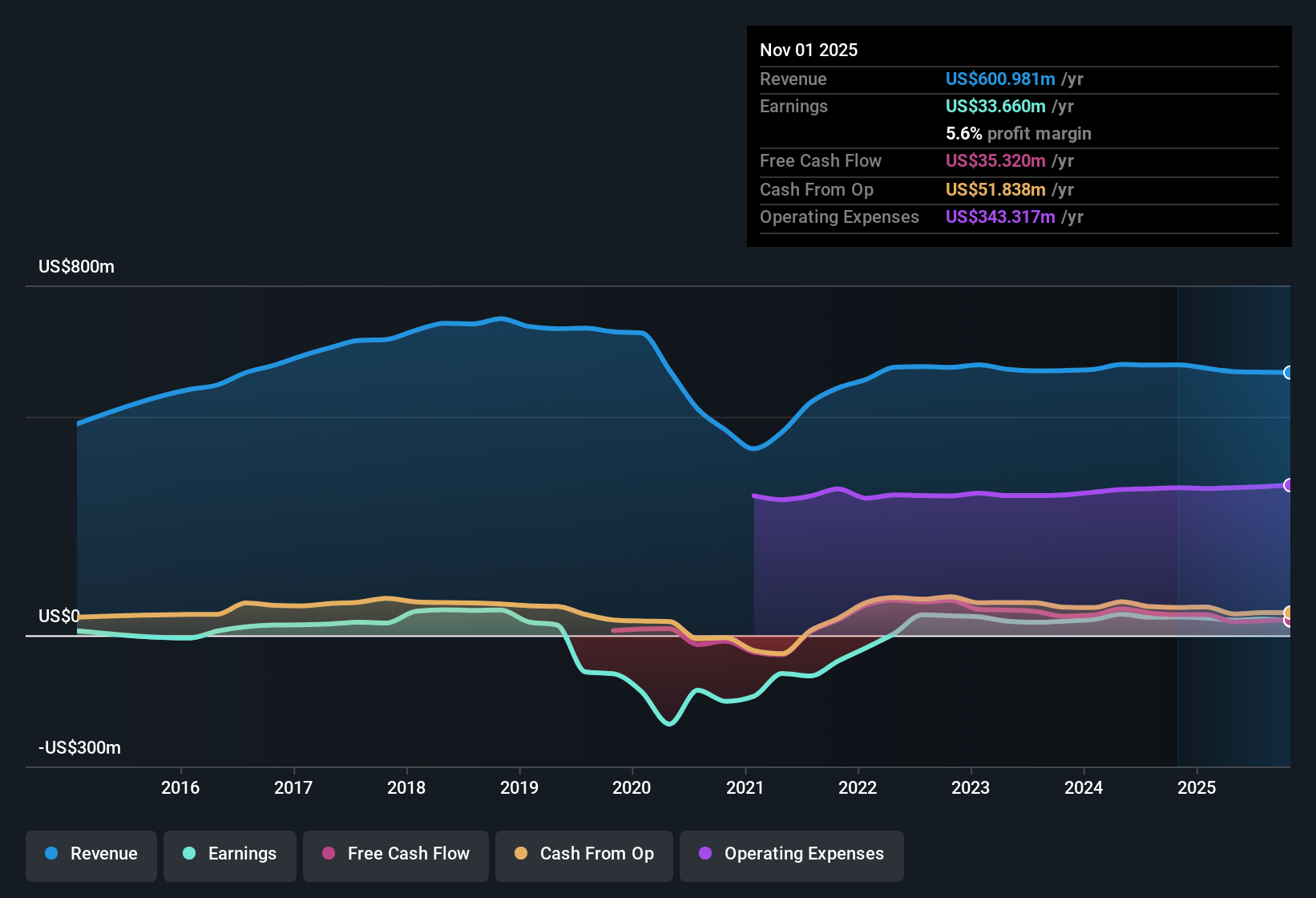

- Over the last 12 months, J.Jill earned $36.8 million of net income on $601.7 million of revenue, for a 6.1% net margin compared with 6.7% the prior year.

- Consensus narrative emphasizes operational efficiency and inventory discipline as margin supports, yet the move from 6.7% to 6.1% shows that, even with these efforts, higher costs like tariffs and promotions are still squeezing profitability.

- Analysts expect profit margins to reach 10.6% in about three years, which is a big step up from the current 6.1% and assumes these pressures can be managed more effectively.

- Same store sales have been slightly negative in recent quarters, including a 1% decline in Q2 2026, so margin expansion would likely need to come more from cost control and mix than from strong top line growth.

Valuation Discount At 5.9x P/E

- The trailing P/E of about 5.9 times sits far below both the peer average of 33.2 times and the US Specialty Retail industry at 19.4 times, while the DCF fair value of $47.70 is well above the current $14.26 share price.

- Bears focus on the most recent year of negative earnings growth and the margin slip to 6.1%, arguing that the low multiple could be a warning rather than an opportunity.

- Over five years, earnings have grown about 67.6% per year as the company moved into profitability, so the long term trend looks very different from the latest softer year.

- Even if you only anchor on the 6.1% margin and modest 1.7% expected annual revenue growth, the gap between $14.26 and the $47.70 DCF fair value leaves a large buffer if those assumptions hold.

Modest 1.7% Growth, Bigger EPS Ambitions

- Analysts are modeling revenue growth of about 1.7% a year to roughly $633.7 million in 2028, but expect earnings to rise to $67.1 million and EPS of $4.35, assuming margins improve from 6.1% to 10.6% and the stock trades at roughly 6.2 times those earnings.

- Analysts' consensus narrative leans on omnichannel investments and product expansion to bridge the gap between low single digit revenue growth and much faster earnings growth.

- Recent quarterly revenue has stayed in a tight band around $142 million to $162 million, so the step up to $633.7 million over 12 months is not a huge stretch if that stability continues.

- The bigger question is whether initiatives like more versatile assortments and modernized marketing can realistically lift margins almost 4.5 percentage points from today’s 6.1% while facing ongoing tariff and promotional pressures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for J.Jill on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use that perspective to quickly build and share your own narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding J.Jill.

Explore Alternatives

J.Jill’s story hinges on ambitious margin expansion despite soft same store sales and cost pressures, which leaves execution risk around turning modest growth into higher profitability.

If that reliance on a big margin lift from a slow growing base feels precarious to you, focus on steadier compounders using our stable growth stocks screener (2088 results) and quickly compare businesses already proving consistent revenue and earnings momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com