Energy‑Efficient Logistics Expansion Might Change The Case For Investing In Argan (ENXTPA:ARG)

- In recent months, ARGAN announced a new lease with JUNG LOGISTIQUE for a 30,000 sq.m AutOnom® logistics facility in Tournan-en-Brie and confirmed with DECATHLON the modernization of heating systems across more than 170,000 sq.m of logistics space using next-generation heat pumps.

- These projects underline ARGAN’s focus on pairing logistics expansion with concrete energy-efficiency upgrades, enhancing the resilience and decarbonization profile of its tenant portfolio.

- We’ll now examine how ARGAN’s rollout of energy-efficient logistics assets could shape the company’s investment narrative for long-term investors.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Argan's Investment Narrative?

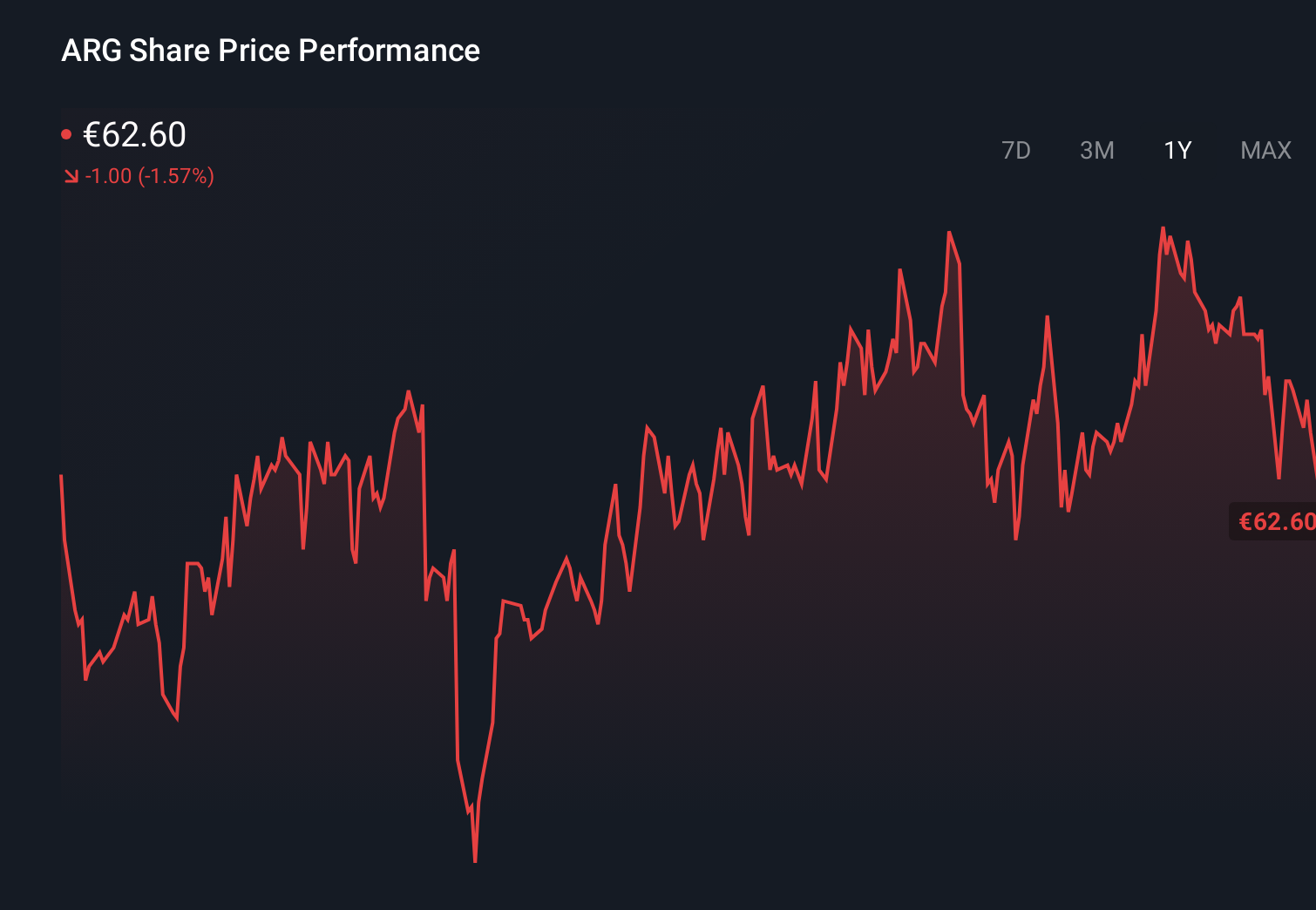

To own Argan, you really need to believe that its AutOnom® concept and energy‑efficient warehouses can offset a fairly downbeat set of earnings and revenue forecasts over the next few years. The recent JUNG LOGISTIQUE lease in Tournan‑en‑Brie and the DECATHLON heat‑pump rollout fit neatly into that story, reinforcing near‑term catalysts around asset quality, tenant stickiness and the perception of resilient, “future‑proofed” logistics real estate. That said, these projects alone do not obviously change the bigger numbers: analysts still expect profit and sales to decline, and recent share price moves have been muted despite Argan trading well below both analyst and community fair value estimates. The key question is whether this sustainability‑led reinvestment is enough to counter falling earnings and modest past returns.

However, one financial risk in particular may matter more than the green upgrades. Despite retreating, Argan's shares might still be trading 23% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Argan - why the stock might be worth just €79.50!

Build Your Own Argan Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Argan research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Argan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Argan's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com