AeroVironment (AVAV) Revenue Spike to $454.7M Clashes With Deepening EPS Loss Narrative

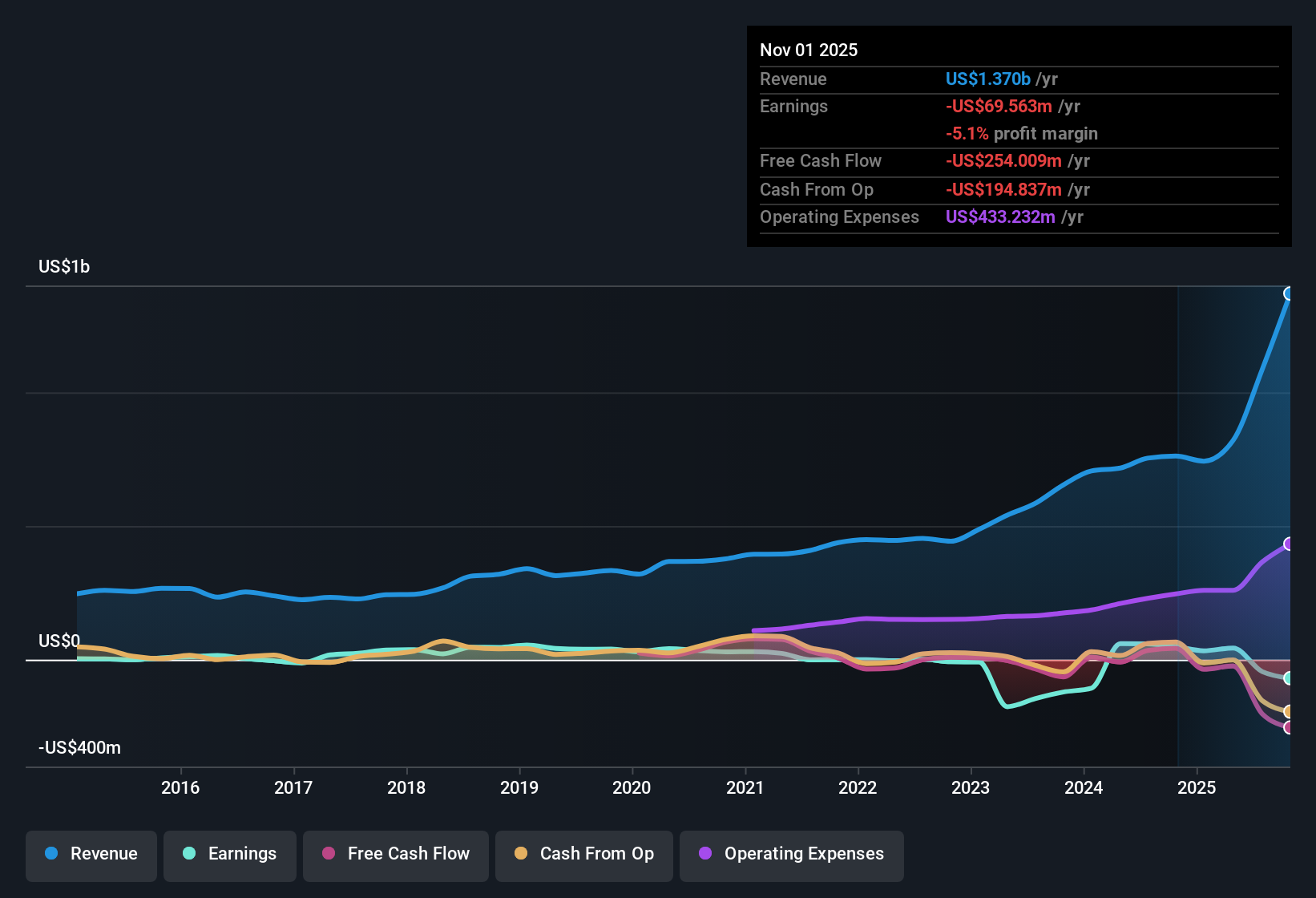

AeroVironment (AVAV) just posted its latest results with Q1 2026 revenue of about $454.7 million and a basic EPS loss of roughly $1.44, while trailing twelve month figures show revenue of around $1.1 billion and basic EPS of about negative $1.37. Over the past few reported periods, revenue has moved from $196.9 million in Q4 2024 to $189.5 million, $188.5 million, $167.6 million, $275.1 million, and now $454.7 million. Over the same stretch, EPS has shifted from a $0.22 profit to $0.76, $0.27, a slight loss, a $0.59 profit, and then a deeper loss. Given that mix of rapid top line expansion and choppy profitability, investors are likely to focus squarely on where margins are heading from here.

See our full analysis for AeroVironment.With the headline numbers on the table, the next step is to weigh them against the prevailing narratives around AeroVironment, assessing where the growth story holds up and where the latest margin trends might prompt a reassessment.

See what the community is saying about AeroVironment

Growth Surges to $454.7 Million Revenue

- Total revenue climbed to about $454.7 million in Q1 2026, up from $275.1 million, $167.6 million, $188.5 million, $189.5 million, and $197.0 million across the prior five reported quarters. This shows a sharp step up in scale.

- Consensus narrative stresses that expansion into advanced defense technologies and international markets should drive sustained revenue growth and backlog visibility. Investors now have to weigh that long term story against the recent flip to a trailing 12 month net loss of about $44.9 million after previously reporting positive figures like $58.9 million and $48.6 million, which shows that rapid top line gains have not recently translated into consistent profitability.

From Profits To A $67.4 Million Loss

- Net income swung from several profitable quarters, including $21.2 million, $7.5 million, $16.7 million and $6.0 million, to a loss of roughly $67.4 million in Q1 2026. This left trailing 12 month Basic EPS at about negative $1.37 despite earlier positive TTM readings like $2.13 and $1.74.

- Bears argue that heavy reliance on U.S. defense contracts and pressure on margins after the BlueHalo acquisition threaten long term earnings. The recent drop in gross and net profitability aligns with that worry, as the large revenue base of about $1.1 billion on a trailing 12 month view is not currently producing positive net income and follows a period where losses have reportedly widened at about 7 percent per year over five years. This reinforces concerns that higher volumes alone may not be enough to restore margins without better cost control and integration progress.

High Growth Forecasts Versus Rich Valuation

- At a share price of $245.25, AeroVironment trades at a premium valuation with a Price to Sales ratio of 11.2 times versus peers around 6 times and the broader U.S. Aerospace and Defense industry at 2.9 times. The stock also sits above a DCF fair value of about $205.78, in the context of analysts forecasting roughly 14.3 percent annual revenue growth and very strong earnings growth of about 97.9 percent per year.

- Bullish narratives highlight that expanding into areas like space based communications, directed energy and AI enabled platforms could support higher long term margins, and the strong growth forecasts back that optimism. The same analysis notes major shareholder dilution over the past year and expectations that shares outstanding may grow about 7 percent annually, which together with the valuation premium means bulls are effectively betting that the projected swing to profitability and margin improvement will more than offset both the rich multiples and the impact of issuing additional stock.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AeroVironment on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and capture that view in a quick narrative in just a few minutes, then Do it your way.

A great starting point for your AeroVironment research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

AeroVironment’s rapid revenue growth comes with inconsistent profitability, rising losses and rich valuation multiples that leave little margin for execution missteps.

If that mix feels too risky, use our these 900 undervalued stocks based on cash flows today to explore companies where stronger fundamentals align with more reasonable prices and clearer upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com