Daktronics (DAKT) EPS Rebound Tests Bullish Profit-Margin Narrative After Volatile Year

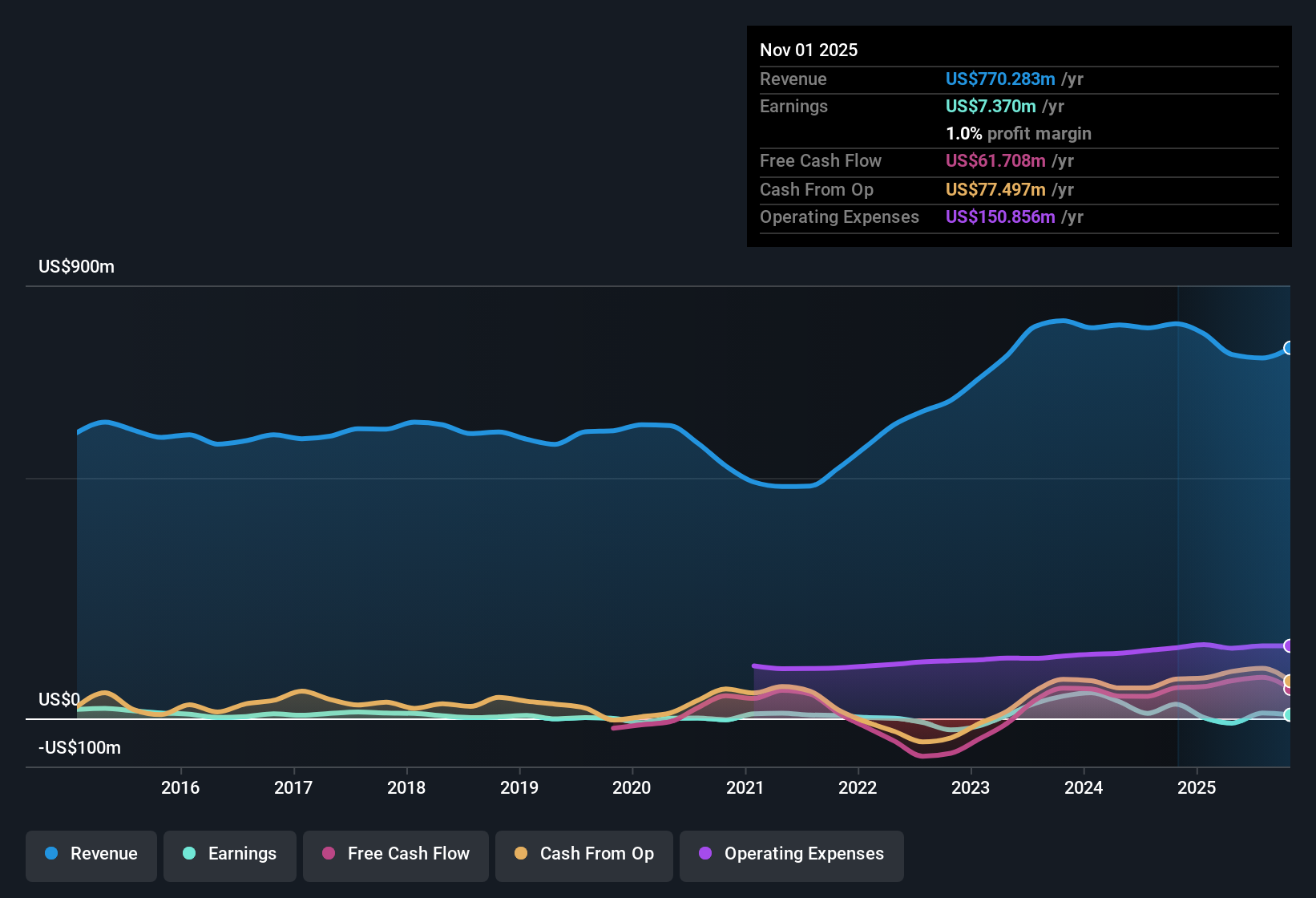

Daktronics (DAKT) just posted its Q2 2026 scorecard with revenue of about $219 million and basic EPS of $0.34, setting a clear marker after a volatile run of recent quarters. The company has seen revenue move from $215.9 million in Q4 2024 to a range between roughly $149.5 million and $226.1 million through 2025, while quarterly EPS has swung between a loss of $0.36 and a profit of $0.46. This leaves investors focused on how durable the latest profitability really is as margins edge forward but remain tightly watched.

See our full analysis for Daktronics.With the headline numbers on the table, the next step is to compare these results with the prevailing narratives around Daktronics to see which stories hold up and which need a rethink.

See what the community is saying about Daktronics

Margins Barely Positive At 1.5%

- Over the last 12 months Daktronics earned $11.3 million of net income on $749.4 million of revenue, which works out to a 1.5% net margin compared with 1.4% in the prior year.

- Analysts' consensus view that operational efficiencies and higher value services can steadily lift margins over time is partly tested by this slim margin, because:

- Five year earnings growth averaged 23.6% per year, yet trailing 12 month earnings growth was negative, showing that recent performance has not kept pace with the longer term trajectory.

- A one off $17.4 million loss is explicitly noted as weighing on recent results, so some of the margin pressure reflects exceptional items rather than the core business alone.

Lumpy Earnings With One Off Hit

- The trailing 12 month figures include that $17.4 million one off loss, which dragged EPS to $0.23 even though the latest quarter alone delivered EPS of about $0.34 and net income of $16.5 million.

- What is striking for the bullish narrative that expects profit margins to rise toward 12.9% is how volatile recent profitability has been, because:

- Over the last six reported quarters, quarterly EPS has swung between a loss of roughly $0.36 and a profit of about $0.46 while quarterly revenue moved between about $149.5 million and $226.1 million.

- That variability, combined with the recent negative year over year earnings growth, means bulls need to assume the one off loss and earnings swings are temporary rather than structural.

Rich Valuation Versus Peers

- At a share price of $20.90, Daktronics trades on a P/E of 89.8 times compared with 24.6 times for the US Electronic industry and 33.8 times for peers, and above a DCF fair value of about $14.48.

- Critics highlight that this premium price tag clashes with the company’s recent fundamentals, because:

- Trailing 12 month net income of $11.3 million on $749.4 million of revenue leaves only a 1.5% margin, which is modest for a business priced at more than three times the peer P/E average.

- Negative earnings growth over the most recent year plus notable insider selling in the last three months give bears numerical support when they argue that the current multiple bakes in a lot of future improvement.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Daktronics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to test your own thesis, shape a narrative that fits your view, and Do it your way.

A great starting point for your Daktronics research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Explore Alternatives

Daktronics combines thin margins, lumpy earnings, and a rich valuation multiple. This leaves investors exposed if profitability or sentiment slip even slightly from expectations.

If you are uncomfortable paying up for that kind of uncertainty, use our these 900 undervalued stocks based on cash flows to quickly refocus on businesses where prices better reflect underlying performance and potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com