Does Block’s Latest Fintech Integration Shift the Case for the Stock at $61.57?

- If you are wondering whether Block is a beaten down opportunity or a value trap at today's price of around $61.57, you are not alone, and that is exactly what we are going to unpack here.

- The stock is up 0.8% over the last week but down 7.8% over the past month, and its longer term performance tells an even tougher story with returns of -29.0% year to date and -37.3% over the last year, highlighting both volatility and shifting market expectations.

- Recent headlines have focused on Block's continued push to integrate its Square and Cash App ecosystems more tightly and on regulatory scrutiny across the broader fintech space, helping explain some of the market's swings as investors reassess growth and risk. At the same time, ongoing debates about digital payments adoption and competition from peers have kept sentiment mixed and occasionally reactive.

- Right now, Block scores a 3/6 valuation score, suggesting the market might be undervaluing the company on several key checks but not across the board. Next, we will walk through the main valuation approaches the market is using today before exploring a more insightful way to think about Block's true worth by the end of this article.

Find out why Block's -37.3% return over the last year is lagging behind its peers.

Approach 1: Block Excess Returns Analysis

The Excess Returns model looks at how much profit Block can generate above the return that investors demand for holding its equity, then capitalizes those surplus profits into an intrinsic value per share.

In this framework, Block starts with a Book Value of $36.94 per share and an Average Return on Equity of 9.33%. Based on analyst expectations, this translates into a Stable EPS of $3.91 per share, while the required Cost of Equity is estimated at $3.25 per share. The gap between these two, an Excess Return of $0.66 per share, represents the economic value Block is expected to create beyond its funding cost. Looking ahead, that profitability is applied to a growing capital base. Stable Book Value is projected to reach $41.89 per share, again anchored to estimates from eight analysts.

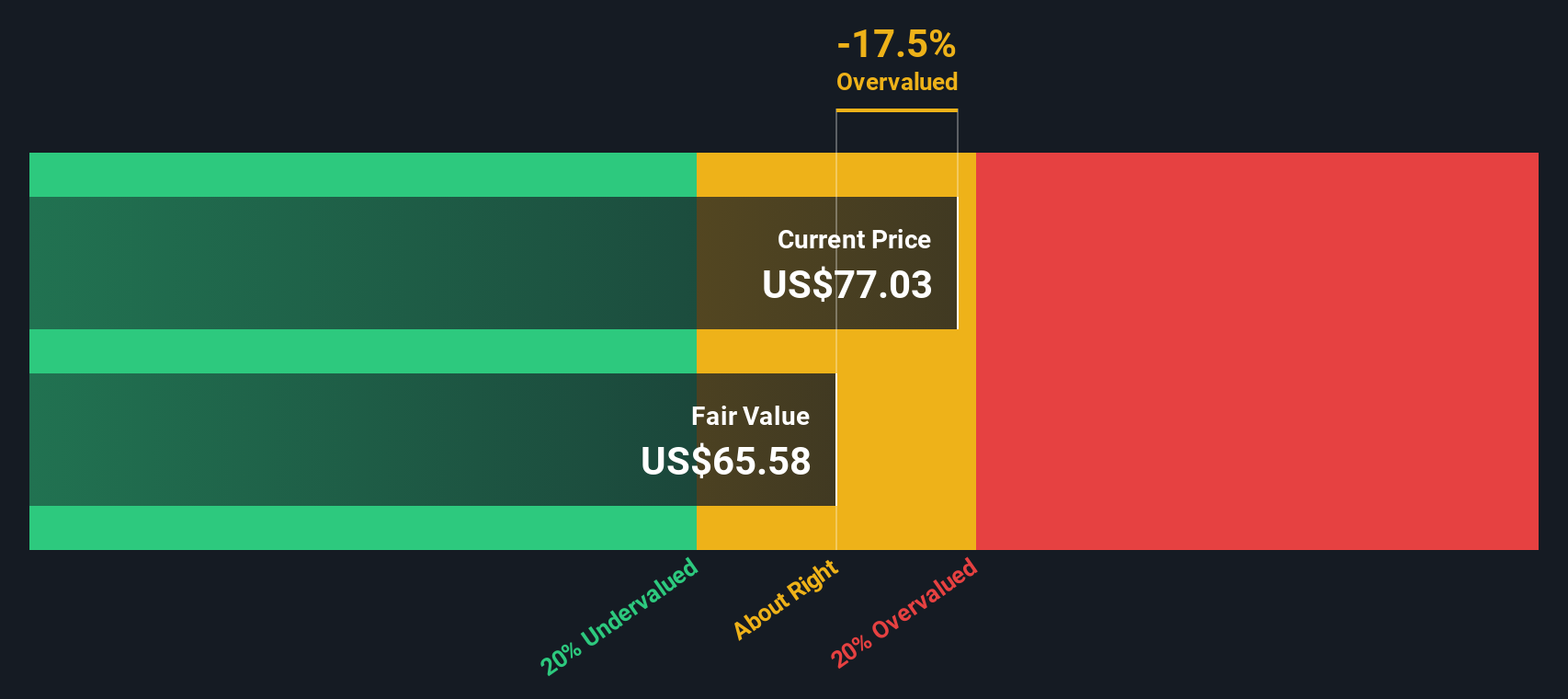

Putting these inputs through the Excess Returns Model yields an intrinsic value of about $56.64 per share. At the current price, the stock is roughly 8.7% above that estimate, so Block appears only slightly overvalued using this framework.

Result: ABOUT RIGHT

Block is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Block Price vs Earnings

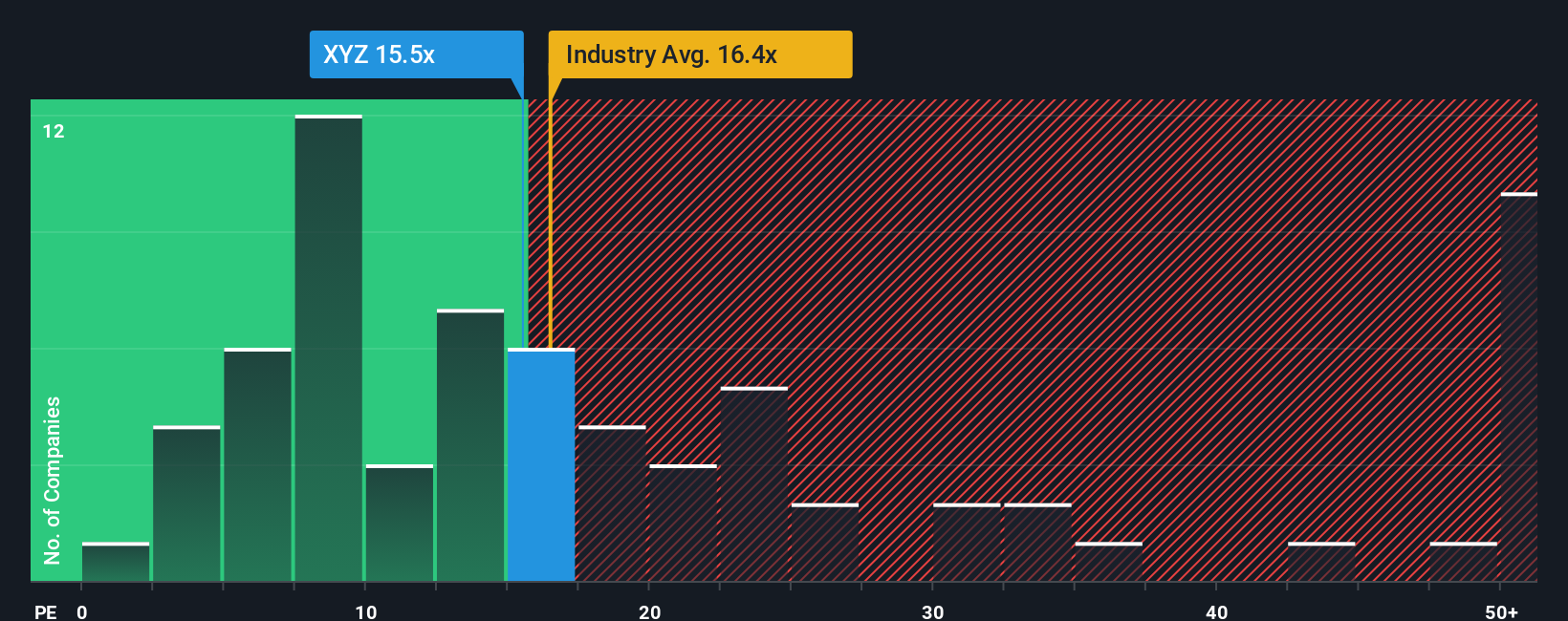

For a profitable company like Block, the Price to Earnings ratio is a practical way to gauge whether investors are paying a sensible price for each dollar of current earnings. It ties the valuation directly to the bottom line that ultimately supports long term returns.

What counts as a fair PE depends on how fast earnings are expected to grow and how risky those profits appear. Higher growth and more predictable cash flows can justify a higher multiple, while slower or more volatile earnings usually deserve a discount. Block currently trades on a PE of about 11.9x, below both the Diversified Financial industry average of roughly 13.4x and well under its peer group, which averages around 58.0x.

Simply Wall St’s Fair Ratio refines this comparison by estimating what PE Block should trade on, given its earnings growth outlook, margins, risk profile, industry, and market cap. For Block, that Fair Ratio is 19.1x, noticeably higher than the current 11.9x. This indicates that the market may not be fully reflecting the company’s fundamentals and growth potential in today’s price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Block Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to connect your view of Block’s story to a set of future revenue, earnings, and margin assumptions. These can then be turned into a financial forecast and into a Fair Value you can compare against today’s Price, all within the Simply Wall St Community page where millions of investors share their perspectives. When new news or earnings shift the outlook, your Narrative updates dynamically. You can see, for example, how a bullish investor might build a Narrative around medium term margin expansion and a Fair Value near the high end of analyst targets around $104, while a more cautious investor might focus on lending risk, crypto volatility, and competition to arrive closer to the low end around $35. This provides a clear, easy to use framework for deciding whether Block is a buy, hold, or sell at its current price.

Do you think there's more to the story for Block? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com