Cracker Barrel (CBRL) Margins Stuck Near 1.3%, Testing Bullish Earnings-Growth Narrative

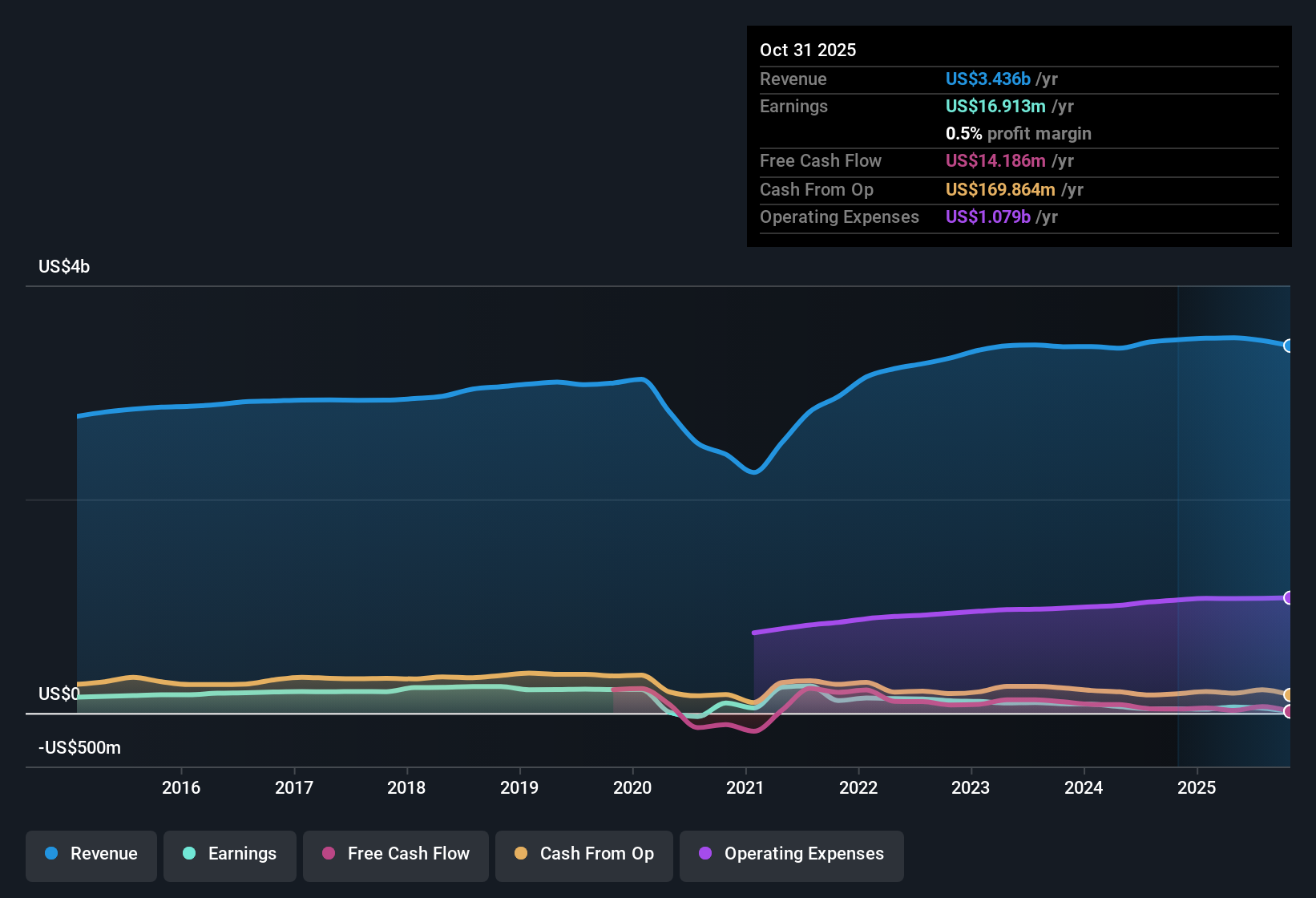

Cracker Barrel Old Country Store (CBRL) has kicked off Q1 2026 with a backdrop of Q4 2025 revenue of about $868 million and EPS of $0.30, alongside trailing twelve month EPS of $2.08 on roughly $3.5 billion in revenue. The company has seen quarterly revenue move between about $845 million and $949 million through fiscal 2025, with EPS ranging from $0.22 to $1.00, while trailing figures show a modest uptick in net margin to 1.3% from 1.2%. Against that setup, investors will be watching how these slim but improving profitability levels frame the latest results and what they signal about the durability of the margin story.

See our full analysis for Cracker Barrel Old Country Store.With the headline numbers on the table, the next step is to pit these results against the dominant narratives around Cracker Barrel to see which stories hold up and which ones need a rethink.

See what the community is saying about Cracker Barrel Old Country Store

Margins Edge Up To 1.3%

- Trailing net profit margin is 1.3% compared with 1.2% a year ago, on about $3.5 billion of revenue and $46.4 million of net income.

- Analysts' consensus view that menu simplification and more efficient back-of-house processes can lift margins meets mixed evidence so far

- Same restaurant sales growth has moved from negative 1.9% in Q3 2024 to 3.7% in Q2 2025 and 2.6% on a trailing basis, which is consistent with efforts to enhance guest experience and pricing.

- At the same time, the modest 0.1 percentage point margin improvement and Q4 2025 EPS of $0.30 show that elevated expenses and investments are still limiting how much of that sales progress turns into profit.

Sales Growth Still Modest

- Over the last 12 months, revenue growth is about 2.4% per year, with quarterly sales ranging between roughly $821 million and $949 million despite the store base ticking up from 721 to 728 locations.

- Consensus narrative expects better guest experience and refreshed stores to drive stronger same store sales, yet recent figures highlight only gradual traction

- Same restaurant sales growth was 0.1% in Q3 2025 and 3.7% in Q2 2025, showing improvement from prior declines but not a broad based acceleration across the year.

- The retail segment has seen a 2.8% revenue drop and Q4 2025 revenue of $868 million sits below Q2 2025’s $949 million, which challenges the idea that all parts of the business are benefiting equally from the strategic refresh.

Cheap P/E Comes With Baggage

- The stock trades on a P/E of 13.5 times, below peers at 19.1 times and the US hospitality industry at 23.1 times, while trailing results include a $16.9 million one off loss and the company carries high debt.

- Skeptics point to leverage and insider selling as reasons the low P/E may be warranted despite forecast 117.8% annual earnings growth

- Significant insider selling in the last three months and an unstable dividend track record sit alongside that one off $16.9 million loss, suggesting the reported earnings base has been noisy and potentially riskier than the headline growth forecast implies.

- High debt and the plan to refinance $300 million of convertible debt at likely higher interest costs mean more of any future profit growth could be absorbed by interest expense rather than flowing to shareholders.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cracker Barrel Old Country Store on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spotting a different angle on these figures? Use that insight to quickly build and share your own market view in just a few minutes: Do it your way.

A great starting point for your Cracker Barrel Old Country Store research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Explore Alternatives

Cracker Barrel’s slim margins, muted sales momentum, high debt load, and recent insider selling all raise questions about how durable its recovery story really is.

If that combination of leverage and earnings uncertainty makes you uneasy, use our solid balance sheet and fundamentals stocks screener (1939 results) to quickly focus on companies with stronger finances and more resilient balance sheets that are built for tougher conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com