MedinCell (ENXTPA:MEDCL): Assessing Valuation After Teva’s FDA Filing for Olanzapine Long-Acting Injectable

MedinCell (ENXTPA:MEDCL) has been in focus after partner Teva filed a New Drug Application with the U.S. FDA for its olanzapine long acting injectable, which is built on MedinCell’s BEPO technology.

See our latest analysis for MedinCell.

The latest regulatory milestone appears to have reignited interest in MedinCell, with the 1 day share price return of 3.85 percent and a 90 day share price return of 41.39 percent contributing to a robust 1 year total shareholder return of 77.19 percent. This suggests that momentum is building rather than fading.

If this kind of catalyst driven story appeals to you, it might also be worth exploring other innovative healthcare stocks that could be setting up for their own next leg higher.

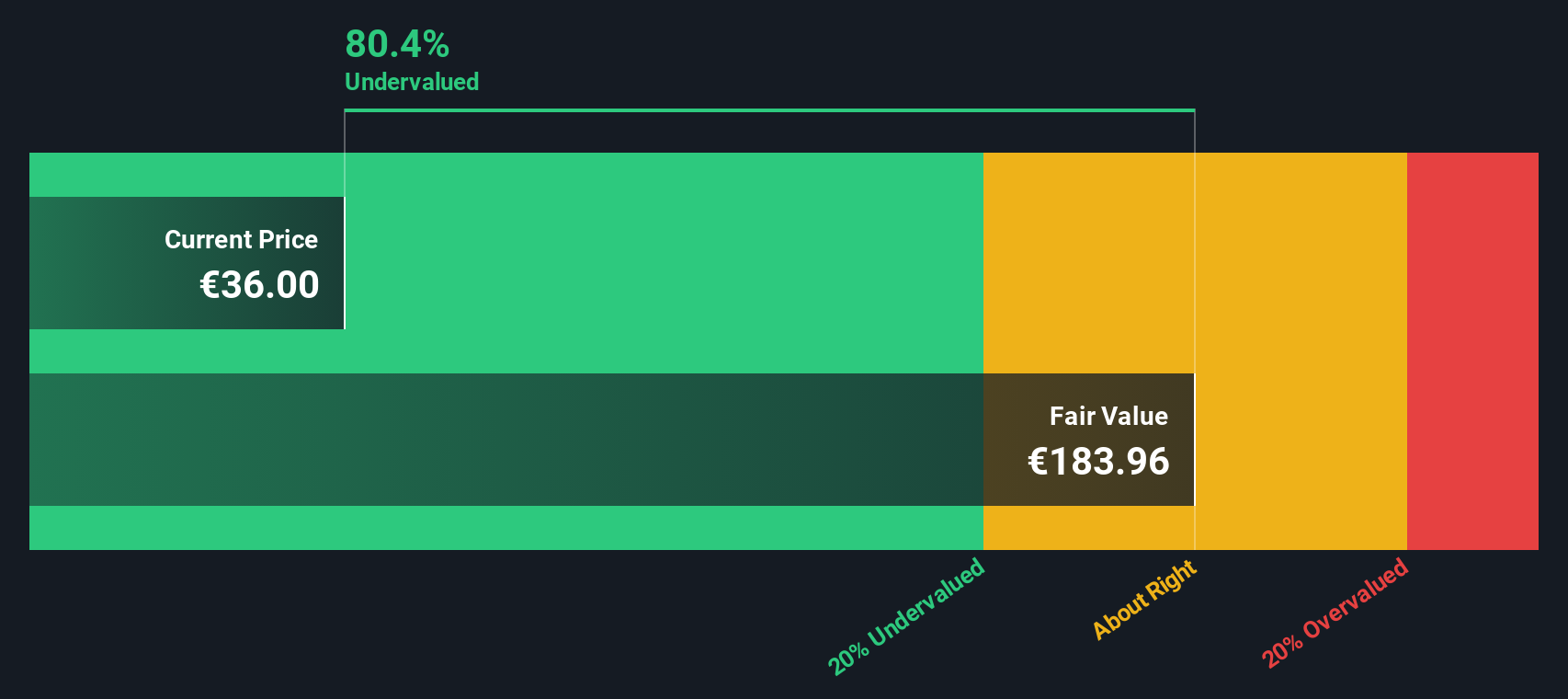

With shares already up sharply over the past year and analysts still seeing upside to their price targets, the key question now is whether MedinCell remains undervalued or if the market is already pricing in its future growth.

Most Popular Narrative Narrative: 20% Undervalued

With MedinCell last closing at €27.50 against a narrative fair value near €34.39, the story leans toward substantial upside if assumptions hold.

U.S. patent extensions for UZEDY (to 2042) and Olanzapine LAI (to 2044) significantly prolong periods of exclusivity, protecting pricing power and supporting higher net margins and long-term earnings visibility than may be reflected in the current stock price.

Curious how a loss making company can be modeled with soaring margins, rapid top line expansion and a premium future earnings multiple, yet still look underpriced on paper? The full narrative unpacks the aggressive growth path, the step change in profitability and the valuation bridge that connects today’s share price to those ambitious forecasts.

Result: Fair Value of $34.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the thesis could unravel if regulatory approvals slip or UZEDY and Olanzapine LAI underperform commercially, which could pressure revenues and future earnings assumptions.

Find out about the key risks to this MedinCell narrative.

Another Lens on Valuation

Our DCF model paints a far more optimistic picture, suggesting fair value closer to €93.97, meaning MedinCell could be trading at roughly a 70 percent discount. When one method appears cheap and the other looks more conservative, which story do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MedinCell Narrative

If you see the story differently, or just want to dig into the numbers yourself, you can build a fresh view in minutes: Do it your way.

A great starting point for your MedinCell research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If you stop at MedinCell, you could miss out on other powerful setups. Use the Simply Wall Street Screener to actively hunt your next winner.

- Capture early growth stories by scanning these 3597 penny stocks with strong financials that pair smaller market caps with surprisingly resilient fundamentals and financial discipline.

- Position ahead of the next tech wave by targeting these 26 AI penny stocks that blend AI potential with tangible business traction, not just hype.

- Lock in potential mispricings by focusing on these 901 undervalued stocks based on cash flows where strong cash flows and discounted valuations could set up compelling risk reward profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com