Compass Minerals (CMP) Q4 Loss Narrows Sharply, Testing Persistent Bearish Profitability Narrative

Compass Minerals International (CMP) closed out FY 2025 with fourth quarter revenue of $227.5 million and a basic EPS loss of $0.17, setting the tone for another year where top line scale contrasts with bottom line pressure. The company has seen quarterly revenue move from $202.9 million in Q3 2024 to $227.5 million in Q4 2025, while basic EPS has hovered in negative territory, from a $1.05 loss in Q3 2024 to a $0.17 loss most recently. This leaves investors focused on whether improving margins can eventually turn that sales base into sustainable profits.

See our full analysis for Compass Minerals International.With the latest numbers on the table, the next step is to see how this earnings profile stacks up against the dominant narratives around Compass Minerals, highlighting where the margin story supports the consensus view and where it pushes back.

See what the community is saying about Compass Minerals International

Losses Narrow From $48.3 Million To $7.2 Million

- Net loss improved from $48.3 million in Q4 2024 to $7.2 million in Q4 2025, while basic EPS moved from a loss of $1.17 to a loss of $0.17 over the same period.

- Consensus narrative highlights operational improvements and cost discipline, and this step down in losses lines up with that story but also shows there is still work to do:

- Margins look healthier than a year ago, which fits with the focus on lower production costs and more reliable output in both Salt and Plant Nutrition, yet the business is still not generating positive net income.

- Working capital and debt reduction efforts described in the consensus view are consistent with smaller quarterly losses, but the trailing twelve month net loss of $120.9 million reminds us that these gains are coming off a weak base.

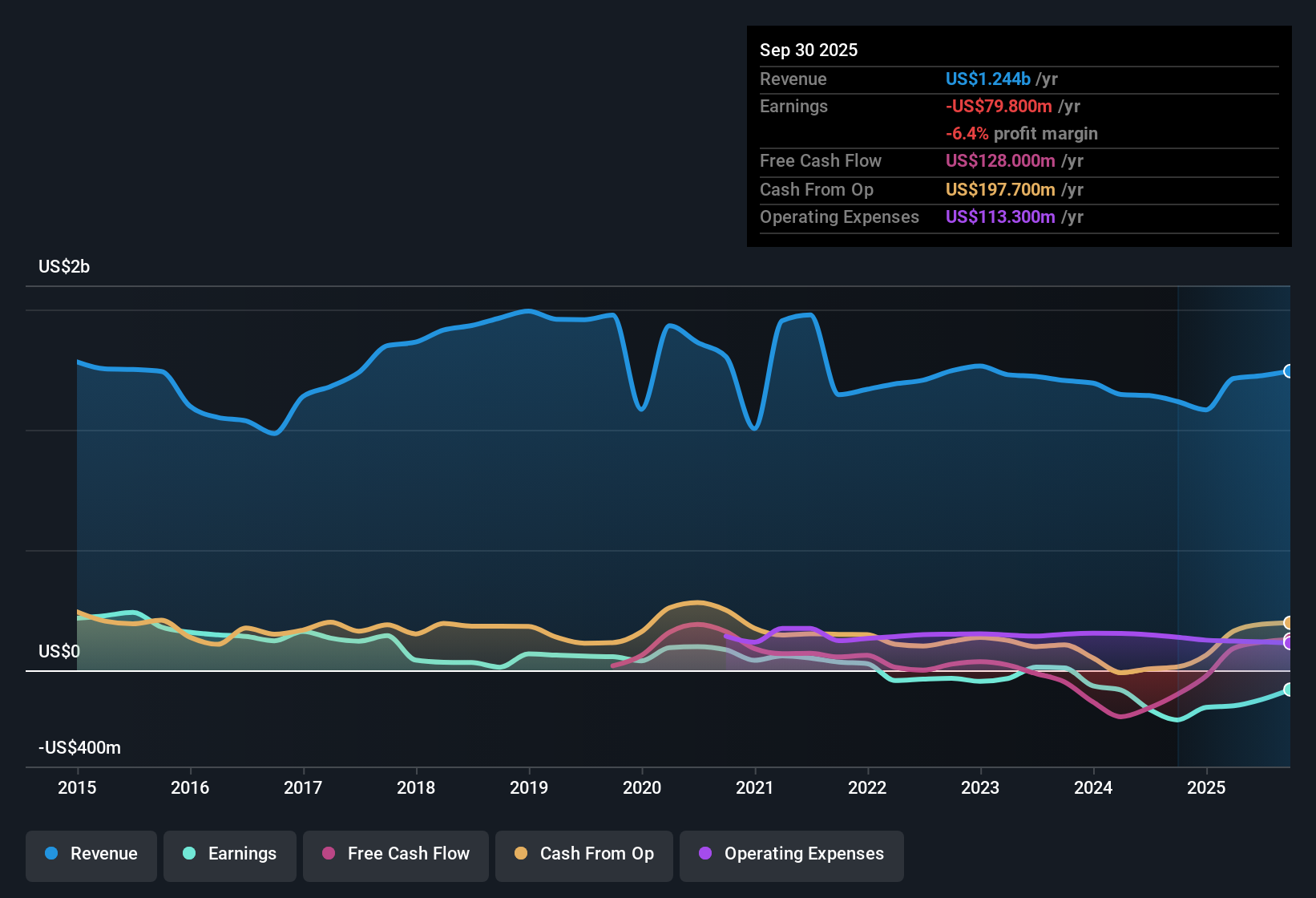

Trailing $1.2 Billion Revenue, But Still Unprofitable

- On a trailing twelve month basis, revenue is about $1.2 billion while net income excluding extra items is a loss of $120.9 million, meaning the company is still losing roughly $120 million a year despite the large sales base.

- Analysts' consensus view that strategic simplification and operational fixes can turn this into sustainable profits is partly supported by recent trends but constrained by current loss levels:

- Bulls point to margin expansion from plant optimization and lower inventories, and the shift from a $147.5 million LTM loss to a $120.9 million LTM loss suggests some progress toward that goal.

- At the same time, the risk section notes that interest payments are not well covered by earnings, and ongoing annual losses at this scale show why leverage and financing costs remain a central concern.

Cheap At 0.6x Sales, But Above DCF Fair Value

- The stock trades on a Price to Sales ratio of 0.6 times versus peers at 7.1 times and the US Metals and Mining industry at 2.0 times, yet the DCF fair value of $6.12 is well below the current $17.26 share price.

- Bears argue that weak profitability and debt pressures justify a cautious stance, and the valuation data gives them several concrete points to lean on:

- Losses have reportedly widened at about 68.8 percent per year over the last five years and interest payments are not well covered, which helps explain why a DCF model points to a fair value far under where the stock currently trades.

- Even though the forward view calls for earnings to grow about 13.74 percent per year and turn positive within three years, the gap between the $6.12 DCF fair value and $17.26 market price shows that execution on those forecasts matters a lot for anyone buying at today’s level.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Compass Minerals International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use that angle to build your own Compass Minerals story in just a few minutes, and share it via Do it your way.

A great starting point for your Compass Minerals International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Compass Minerals is still battling sizable net losses, leverage concerns, and a market price that sits far above DCF fair value despite modest operational progress.

If that mix of ongoing losses and debt risk feels uncomfortable, use our solid balance sheet and fundamentals stocks screener (1939 results) today to focus on financially stronger businesses built on healthier balance sheets and sturdier earnings power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com