Adobe (ADBE.US) Q4 results and FY2026 guidance all exceeded expectations, but it was difficult to overcome the anxiety of AI disruption in the market

The Zhitong Finance App learned that Adobe (ADBE.US) issued an optimistic annual performance guide, but investors reacted lackluster. They're always looking for more clear signs that the software maker can thrive in the age of artificial intelligence (AI).

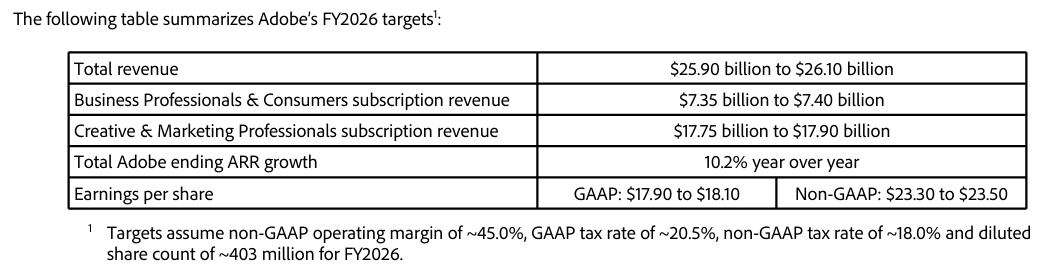

Adobe said on Wednesday that it expects revenue for the 2026 fiscal year ending November 2026 to reach 25.9 billion to 26.1 billion US dollars. Although the median forecast range exceeded the average expectations of Wall Street analysts, it fell short of the $26.4 billion expected by some analysts. The company also expects adjusted earnings per share for the 2026 fiscal year of $23.30 to $23.50, which is slightly higher than the median forecast range of $23.37 expected by Wall Street analysts.

Meanwhile, financial reports released on Wednesday showed that in the fourth fiscal quarter of fiscal year 2025 ending November 28, Adobe's revenue increased 10% year-on-year to a record $6.19 billion, better than analysts' average forecast of $6.11 billion. Non-GAAP net profit was US$2.29 billion, up 8% from US$2.13 billion in the same period last year. Adjusted earnings per share were $5.50, better than analysts' average expectations of $5.39.

The digital media division, which includes Adobe's flagship creative and document processing software, had revenue of $4.62 billion, up 11% year over year; the division's annual recurring revenue (ARR) was $19.2 billion. The digital experience division's revenue was $1.52 billion, up 9% year over year.

Adobe's performance in fiscal year 2025 was better than market expectations, and CEO Shantanu Narayen (Shantanu Narayen) said this reflected Adobe's “growing importance in the global AI ecosystem and the rapid adoption of our AI-driven tools.”

However, Adobe did not update some of the AI-related metrics it disclosed three months ago. In September of this year, the company said that its annual recurring revenue affected by AI had exceeded 5 billion US dollars, while sales of AI priority products had exceeded 250 million US dollars.

Investors have been worried that generative AI could have an impact on Adobe's business. Adobe's challenges are multi-dimensional. On the one hand, smaller companies like Canva and Figma are seizing more market share; on the other hand, big tech companies like Meta are integrating more AI features. More worryingly, AI-native tools like Midjourney are challenging Adobe's long-standing leadership in creative software. Although AI features in apps like Photoshop have been used tens of billions of times, many other popular tools — such as Google's (GOOGL.US) video generation model Veo — have been developed by other companies.

The stock has performed less well than its tech peers this year as investors fear Adobe will lag behind in the AI era. Jefferies analyst Brent Thill (Brent Thill) wrote in a report before the earnings report was released: “Concerns about AI disruption are plaguing Adobe and the entire application software sector.” He said investors may be waiting for “sufficiently significant and sustainable accelerated growth to dispel concerns about AI disruption and re-enter the market.”

To ensure that its features can be seen by a wider range of users, Adobe announced on Wednesday that it will integrate Photoshop and Acrobat into OpenAI's ChatGPT and provide some features free of charge to chatbot users.