Two Harbors Investment (TWO): Reassessing Valuation After a Recent 5% Share Price Rebound

Two Harbors Investment (TWO) has quietly climbed about 5% over the past month even as its year to date return remains negative, a setup that naturally raises questions about what the market is repricing.

See our latest analysis for Two Harbors Investment.

The recent 5.1% 1 month share price return looks more like a tentative rebound than a trend shift, given the roughly 15% negative year to date share price return and still weak multi year total shareholder returns. Investors seem to be cautiously reassessing the risk reward trade off as income stability and book value resilience come back into focus.

If Two Harbors has you rethinking where income and risk intersect, it could be worth exploring fast growing stocks with high insider ownership as a hunting ground for the market’s next committed owner operators.

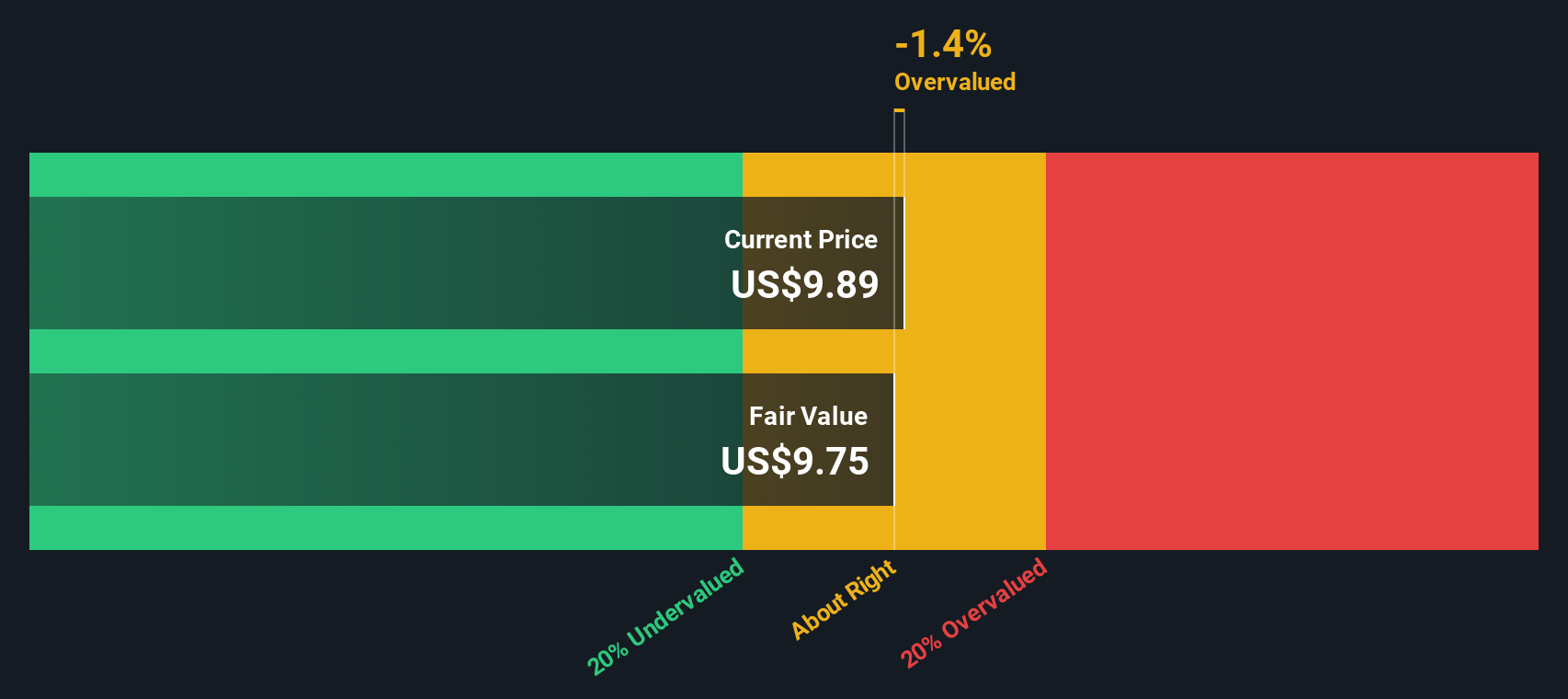

With shares still trading below analyst targets yet burdened by weak long term returns and volatile earnings, is Two Harbors quietly undervalued here, or is the market already discounting any realistic rebound in future growth?

Price-to-Sales of 2x: Is it justified?

On a price-to-sales basis, Two Harbors Investment trades at roughly 2 times sales. This screens as cheap versus peers but rich against its own fair ratio.

The price-to-sales multiple compares the value the market places on the company to the revenue it generates. It is a common yardstick for financials where earnings can be volatile or temporarily negative. For Two Harbors, this lens matters because reported profits are currently in the red, yet investors still need a way to benchmark valuation against the broader Mortgage REITs space.

Relative to the US Mortgage REITs industry average price-to-sales of about 4.7 times, Two Harbors looks like a discount play. This suggests the market may be pricing in lower growth or higher risk than for peers. However, that same 2 times sales multiple sits far above an estimated fair price-to-sales ratio of roughly 0.4 times, implying meaningful room for the valuation to compress if sentiment or fundamentals do not improve.

Explore the SWS fair ratio for Two Harbors Investment

Result: Price-to-Sales of 2x (OVERVALUED)

However, persistent revenue contraction and ongoing net losses, despite improving net income growth, could quickly undermine any perceived valuation support or rebound narrative.

Find out about the key risks to this Two Harbors Investment narrative.

Another View: DCF Points the Other Way

While the 2 times sales ratio hints at overvaluation versus a 0.4 times fair ratio, our DCF model tells a different story. In that framework, Two Harbors looks roughly 34% undervalued, with an estimated fair value near $15.31 versus a $10.14 share price.

Look into how the SWS DCF model arrives at its fair value.

If cash flow assumptions prove closer to reality than today’s muted revenue and earnings profile, could the market be underestimating the upside, or is the DCF simply too optimistic for a business this cyclical?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Two Harbors Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Two Harbors Investment Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a personalized view in minutes: Do it your way.

A great starting point for your Two Harbors Investment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to scan fresh opportunities on Simply Wall St, where focused screeners surface shares the market has not fully priced.

- Capture momentum early by reviewing these 26 AI penny stocks that are harnessing real world artificial intelligence trends before they become front page stories.

- Explore ways to increase your income potential with these 12 dividend stocks with yields > 3% that aim to balance reliable payouts with sustainable business fundamentals.

- Consider positioning yourself ahead of the crowd with these 81 cryptocurrency and blockchain stocks shaping the infrastructure and innovation powering digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com