Materion (MTRN) Valuation After Harvey Partners’ New Stake and Q3 Margin Expansion

Harvey Partners just disclosed a fresh position in Materion (MTRN), scooping up 318,000 shares for about $38.4 million, after a third quarter that featured margin gains across electronic materials and precision optics.

See our latest analysis for Materion.

That institutional vote of confidence lands as Materion’s share price trades around $127.4, with a robust year to date share price return of roughly 34% and a five year total shareholder return of about 120%. This suggests positive momentum is building around its growth story rather than fading.

If this kind of institutional interest has you thinking more broadly about the market, it could be a good time to explore fast growing stocks with high insider ownership.

With the stock up sharply this year and still trading at a double digit discount to analyst and intrinsic value estimates, the key question now is whether Materion remains mispriced or if the market is already baking in its future growth.

Most Popular Narrative: 11.3% Undervalued

With Materion last closing at $127.40 against a most-followed fair value estimate of $143.67, the narrative leans toward meaningful upside still on the table.

Structural cost improvements, operational efficiencies, and favorable product mix within Electronic Materials are driving record-high EBITDA margins, with management expecting continued year-over-year margin expansion. This should result in lasting improvements in net profitability as volumes recover across semiconductor and electronics markets.

Curious how margin gains, accelerating earnings and a lower future earnings multiple can still produce upside from here? The full narrative unpacks the math behind that apparent contradiction.

Result: Fair Value of $143.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, demand uncertainty in semiconductors and procurement risks tied to Chinese customers could derail margin expansion and challenge the current undervaluation thesis.

Find out about the key risks to this Materion narrative.

Another View on Valuation

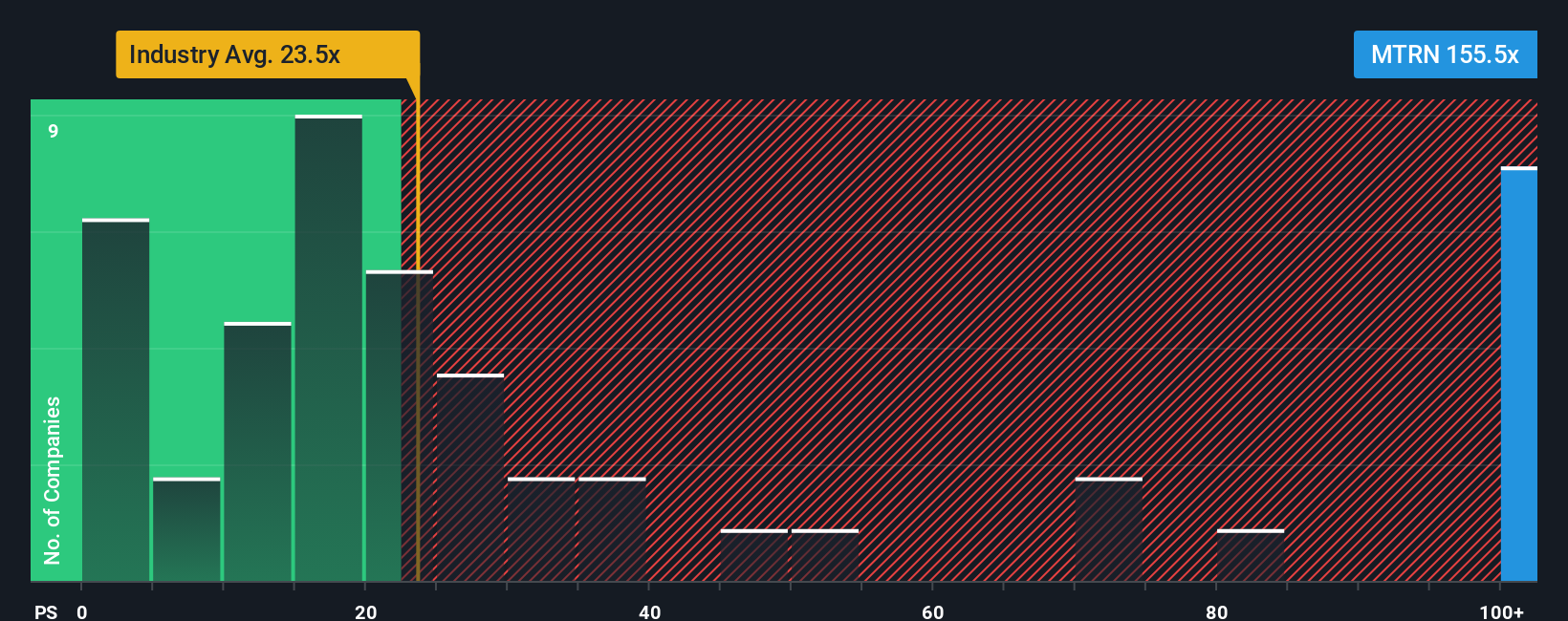

While the narrative and DCF style fair value work suggest upside, Materion looks expensive on earnings. The stock trades on a price to earnings ratio of 136.2 times, versus 37.3 times for peers, 22 times for the broader industry, and a 34.8 times fair ratio the market could drift toward.

That gap implies a lot of good news is already priced in, raising the risk that even small disappointments on growth or margins could hit the share price. How comfortable are you with paying up today for tomorrow's earnings story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Materion Narrative

If this perspective does not fully match your own, dive into the numbers and build a fresh view in just a few minutes: Do it your way.

A great starting point for your Materion research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Turn today’s insight into a smarter portfolio move, and do not let the next wave of opportunities pass you by while others position ahead of time.

- Position for powerful income potential by reviewing these 12 dividend stocks with yields > 3% that combine attractive yields with resilient business models.

- Capitalize on structural growth in medical innovation through these 30 healthcare AI stocks targeting companies at the intersection of healthcare and intelligent automation.

- Strengthen your watchlist with these 905 undervalued stocks based on cash flows that appear mispriced relative to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com