Prudential Financial (PRU): Assessing Valuation as New CIO and Advisory Expansion Target Tech‑Enabled Growth

Prudential Financial (PRU) is shaking up its investment leadership and distribution engine at the same time, naming Matthew Armas as incoming chief investment officer while bolstering Prudential Advisors with new talent and tech driven tools.

See our latest analysis for Prudential Financial.

Those moves come as Prudential’s $114.76 share price has logged a 7.51% 1 month share price return but remains slightly negative year to date. A 5 year total shareholder return of 88.10% shows longer term compounding still intact and momentum cautiously rebuilding.

If this leadership refresh has you thinking about where else capital and expertise are lining up, it could be a good moment to explore fast growing stocks with high insider ownership for other potential standouts.

With shares only a touch below analyst targets but trading at what some models suggest is a steep intrinsic discount, the key question is whether Prudential is quietly undervalued or whether the market already anticipates the next leg of growth.

Most Popular Narrative Narrative: 80% Undervalued

Compared with Prudential Financial’s last close at $114.76, the most widely followed narrative pegs fair value materially higher. This implies a deep discount that hinges on improving profitability and disciplined capital allocation.

The company's continued investment in digital transformation (including AI powered underwriting, automation, and customer self service capabilities) is expected to lower operating costs and improve net margins over time as technology adoption further enhances scale and efficiency.

Curious how modest revenue growth, rising margins and a lower future earnings multiple can still point to such a rich upside? The narrative’s math might surprise you. It blends slow but steady top line expansion with a sharp earnings inflection and shrinking share count to justify today’s gap. Want to see exactly how those moving pieces stack up into that fair value call?

Result: Fair Value of $115.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying RILA competition and execution risks around digital transformation could easily derail those optimistic earnings and margin assumptions.

Find out about the key risks to this Prudential Financial narrative.

Another Way to Read the Valuation

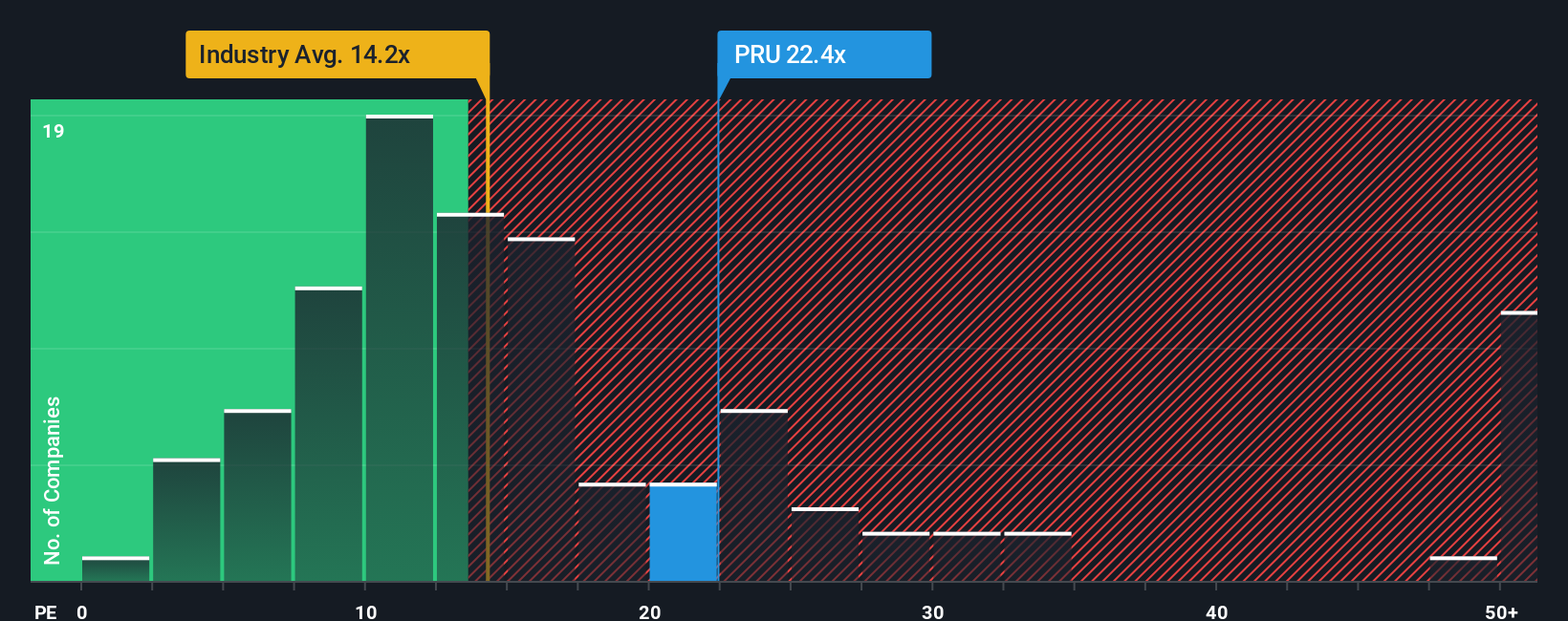

On earnings, Prudential looks far less cheap. Its current P/E of 15.5 times is higher than both the US Insurance industry at 13 times and peers at 13.5 times, and only slightly below a 16.1 times fair ratio, suggesting less margin of safety if profits disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prudential Financial Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Prudential Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before markets move without you, put Simply Wall Street’s Screener to work and uncover fresh, data backed opportunities that align with your strategy in minutes.

- Capitalize on mispriced quality by scanning these 905 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Ride powerful innovation trends by targeting these 26 AI penny stocks positioned at the forefront of automation, machine learning, and next generation software solutions.

- Strengthen your income strategy by focusing on these 12 dividend stocks with yields > 3% that can boost portfolio yield while still passing fundamental health checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com