Assessing Charles Schwab (SCHW) Valuation as Retail Trading Activity Extends Six-Month Rally

Charles Schwab (SCHW) is back in focus after its Schwab Trading Activity Index rose for a sixth straight month in November, underscoring persistent client net buying and heightened appetite for equities across key growth sectors.

See our latest analysis for Charles Schwab.

The steady climb in Schwab’s trading activity comes as the share price sits around $95.81 and has delivered a robust year to date share price return of roughly 29.8 percent, signaling that momentum is still building rather than fading.

If Schwab’s renewed trading momentum has your attention, this could be a good moment to explore other financial names with strong participation trends using our screener for fast growing stocks with high insider ownership.

Yet with shares already up strongly this year and trading at only a modest discount to Wall Street targets, investors now face a tougher call: Is Schwab still mispriced, or is the market already baking in its next leg of growth?

Most Popular Narrative: 14.2% Undervalued

With Charles Schwab’s fair value estimate sitting around $111.61 versus a $95.81 last close, the leading narrative implies meaningful upside still on the table.

Ongoing digital transformation and operational enhancements (e.g. AI-powered efficiency and automation) are expected to sustainably reduce cost-to-serve and improve client experience at scale, underpinning long-term operating margin expansion.

Want to see how this efficiency push turns into a richer valuation story? The core thesis leans on ambitious growth, fatter margins, and a future earnings multiple that rivals market leaders. Curious which specific profit and revenue milestones have to be hit for that upside to materialize? The full narrative lays out the exact roadmap behind that target.

Result: Fair Value of $111.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from low cost digital brokers and sensitivity to lower interest rates could quickly challenge Schwab’s margin expansion and growth assumptions.

Find out about the key risks to this Charles Schwab narrative.

Another View: Market Ratio Signals Caution

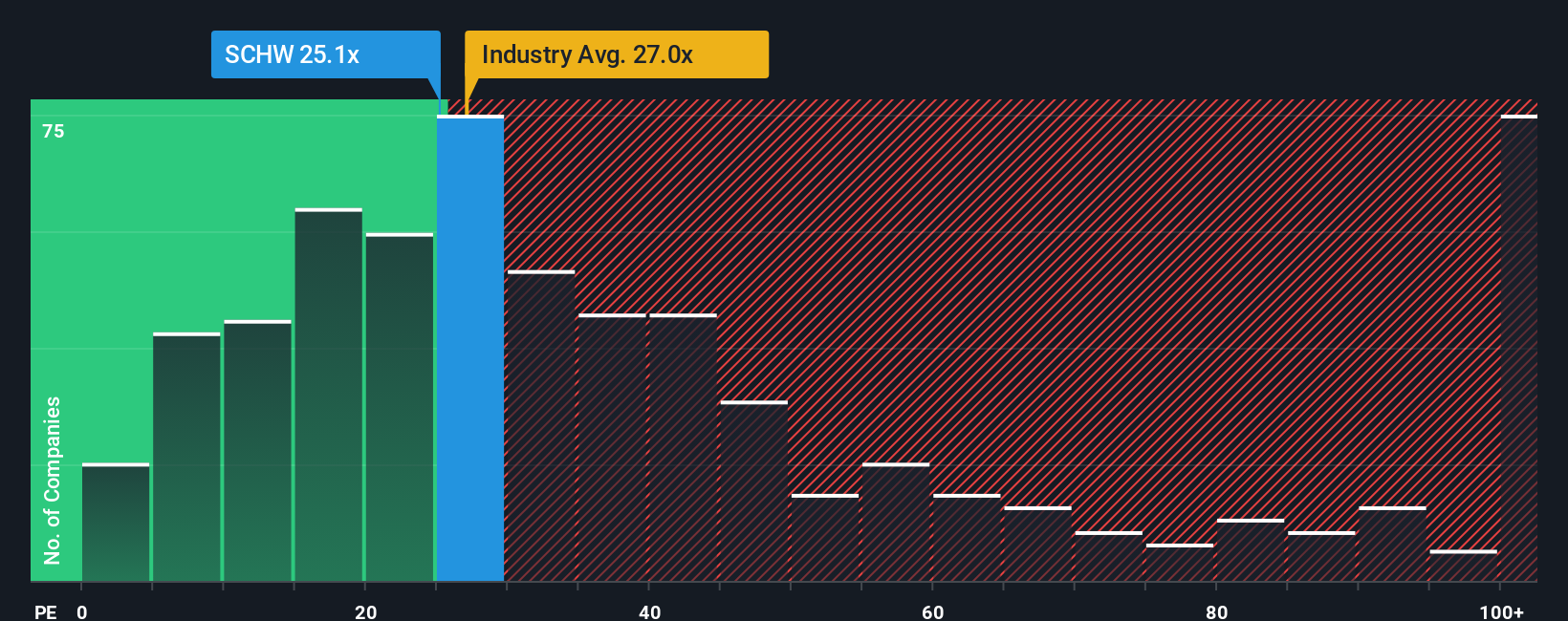

While the narrative fair value points to upside, Schwab’s current price to earnings ratio of 21.9 times already sits below both peers at 31 times and the US Capital Markets industry at 25.3 times, but above its fair ratio of 18.5 times, hinting at valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Charles Schwab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Charles Schwab Narrative

If you see the story differently or want to stress test assumptions with your own inputs, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your Charles Schwab research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Schwab might be compelling, but you will give up potential edge if you stop here. Use these focused screens to help you uncover your next high conviction move.

- Capture potential under-the-radar bargains by targeting companies trading below intrinsic value through these 905 undervalued stocks based on cash flows that still show solid fundamentals and cash flow strength.

- Explore powerful shifts in medicine and diagnostics by filtering for innovators improving patient outcomes with these 30 healthcare AI stocks and reshaping how healthcare data is used.

- Look for opportunities in the next wave of digital finance by focusing on businesses that may benefit from blockchain adoption with these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com