Does Dollarama’s Global Expansion And Analyst Buzz Change The Bull Case For TSX:DOL?

- In recent months, Dollarama has accelerated its international push, including opening Dollarcity’s first store in Mexico and acquiring Australia’s largest discount retailer, while continuing to be highlighted by major brokerages as a high-quality growth story.

- This combination of geographic diversification and growing analyst recognition underscores how investors are focusing on Dollarama’s potential to extend its value-focused retail model well beyond Canada.

- We’ll now examine how Dollarama’s heightened analyst recognition, particularly its designation as a top quality growth pick, reshapes its investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Dollarama Investment Narrative Recap

To own Dollarama today, you need to believe its value retail formula can keep translating into steady growth while the company scales across multiple countries without losing margin discipline. The latest recognition from RBC and Desjardins reinforces the current growth narrative, but does not materially change the near term picture where the key catalyst remains successful international expansion and the biggest risk is execution missteps, especially in Australia and new Latin American markets.

RBC Capital Markets naming Dollarama its top quality growth pick for 2026 is particularly relevant here, because it reflects how analysts are tying the stock’s appeal to predictable growth and market share gains at a time when the company is committing significant capital and management attention to its global rollout. That endorsement effectively spotlights the same expansion that could either extend Dollarama’s growth runway or expose investors to higher operational and regulatory risk if integration and local adaptation prove more difficult than expected.

Yet while international growth is attracting attention, investors should also be aware of how market saturation risk in Canada could...

Read the full narrative on Dollarama (it's free!)

Dollarama's narrative projects CA$9.1 billion revenue and CA$1.6 billion earnings by 2028.

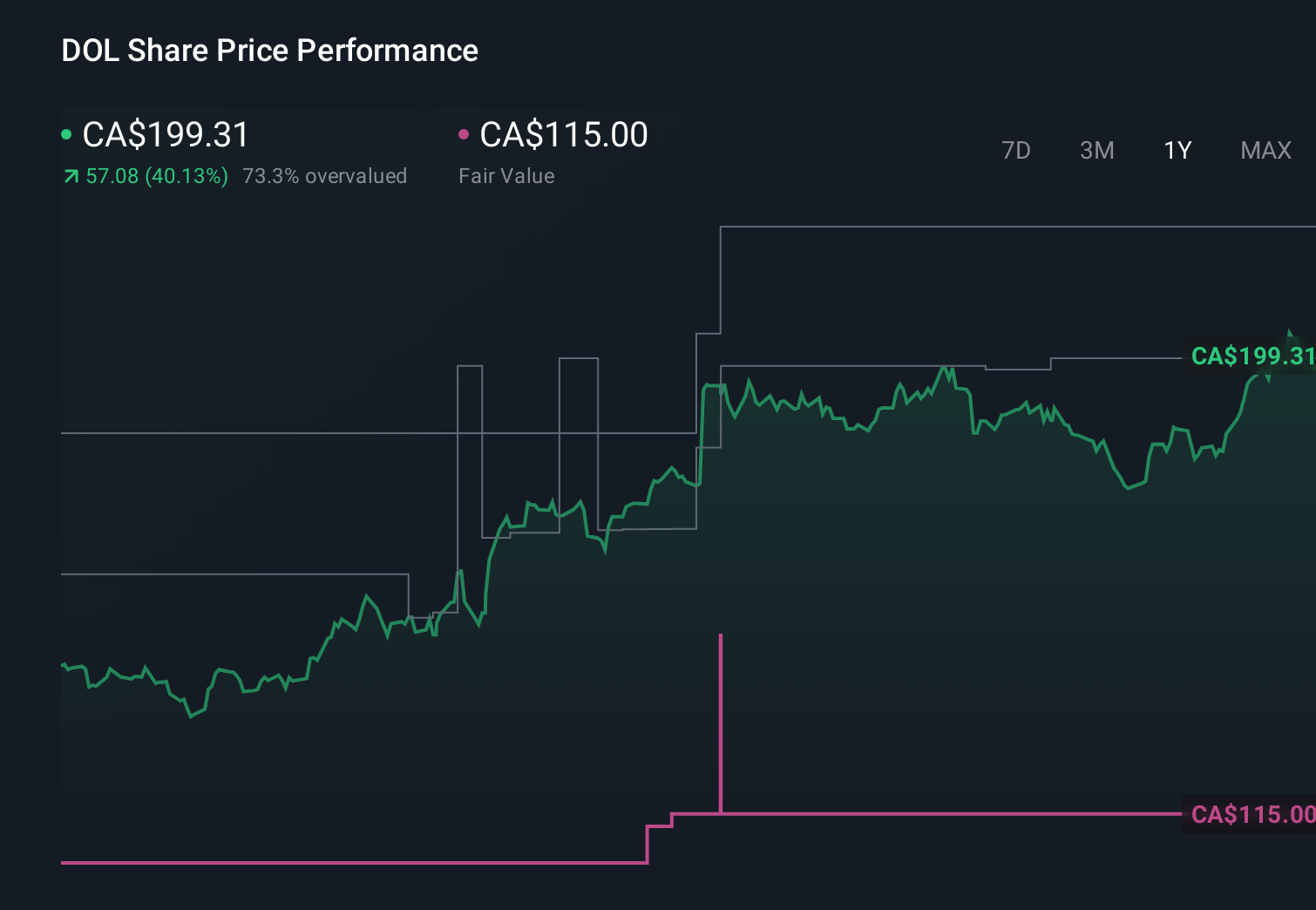

Uncover how Dollarama's forecasts yield a CA$200.81 fair value, in line with its current price.

Exploring Other Perspectives

Fourteen members of the Simply Wall St Community currently peg Dollarama’s fair value between C$117.50 and C$223, reflecting very different expectations. Against this spread, the ambitious push into Mexico and Australia could be a key swing factor for future performance, so it pays to consider several viewpoints before deciding how that risk fits your own expectations.

Explore 14 other fair value estimates on Dollarama - why the stock might be worth 41% less than the current price!

Build Your Own Dollarama Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollarama research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dollarama research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollarama's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com