Asian Dividend Stocks To Enhance Your Portfolio

As global markets exhibit mixed signals, with Japan facing monetary tightening and China experiencing an economic slowdown, investors are increasingly turning their attention to dividend stocks in Asia as a potential source of steady income amidst uncertainty. In such a dynamic environment, selecting dividend stocks that offer stable yields and have resilient business models can be crucial for enhancing portfolio performance.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.68% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| NCD (TSE:4783) | 4.36% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.74% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.05% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.61% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.42% | ★★★★★★ |

Click here to see the full list of 1022 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

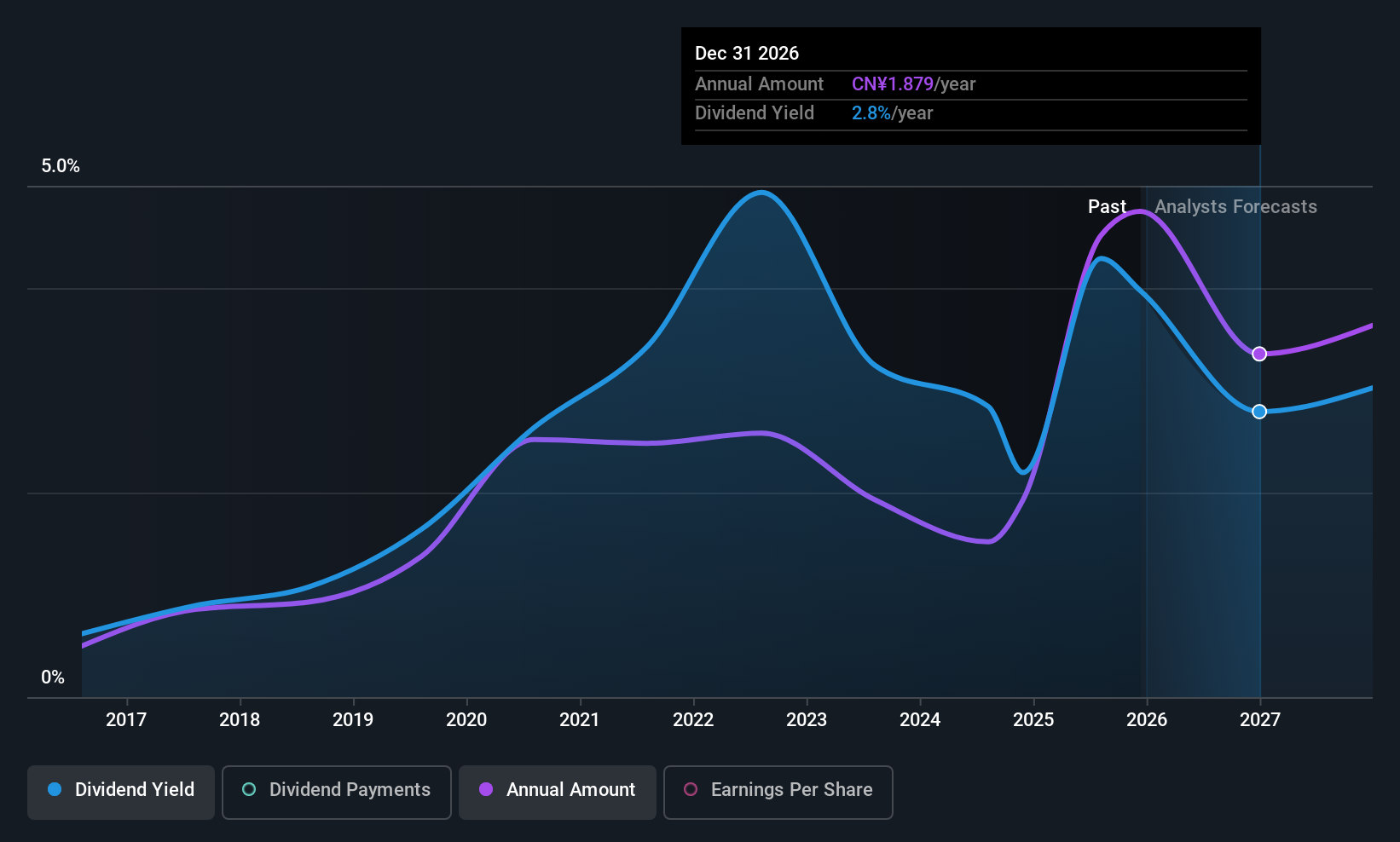

New China Life Insurance (SHSE:601336)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: New China Life Insurance Company Ltd. offers life insurance products and services to individuals and institutions in China, with a market cap of CN¥189.03 billion.

Operations: New China Life Insurance Company Ltd. generates revenue through providing life insurance products and services to both individuals and institutions in China.

Dividend Yield: 3.9%

New China Life Insurance has a low payout ratio of 21.6%, indicating its dividends are well covered by earnings, and a cash payout ratio of 8.6%, showing strong coverage by cash flows. Despite a recent interim dividend increase, the company's dividend history is marked by volatility and unreliability over the past decade. Recent financial performance shows significant earnings growth; however, future forecasts predict a decline in earnings, which could impact dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of New China Life Insurance.

- Our expertly prepared valuation report New China Life Insurance implies its share price may be lower than expected.

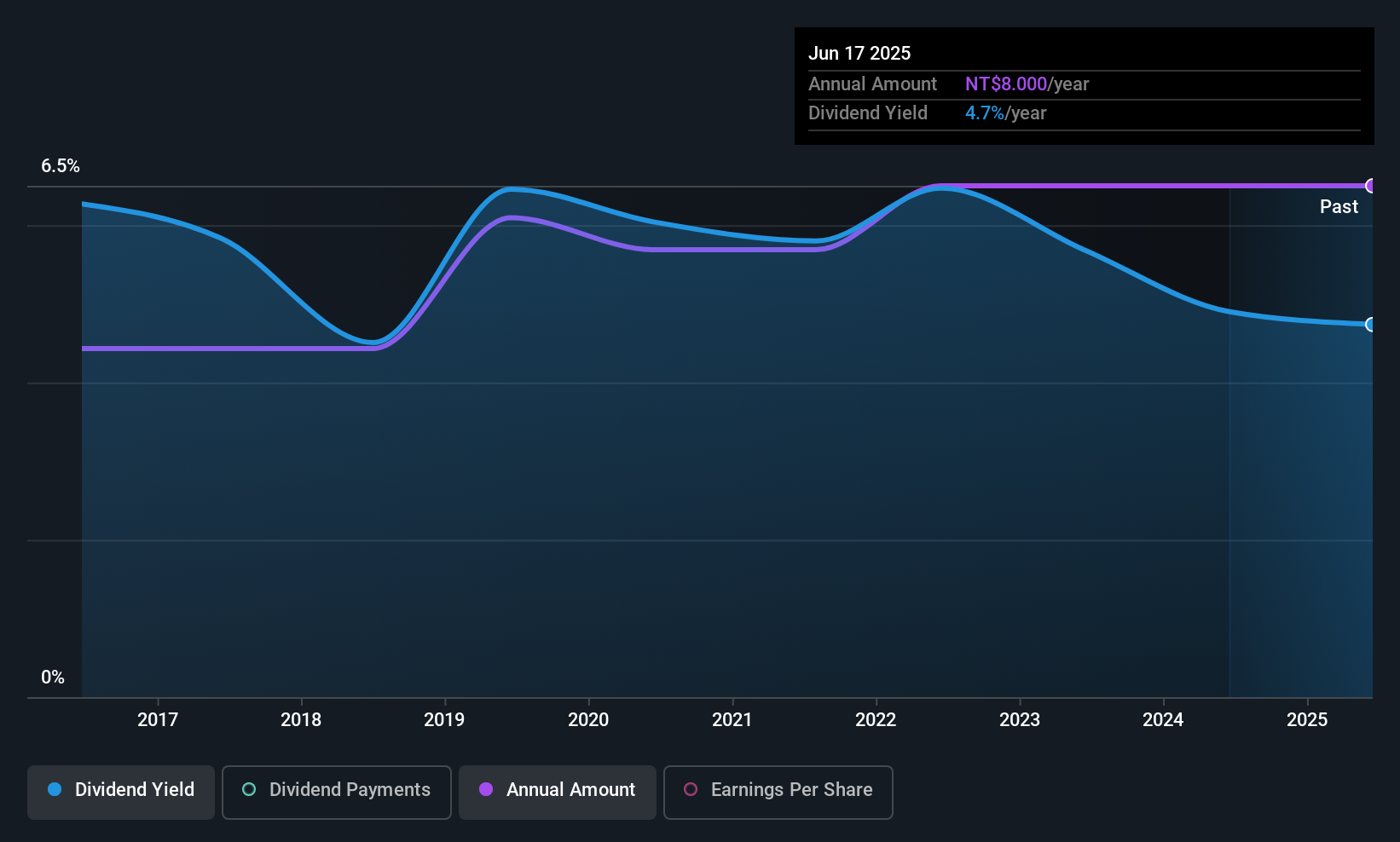

Solidwizard Technology (TPEX:8416)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Solidwizard Technology Co., Ltd. offers software, hardware, and consulting service solutions in Taiwan and China with a market cap of NT$5.16 billion.

Operations: Solidwizard Technology Co., Ltd. generates revenue of NT$1.52 billion in Taiwan and NT$168.49 million in China.

Dividend Yield: 4.4%

Solidwizard Technology's recent earnings report highlights robust growth, with third-quarter net income rising to TWD 84.47 million from TWD 51 million a year ago. The company's dividend payments are well-supported by both earnings and cash flows, with payout ratios of 63.1% and 56.7%, respectively. Although trading below its estimated fair value, Solidwizard offers a reliable dividend yield of 4.37%, albeit lower than the top quartile in Taiwan's market, yet dividends have been stable and growing for a decade.

- Get an in-depth perspective on Solidwizard Technology's performance by reading our dividend report here.

- According our valuation report, there's an indication that Solidwizard Technology's share price might be on the cheaper side.

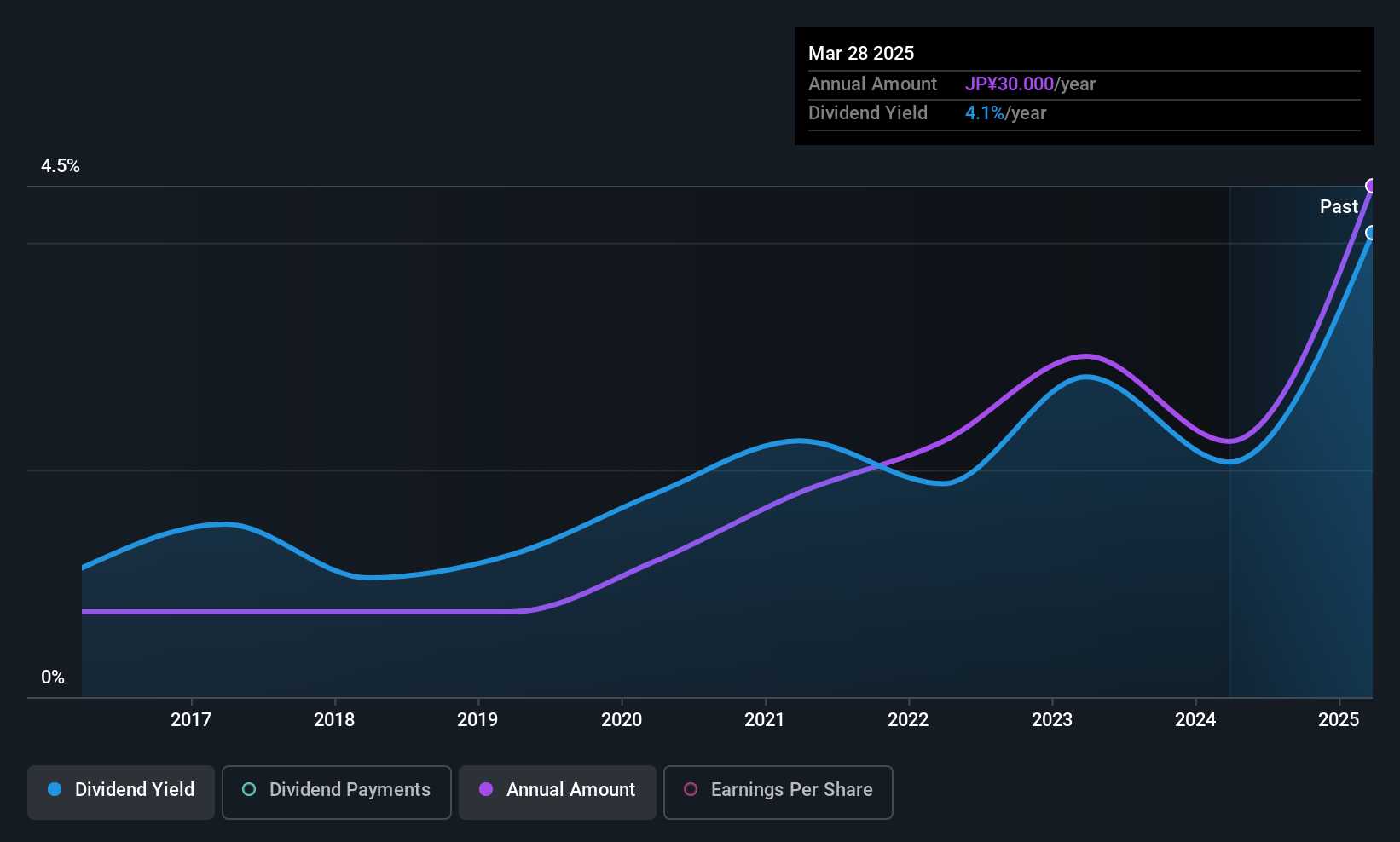

Kimura Chemical Plants (TSE:6378)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kimura Chemical Plants Co., Ltd. is an engineering company with a market cap of ¥25.02 billion.

Operations: Kimura Chemical Plants Co., Ltd. generates revenue through its Engineering Business (¥7.10 billion), Chemical Engineering Business (¥12.63 billion), and Energy and Environment Business (¥7.75 billion).

Dividend Yield: 3.2%

Kimura Chemical Plants has a price-to-earnings ratio of 11.9x, which is attractive compared to the JP market average of 14.1x, indicating good value. The company's dividend payments are covered by earnings with a payout ratio of 38.6%, though cash flow coverage is tighter at 86.4%. Despite recent growth in dividends over the past decade, their reliability is questionable due to volatility and an unstable track record in payouts.

- Take a closer look at Kimura Chemical Plants' potential here in our dividend report.

- Our valuation report here indicates Kimura Chemical Plants may be overvalued.

Seize The Opportunity

- Unlock our comprehensive list of 1022 Top Asian Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com