e.l.f. Beauty (ELF): Valuation Check After Profit Slump, Cautious Outlook and Insider Stock Sales

e.l.f. Beauty (ELF) just delivered an earnings beat that came with a sharp catch: net income plunged roughly 85%, full year sales guidance underwhelmed, and heavy pre earnings insider selling spooked investors.

See our latest analysis for e.l.f. Beauty.

That mix of an earnings beat, a steep drop in net income and heavy insider selling has quickly shifted sentiment. The share price is now at $78.62 and the 90 day share price return is about minus 43%, even though the five year total shareholder return is still roughly 264%. This suggests long term holders remain well ahead despite fading momentum.

If this sharp reset in expectations has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas beyond e.l.f. Beauty.

With profits under pressure, guidance trimmed and the stock now trading at a sizeable discount to analyst targets, is e.l.f. Beauty quietly becoming undervalued, or is the market rightly pricing in slower growth from here?

Most Popular Narrative Narrative: 35.4% Undervalued

With e.l.f. Beauty last closing at $78.62 against a narrative fair value of about $121.71, the implied upside rests on ambitious growth and margin expansion.

The company is highly effective at leveraging influencer marketing, social media virality, and community-driven innovation (e.g., TikTok Shop exclusives, rapid launch cadence). This enables lower customer acquisition costs and highly efficient brand-building, supporting both top-line growth and sustainable net margin expansion.

Curious how fast revenue must climb and how far margins must rise to justify this upside, even after recent volatility and insider selling clouds the picture, the narrative’s growth math might surprise you.

Result: Fair Value of $121.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained tariff pressure on China sourced production, along with rising SG&A after the Rhode acquisition, could quickly erode margins and challenge the growth case.

Find out about the key risks to this e.l.f. Beauty narrative.

Another View on Valuation

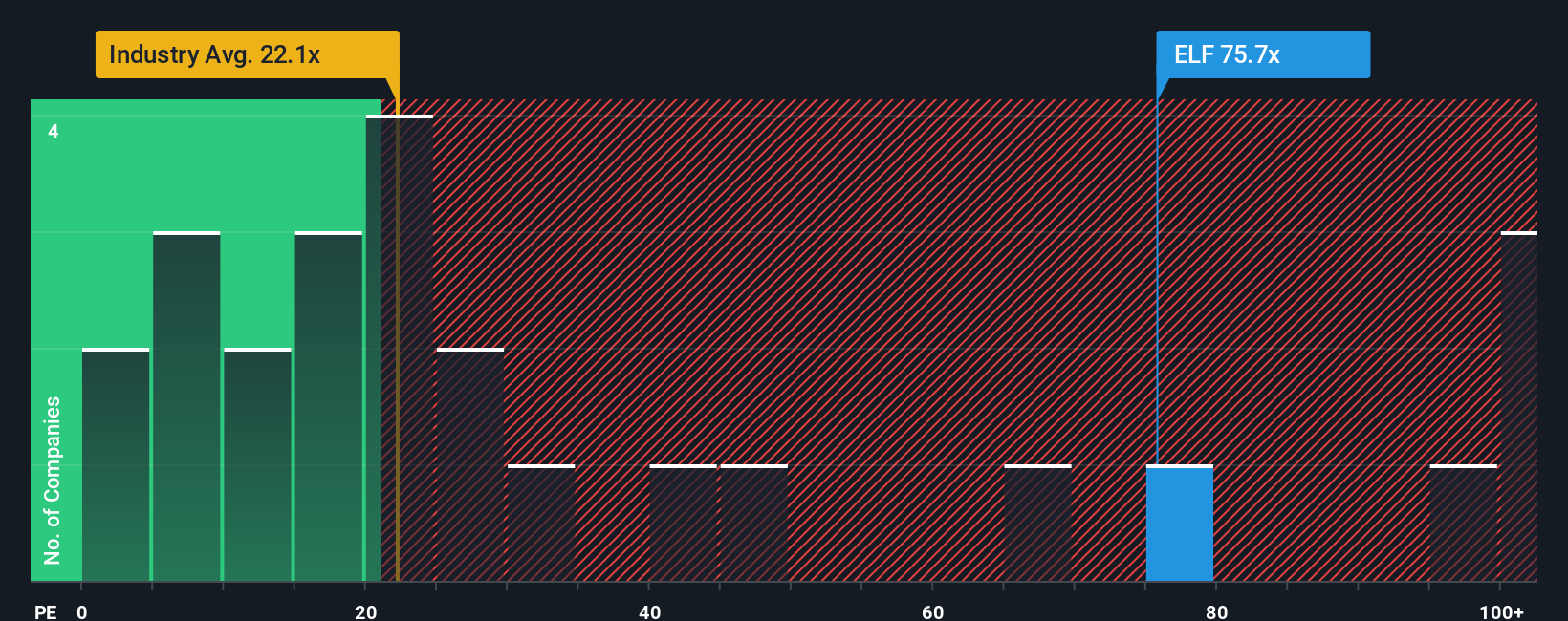

While the narrative fair value points to upside, the earnings multiple tells a tougher story. e.l.f. Beauty trades on a 57.3x P/E, well above the industry average of 22.8x and even its own 43.5x fair ratio. This suggests meaningful de rating risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own e.l.f. Beauty Narrative

If you see the assumptions differently or want to dig into the numbers yourself, you can quickly build a custom thesis in minutes with Do it your way.

A great starting point for your e.l.f. Beauty research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing edge

Before this opportunity slips by, use the Simply Wall St Screener to quickly surface fresh, data driven ideas that match where you want your portfolio to go next.

- Capitalize on mispriced potential by scanning these 906 undervalued stocks based on cash flows that strong cash flow models suggest the market is overlooking today.

- Target reliable income by focusing on these 12 dividend stocks with yields > 3% that could strengthen your portfolio’s cash generation without sacrificing quality.

- Position yourself early in structural change by reviewing these 81 cryptocurrency and blockchain stocks shaping digital finance and blockchain infrastructure worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com