Discover Global Penny Stocks: 3 Picks With Market Caps Over US$300M

Global markets have shown resilience, with major U.S. stock indexes finishing the first week of December higher amid optimism for potential interest rate cuts from the Federal Reserve. In this context, penny stocks—often associated with smaller or newer companies—continue to offer intriguing opportunities for investors seeking affordability and growth potential. Despite their somewhat outdated moniker, these stocks can still provide value when backed by strong financial health.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.08 | £468.07M | ✅ 5 ⚠️ 0 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.615 | $357.52M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.205 | MYR315.87M | ✅ 4 ⚠️ 3 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.935 | A$139.61M | ✅ 4 ⚠️ 3 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$3.02 | NZ$262.38M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.085 | £174.61M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,599 stocks from our Global Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

STI Education Systems Holdings (PSE:STI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: STI Education Systems Holdings, Inc. operates through its subsidiaries to offer various educational services in the Philippines and has a market capitalization of ₱13.55 billion.

Operations: The company generates revenue of ₱5.97 billion from its educational services provided through schools, colleges, and universities in the Philippines.

Market Cap: ₱13.55B

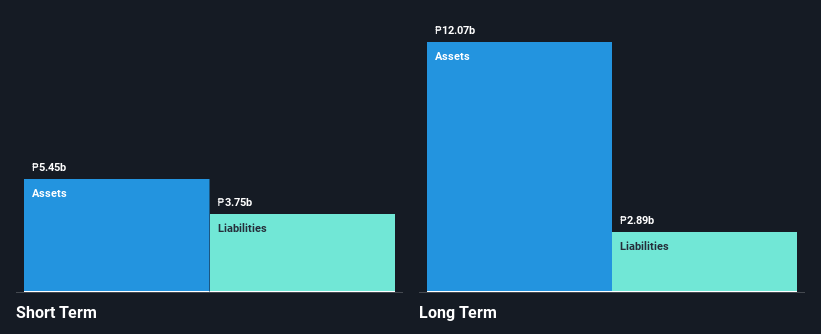

STI Education Systems Holdings, Inc. has demonstrated robust financial performance with a market capitalization of ₱13.55 billion and revenue growth to ₱5.97 billion from educational services in the Philippines. The company has not diluted shareholders meaningfully over the past year and maintains a reliable dividend yield of 3.1%. Its debt-to-equity ratio has improved significantly, and it holds more cash than total debt, indicating strong financial health. Recent earnings reports highlight substantial revenue and net income growth compared to previous periods, reflecting its ability to outperform industry averages in earnings growth while maintaining stable profit margins and low volatility.

- Take a closer look at STI Education Systems Holdings' potential here in our financial health report.

- Assess STI Education Systems Holdings' previous results with our detailed historical performance reports.

Sanxiang Impression (SZSE:000863)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sanxiang Impression Co., Ltd. focuses on real estate development in China and has a market cap of CN¥5.54 billion.

Operations: The company's revenue segment is derived entirely from its operations in China, amounting to CN¥824.72 million.

Market Cap: CN¥5.54B

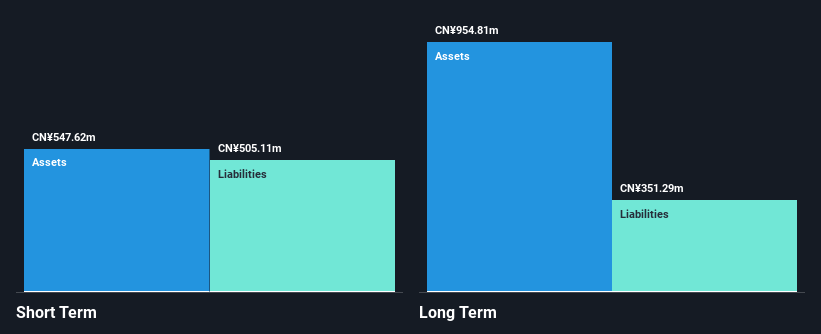

Sanxiang Impression Co., Ltd. faces challenges with declining earnings, reporting CN¥595 million in revenue for the first nine months of 2025 compared to CN¥979.79 million a year earlier. Despite this, the company maintains a satisfactory net debt to equity ratio of 4.3%, and its short-term assets of CN¥4.5 billion comfortably cover both short and long-term liabilities. However, it remains unprofitable with negative return on equity and insufficient EBIT coverage for interest payments at just 0.3 times, indicating financial strain despite an experienced management team and board overseeing operations amidst recent governance changes.

- Click here and access our complete financial health analysis report to understand the dynamics of Sanxiang Impression.

- Gain insights into Sanxiang Impression's past trends and performance with our report on the company's historical track record.

Sichuan Etrol Technologies (SZSE:300370)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sichuan Etrol Technologies Co., Ltd. focuses on the research, development, manufacture, and sale of automation products both in China and internationally, with a market cap of CN¥4.20 billion.

Operations: Revenue Segments: No specific revenue segments are reported for Sichuan Etrol Technologies Co., Ltd.

Market Cap: CN¥4.2B

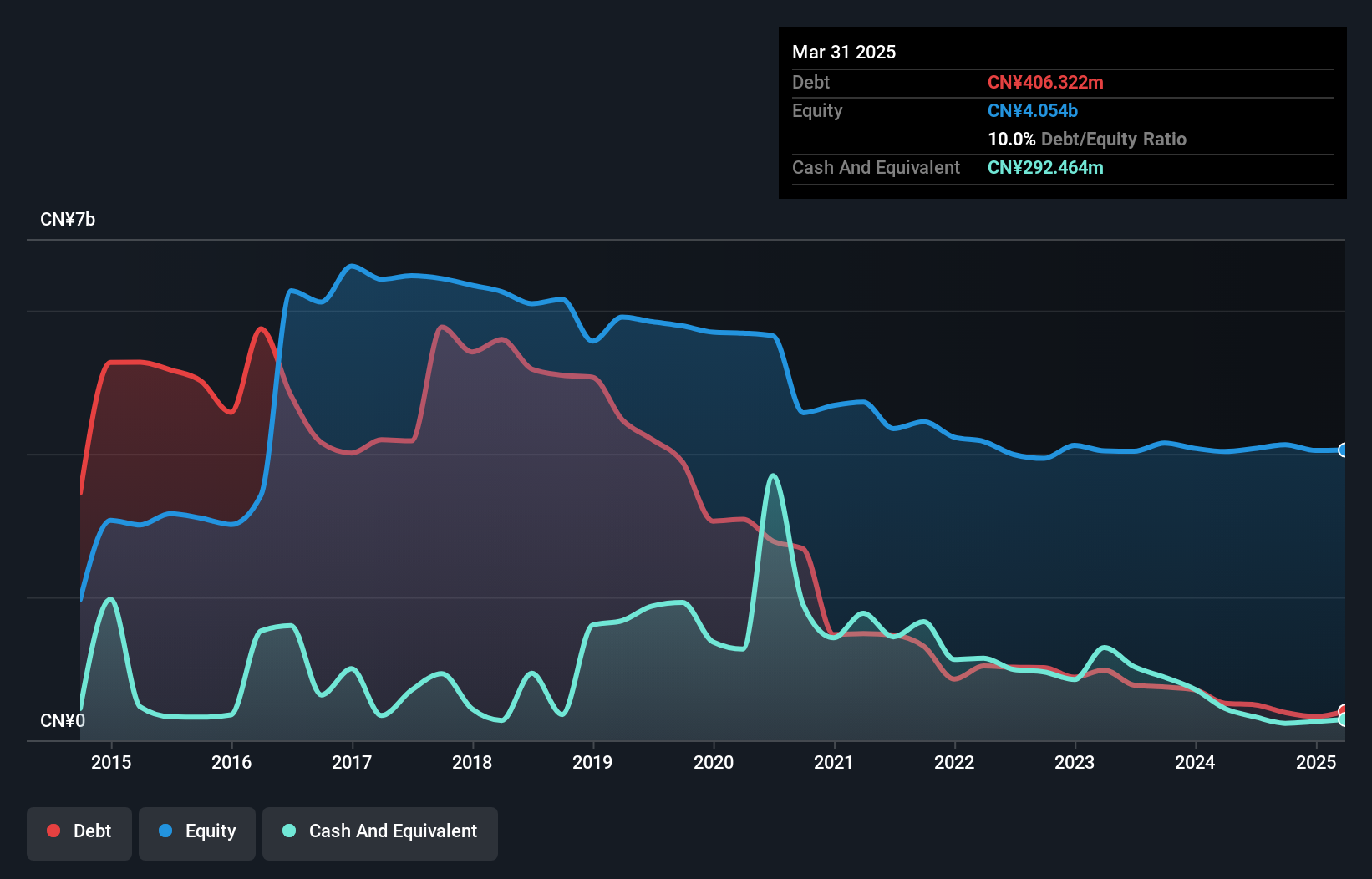

Sichuan Etrol Technologies Co., Ltd. reported a decline in revenue to CN¥204.35 million for the first nine months of 2025, with an increased net loss of CN¥64.92 million compared to the previous year. Despite this, its short-term assets exceed both short and long-term liabilities, providing some financial stability. The company's net debt to equity ratio remains high at 78.4%, indicating significant leverage, while cash runway projections suggest sustainability for over a year if current cash flow trends persist. Recent amendments to company bylaws reflect ongoing governance adjustments amidst these financial challenges and an inexperienced management team.

- Click here to discover the nuances of Sichuan Etrol Technologies with our detailed analytical financial health report.

- Explore historical data to track Sichuan Etrol Technologies' performance over time in our past results report.

Taking Advantage

- Click through to start exploring the rest of the 3,596 Global Penny Stocks now.

- Want To Explore Some Alternatives? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com