Dekon Food and Agriculture Group (SEHK:2419) Valuation After Steady November Volumes and Higher Broiler Prices

Dekon Food and Agriculture Group (SEHK:2419) just released its November 2025 operating data, showing steady pig and poultry volumes alongside modest price gains, including a roughly 2% lift in yellow feathered broiler prices month on month.

See our latest analysis for Dekon Food and Agriculture Group.

The upbeat November pricing data lands after a strong run, with year to date share price return of 136.18% and a 1 year total shareholder return of 126.21%, even though recent 90 day share price momentum has cooled.

If Dekon’s surge has you rethinking the food and agriculture space, this could be a good moment to explore fast growing stocks with high insider ownership for other high conviction ideas.

Yet, with revenue and profits growing briskly and the shares still trading at a steep discount to analyst targets and intrinsic value, investors face a key question: Is Dekon still mispriced, or is future growth already baked in?

Price-to-Earnings of 7x: Is it justified?

Dekon Food and Agriculture Group trades on a price-to-earnings ratio of 7x at last close of HK$71.8, which screens as materially undervalued against peers.

The price-to-earnings multiple compares the company’s current share price with its earnings per share. It is a straightforward way to judge how much investors are paying for each unit of profit in a relatively mature yet still growing livestock and poultry business.

In Dekon’s case, earnings are forecast to grow at a strong pace and return on equity is high. A low price-to-earnings therefore suggests the market is not fully pricing in the profit trajectory, especially when the estimated fair price-to-earnings ratio sits far above current levels and points to where sentiment might eventually migrate if execution continues.

Against both the Hong Kong Food industry average and a broader peer set, Dekon’s 7x price-to-earnings multiple is deeply discounted. The gap to the estimated fair price-to-earnings ratio of 22.3x is striking and implies the shares trade as if earnings were far less robust than recent growth and quality metrics indicate.

Explore the SWS fair ratio for Dekon Food and Agriculture Group

Result: Price-to-Earnings of 7x (UNDERVALUED)

However, stubborn livestock cycles, volatile feed costs, or a sharp reversal in pork and poultry pricing could quickly compress margins and challenge today’s generally positive expectations.

Find out about the key risks to this Dekon Food and Agriculture Group narrative.

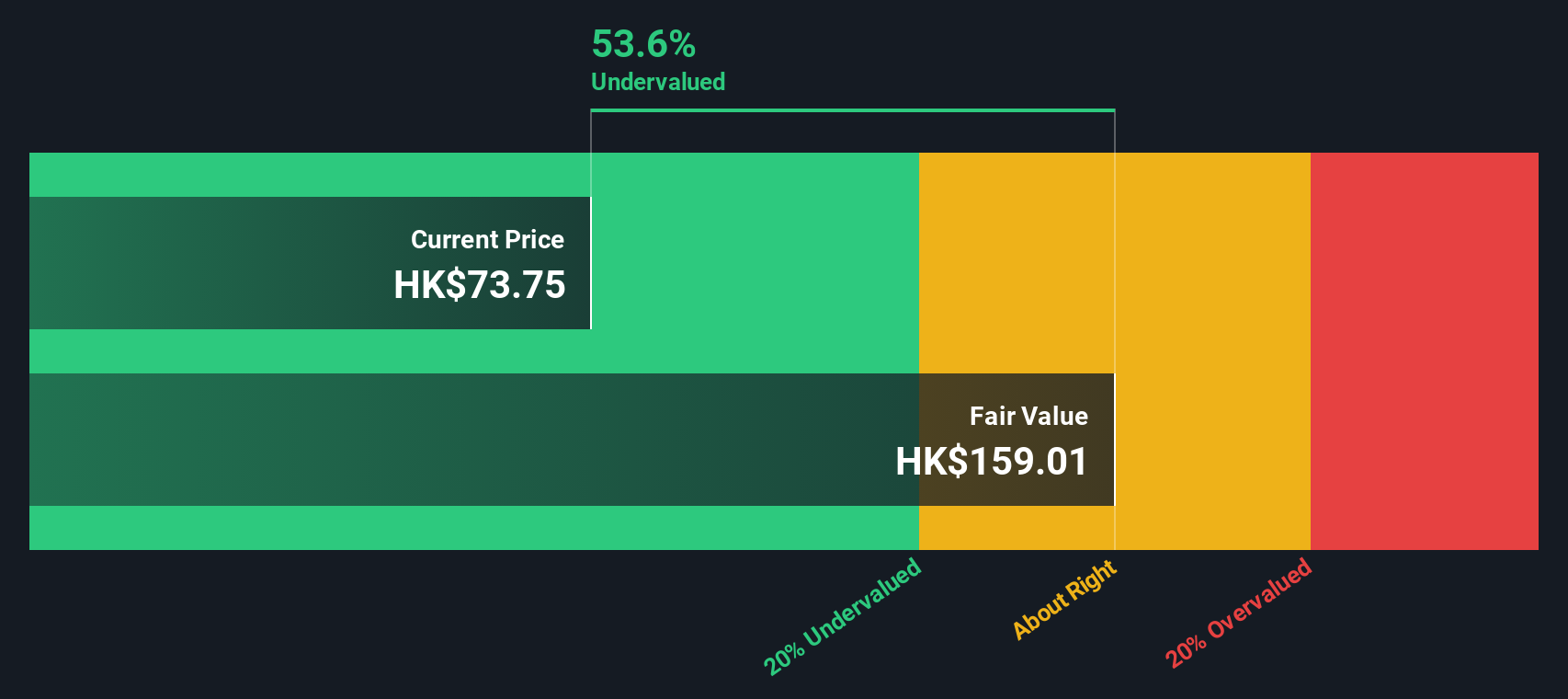

Another View: DCF Points Even Higher

Our DCF model indicates a higher potential value, estimating fair value around HK$160.47. This is more than double the current HK$71.8 share price and suggests notable undervaluation. However, DCF models rely heavily on growth and margin assumptions, so investors may wish to consider how much confidence they place in that potential upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dekon Food and Agriculture Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dekon Food and Agriculture Group Narrative

If you see the story differently, or would rather dig into the numbers firsthand, you can build a personalized view in just minutes using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dekon Food and Agriculture Group.

Ready for your next investing move?

Do not stop with Dekon. Sharpen your edge by using the Simply Wall Street Screener to uncover fresh opportunities before other investors notice them.

- Capitalize on mispriced quality by scanning these 908 undervalued stocks based on cash flows that look attractive on future cash flows rather than just headline multiples.

- Ride innovation trends by targeting these 26 AI penny stocks positioned at the heart of developments in artificial intelligence.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3% that may support reliable cash returns through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com