Assessing Centerra Gold (TSX:CG) Valuation After New Crane Creek Earn-In Deal with Headwater Gold

Centerra Gold (TSX:CG) just deepened its North American footprint by signing a definitive earn in agreement to potentially secure up to 70% of Headwater Gold’s Crane Creek project in Idaho through staged exploration spending.

See our latest analysis for Centerra Gold.

The deal lands at a time when Centerra’s share price has already been in strong form, with a 90 day share price return of about 50% and a year to date share price return above 120%. The three year total shareholder return above 200% suggests this momentum has been building over time rather than appearing out of nowhere.

If this kind of growth story has you thinking more broadly about what is possible in the market, it could be worth exploring fast growing stocks with high insider ownership as a curated way to spot other fast moving opportunities.

With the shares having already re-rated so sharply and trading close to consensus targets, the key question now is whether Centerra still offers undervalued upside or if the market is already pricing in much of that future growth.

Most Popular Narrative Narrative: 2.9% Overvalued

Compared to the latest close of CA$19.07, the most popular narrative fair value of CA$18.53 points to only a modest premium embedded in today’s price, setting up a story that leans on long term project execution and capital discipline.

The analysts have a consensus price target of CA$12.567 for Centerra Gold based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$14.86, and the most bearish reporting a price target of just CA$9.48.

Curious why a company with rising revenues, shifting margins and active buybacks still ends up near fairly valued in this model? The answer lies in a tight balance between assumed earnings growth, future profit ratios and a valuation multiple that leans richer than the broader metals and mining space, all filtered through a specific long term discount rate. Want to see how those ingredients combine into that fair value?

Result: Fair Value of $18.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent grade uncertainty at Mount Milligan and rising royalty costs at Oksut could quickly undermine the current fair value narrative.

Find out about the key risks to this Centerra Gold narrative.

Another View: Earnings Multiple Signals Deep Value

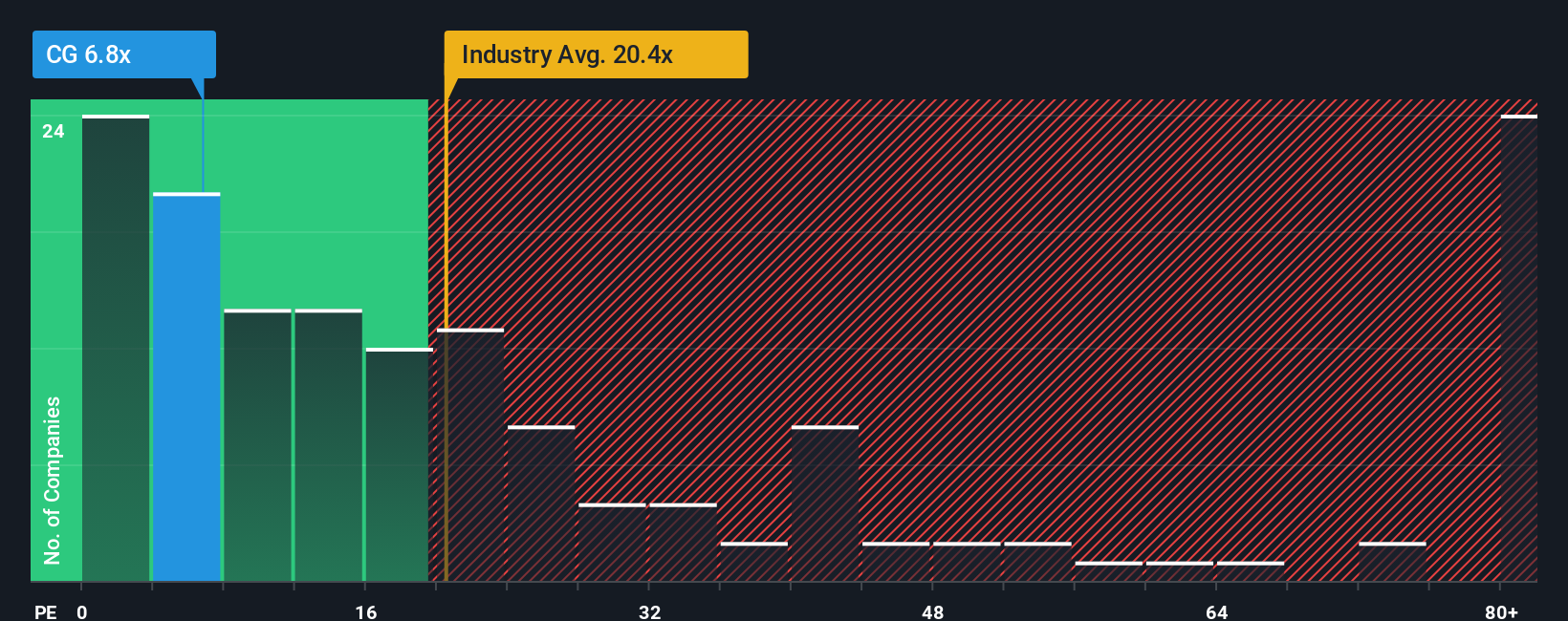

While the popular narrative sees Centerra as roughly fairly valued, the earnings lens tells a different story. At 8.2 times earnings, versus an industry average of 21.2 times and a fair ratio of 12.4 times, the shares look materially cheaper. Is the market underestimating execution risk or overreacting to it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Centerra Gold Narrative

If you would rather dig into the numbers yourself and question these assumptions, you can quickly build a personalized view in under three minutes: Do it your way.

A great starting point for your Centerra Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the market moves on without you, put Simply Wall St’s Screener to work and line up your next potential candidates with clear, data backed filters.

- Support a growth-oriented approach by targeting under the radar companies that still trade below their intrinsic value using these 908 undervalued stocks based on cash flows.

- Explore the surge in intelligent automation by scanning these 26 AI penny stocks for businesses harnessing AI to reshape entire industries.

- Build your income stream by identifying companies with a history of paying dividends and attractive yields through these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com