Lynas Rare Earths (ASX:LYC) Valuation Check as Morningstar Flags Overpricing and Operational, Index Risks

Investor chatter around Lynas Rare Earths (ASX:LYC) has picked up after Morningstar tagged the stock as overpriced unless rare earth prices climb sharply, at the same time as operational disruption and index profile headlines complicate the outlook.

See our latest analysis for Lynas Rare Earths.

Those concerns have landed just as the share price has cooled off, with a 7 day share price return of minus 9.51 percent and 30 day share price return of minus 10.97 percent following director share sales and index profile shifts. Yet the year to date share price return of 93.87 percent and 1 year total shareholder return of 80.86 percent still point to strong longer term momentum.

If Lynas' volatility has you reassessing your options, this could be a good moment to scan for other materials names and discover fast growing stocks with high insider ownership.

With the shares still trading well above one major fair value estimate, but also sitting at a steep discount to some analyst targets, is Lynas now mispriced on the downside, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 19.7% Undervalued

Compared with Lynas Rare Earths’ A$12.66 last close, the most widely followed narrative points to a materially higher fair value anchored in long range growth.

The analysts have a consensus price target of A$12.55 for Lynas Rare Earths based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$17.5, and the most bearish reporting a price target of just A$7.65.

Want to see what kind of revenue surge and margin reset could justify that upside case, even after today’s pullback? The full narrative spells it out.

Result: Fair Value of $15.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant execution risk on new processing projects and any sharp reversal in rare earth prices could quickly undermine today’s optimistic growth assumptions.

Find out about the key risks to this Lynas Rare Earths narrative.

Another Lens on Value

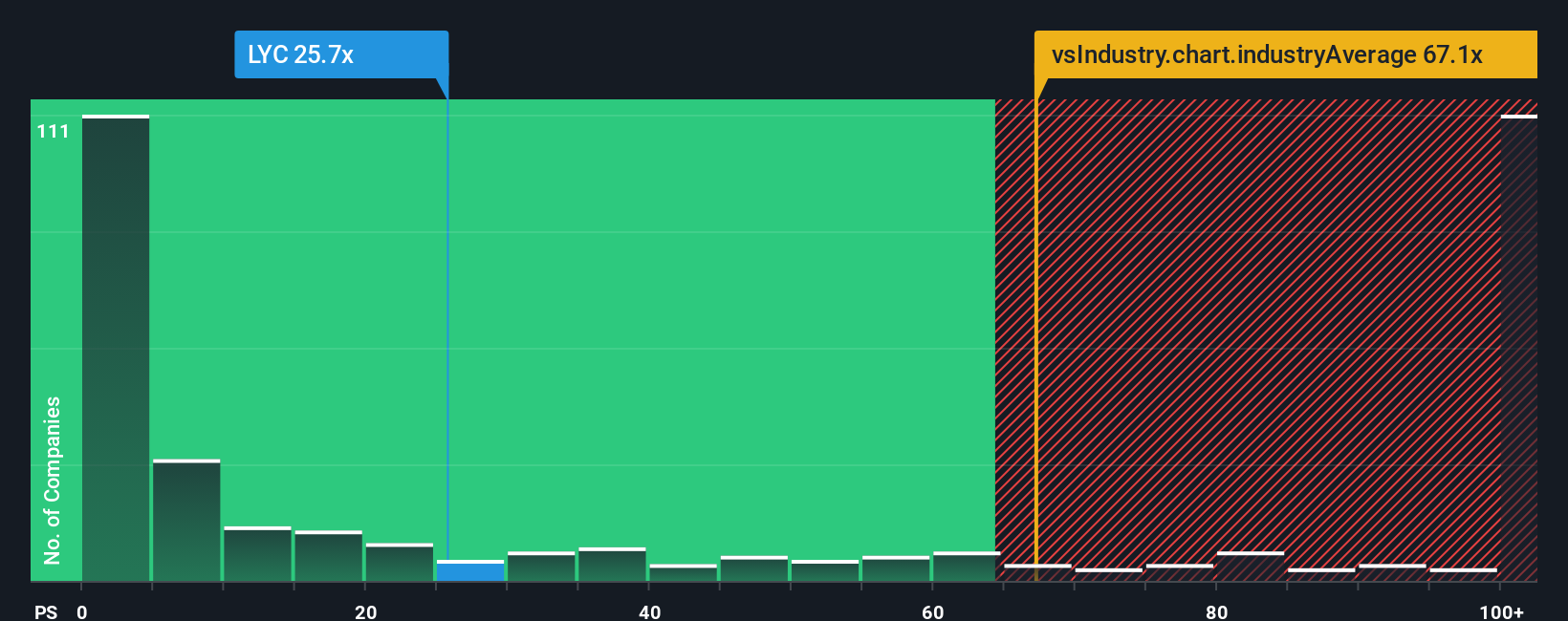

While narratives and analyst targets suggest Lynas Rare Earths is about 19.7 percent undervalued at A$15.77, the market is paying a far richer price tag on sales today. At 22.9 times revenue, versus a fair ratio of 4.2 times, the gap hints at meaningful de rating risk if expectations cool.

That premium also stands out against peers at 7.8 times and an industry average of 121.7 times. This leaves investors to weigh whether Lynas can grow into this pricing, or if any stumble in rare earths or execution could trigger a sharper reset.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lynas Rare Earths Narrative

If you see the story differently or would rather test your own assumptions against the numbers, you can build a fresh view in minutes, Do it your way.

A great starting point for your Lynas Rare Earths research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, line up your next opportunities with targeted stock ideas from the Simply Wall St Screener and avoid leaving potential returns on the table.

- Capture potential income by targeting consistent payers through these 12 dividend stocks with yields > 3%, which can help support both yield and stability in a portfolio.

- Explore structural trends in automation, data and machine learning by using these 26 AI penny stocks to find companies involved in these areas.

- Review opportunities in digital finance by scanning these 81 cryptocurrency and blockchain stocks for companies that focus on blockchain infrastructure and cryptocurrency-related activities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com