Ralph Lauren (RL): Assessing Valuation After a Strong Year-to-Date Share Price Rally

Ralph Lauren (RL) has quietly put together a strong run, with the stock climbing about 7% over the past month and roughly 54% year to date, supported by steady revenue and earnings growth.

See our latest analysis for Ralph Lauren.

At around $357.70 per share, Ralph Lauren’s year to date share price return of over 54% and 1 year total shareholder return above 60% signal momentum that investors increasingly view as backed by improving fundamentals rather than a temporary fashion cycle.

If this kind of steady rerating interests you, it could be a good moment to explore fast growing stocks with high insider ownership for other potential standouts building similar momentum.

With shares now near record highs, modest upside to analyst targets and valuation screens flashing rich, the key question is whether Ralph Lauren is still trading below its true worth or if the market is already discounting years of future growth.

Most Popular Narrative: 3.2% Undervalued

With Ralph Lauren last closing at $357.70 against a narrative fair value near $369.46, the story leans slightly in favor of more upside.

Significant investments in technology, AI driven inventory management, and automated supply chain operations are driving greater operating efficiencies, setting the stage for improved operating margins and inventory turns as scale increases.

Want to see how modest revenue growth, rising margins, and a richer future earnings multiple combine to justify that higher price? The narrative spells out the full playbook.

Result: Fair Value of $369.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer European growth and elevated inventories could quickly challenge today’s upbeat assumptions if consumer demand weakens or discounting returns.

Find out about the key risks to this Ralph Lauren narrative.

Another Angle on Valuation

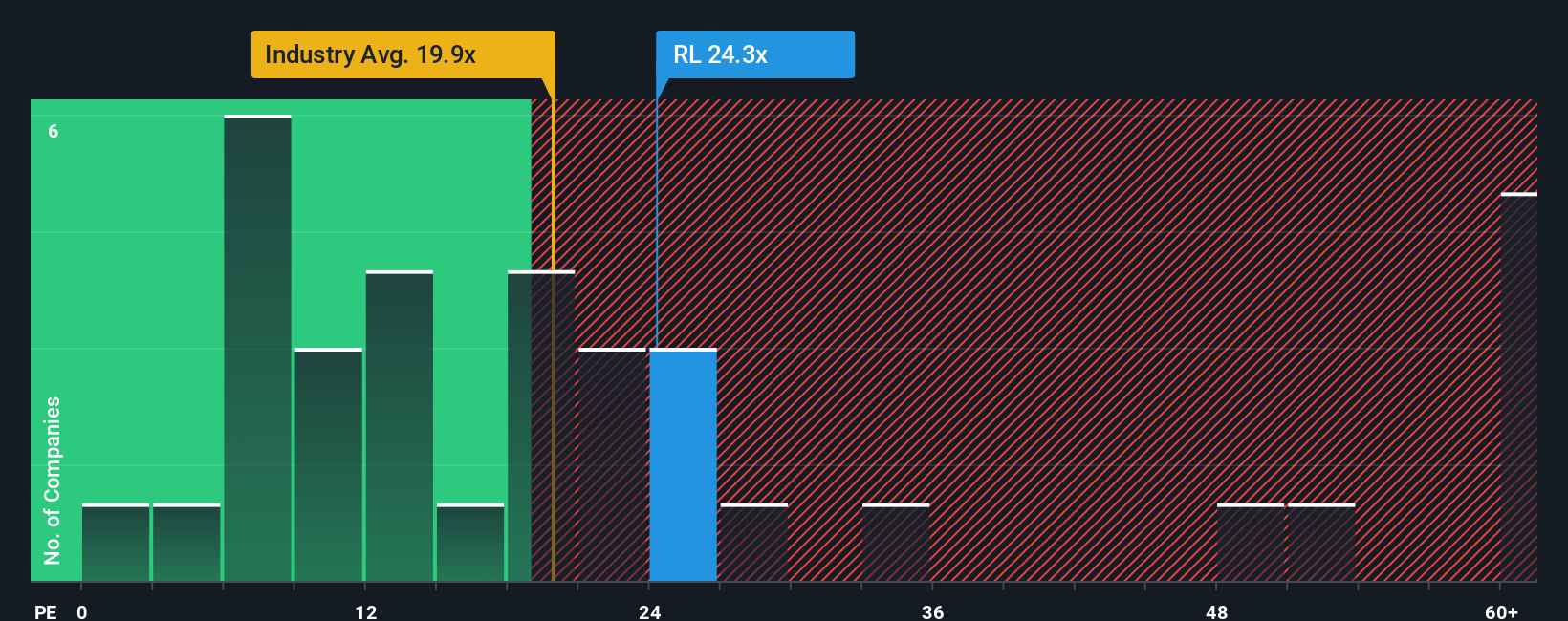

While the narrative fair value suggests Ralph Lauren is about 3% undervalued, a simple earnings multiple view feels less generous. At roughly 25.4 times earnings, versus a 21 times industry average and a 19.9 times fair ratio, the stock carries a noticeable premium that could compress if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ralph Lauren Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full narrative in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ralph Lauren.

Looking for more investment ideas?

Ralph Lauren might fit your strategy, but you will miss powerful opportunities if you stop here instead of using Simply Wall Street’s screener to uncover fresh ideas.

- Capture asymmetrical upside by reviewing these 3602 penny stocks with strong financials that pair tiny share prices with surprisingly resilient balance sheets and earnings potential.

- Position your portfolio for structural growth by examining these 30 healthcare AI stocks transforming diagnostics, treatment pathways, and long term healthcare efficiency.

- Lock in potential income streams by scanning these 12 dividend stocks with yields > 3% that combine solid yields with the financial strength to keep paying through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com