Grab (NasdaqGS:GRAB): Reassessing Valuation After Bullish Roadshow Update on Fintech Profitability and Growth

Grab Holdings (GRAB) just wrapped a roadshow that refocused attention on its fintech engine, with management stressing accelerated loan growth and a realistic path to segment profitability next year, alongside fresh board changes supporting execution.

See our latest analysis for Grab Holdings.

Despite the fintech buzz and fresh board additions, Grab’s 1 month share price return of minus 12.2 percent shows momentum has cooled, even as its 3 year total shareholder return of 56.5 percent still signals a longer term recovery story in motion.

If this kind of platform-driven growth story interests you, it might be a good time to explore other high growth tech and AI names via high growth tech and AI stocks for fresh ideas.

With shares down in the near term but still trading at roughly a 30 percent discount to analyst and intrinsic estimates, are investors overlooking Grab’s next leg of profitable growth, or is the market already pricing in its fintech upside?

Most Popular Narrative Narrative: 36.8% Undervalued

According to BlackGoat, the narrative fair value of roughly $8.20 sits well above Grab’s last close at $5.18, pointing to sizable upside if the assumptions hold.

Financial services are scaling even faster. The loan book has reached $708M (+78% YoY) with disbursals at $2.9B annualised. Deposits exceed $1B across 4M accounts, with NPLs <2%. Most impressively, 90% of GXBank Malaysia’s customers came directly from Grab, at near zero CAC, a distribution advantage traditional banks can’t match.

Want to see what kind of revenue trajectory, profit margin lift, and future earnings multiple are baked into that upside case? The narrative’s valuation playbook might surprise you.

Result: Fair Value of $8.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory pushback around Grab’s potential GoTo deal, along with rising incentive spending, could quickly pressure margins and challenge the current undervalued thesis.

Find out about the key risks to this Grab Holdings narrative.

Another Lens on Valuation

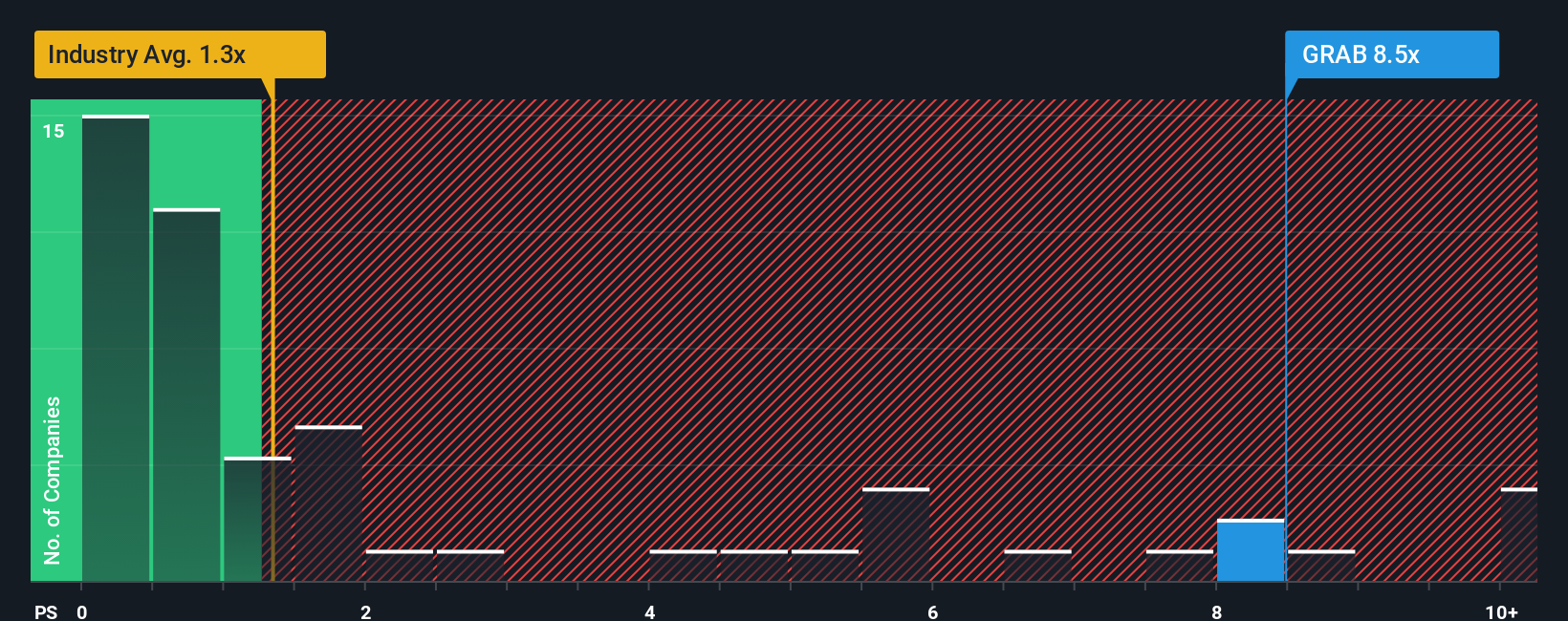

Looked at through its sales multiple, Grab tells a tougher story. The stock trades on a 6.6 times price to sales ratio, far richer than both the US transportation sector at 1.1 times and its peer average at 1.5 times, and well above a 2.9 times fair ratio. This raises the risk that sentiment, not fundamentals, is doing more of the heavy lifting than bulls might like.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grab Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom Grab thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Grab Holdings.

Looking for more investment ideas?

Before markets move again, put Simply Wall St’s screener to work so you can spot high conviction opportunities early instead of watching them run without you.

- Capture asymmetric upside by scanning these 3602 penny stocks with strong financials that already back their tiny market caps with real financial strength and improving fundamentals.

- Ride structural tailwinds by targeting these 12 dividend stocks with yields > 3% that combine meaningful income today with the potential for long term capital growth.

- Position ahead of the next major shift by tracking these 81 cryptocurrency and blockchain stocks tapping into blockchain adoption, digital payments, and new financial infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com