Del Monte Pacific (SGX:D03) Profit Rebound Challenges Bearish Narratives After Recent Loss-Making Quarters

Del Monte Pacific (SGX:D03) has just posted its Q2 2026 scorecard, with revenue of about $234.9 million, basic EPS of $0.0087 and net income of roughly $16.8 million setting the tone for its latest quarter. The company has seen revenue move from roughly $694.0 million in Q2 2025 to $234.9 million in Q2 2026, while net income swung from a loss of about $22.2 million to a profit of $16.8 million and EPS shifted from a loss of $0.0114 to a profit of $0.0087. This points to a very different margin picture across the two periods. Altogether, the latest release suggests a business where profitability and margins are back in focus, even as the revenue base looks very different to a year ago.

See our full analysis for Del Monte Pacific.With the numbers on the table, the next step is to see how this profit rebound and shifting revenue base line up against the dominant narratives around Del Monte Pacific and whether the latest margin profile really supports those stories.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM profit of $77.6 million despite one off loss

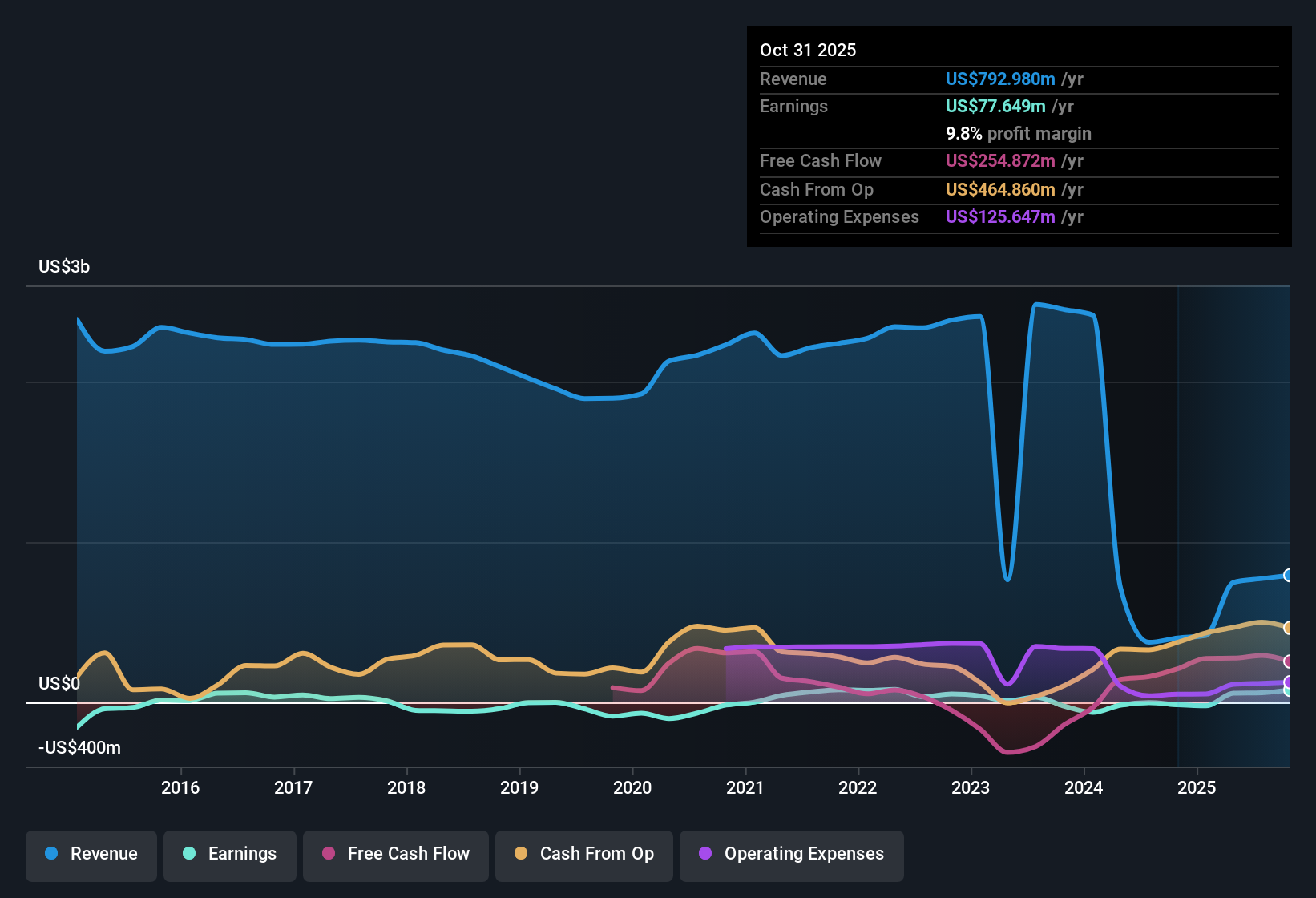

- Over the trailing 12 months, Del Monte Pacific generated $77.6 million in net income from continuing operations on $793.0 million of revenue, even though the same period absorbed a one off loss of $252.9 million from discontinued operations.

- What stands out for a generally bullish view is that profitability over the last year contrasts with earlier losses. However, the negative five year earnings trend of minus 10.2 percent per year and the large one off charge both complicate the argument that a simple turnaround story is firmly in place.

- Support for the optimistic angle comes from the move from quarterly losses in Q2 and Q3 2025, when net income was minus $22.2 million and minus $35.9 million, to positive net income of $45.6 million in Q4 2025 and $16.8 million in Q2 2026.

- At the same time, the presence of $828.96 million of discontinued operations losses in the latest trailing period shows that part of the reported history is shaped by exceptional items rather than a smooth improvement in the underlying business.

Low 2x P E against DCF fair value of 1.20

- The shares trade on a trailing price to earnings ratio of about 2 times, compared with industry and peer averages of 16.6 times and 24.5 times, and a DCF fair value of $1.20 per share versus the current share price of about $0.10.

- From a bullish perspective, the combination of a very low multiple and a wide gap to DCF fair value is often read as deep value. However, the same figures can also be interpreted as the market heavily discounting the sustainability of the recent $77.6 million of trailing net income.

- Value focused investors may point to the near 91.4 percent discount to DCF fair value and the return to profitability as evidence that the current price embeds a lot of bad news already.

- More cautious investors can counter that such a steep discount and a 2 times P E ratio are consistent with markets assigning a high risk premium to the balance sheet and to the quality of those earnings, given the size of the one off loss in the period.

Debt load and negative equity remain central risks

- Risk analysis highlights a high level of debt alongside negative shareholders’ equity, which means the capital structure is stretched even as the company reports positive trailing earnings.

- For a more bearish reading, these balance sheet flags suggest that the positive TTM net income of $77.6 million and the recent quarterly profits in 2026 need to be weighed against financial resilience, rather than viewed in isolation as a clean bill of health.

- Critics emphasize that negative equity typically limits financial flexibility, so even a low 2 times P E multiple can be justified if the market is focusing on leverage and potential future refinancing needs.

- In that light, the large discontinued operations loss of $252.9 million over the trailing period can be seen not only as a one off event but also as a reminder that past restructuring decisions have carried significant costs for shareholders.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Del Monte Pacific's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite a sharp rebound in profitability, Del Monte Pacific still faces heavy leverage, negative equity and sizeable one off losses that cloud the quality of its earnings.

If those fragile finances concern you, use our solid balance sheet and fundamentals stocks screener (1940 results) to quickly find companies with stronger balance sheets, lower debt and more durable financial foundations than Del Monte Pacific.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com