BillionToOne (BLLN) Revenue Surge Tests Bullish Growth Narrative Despite Ongoing EPS Losses

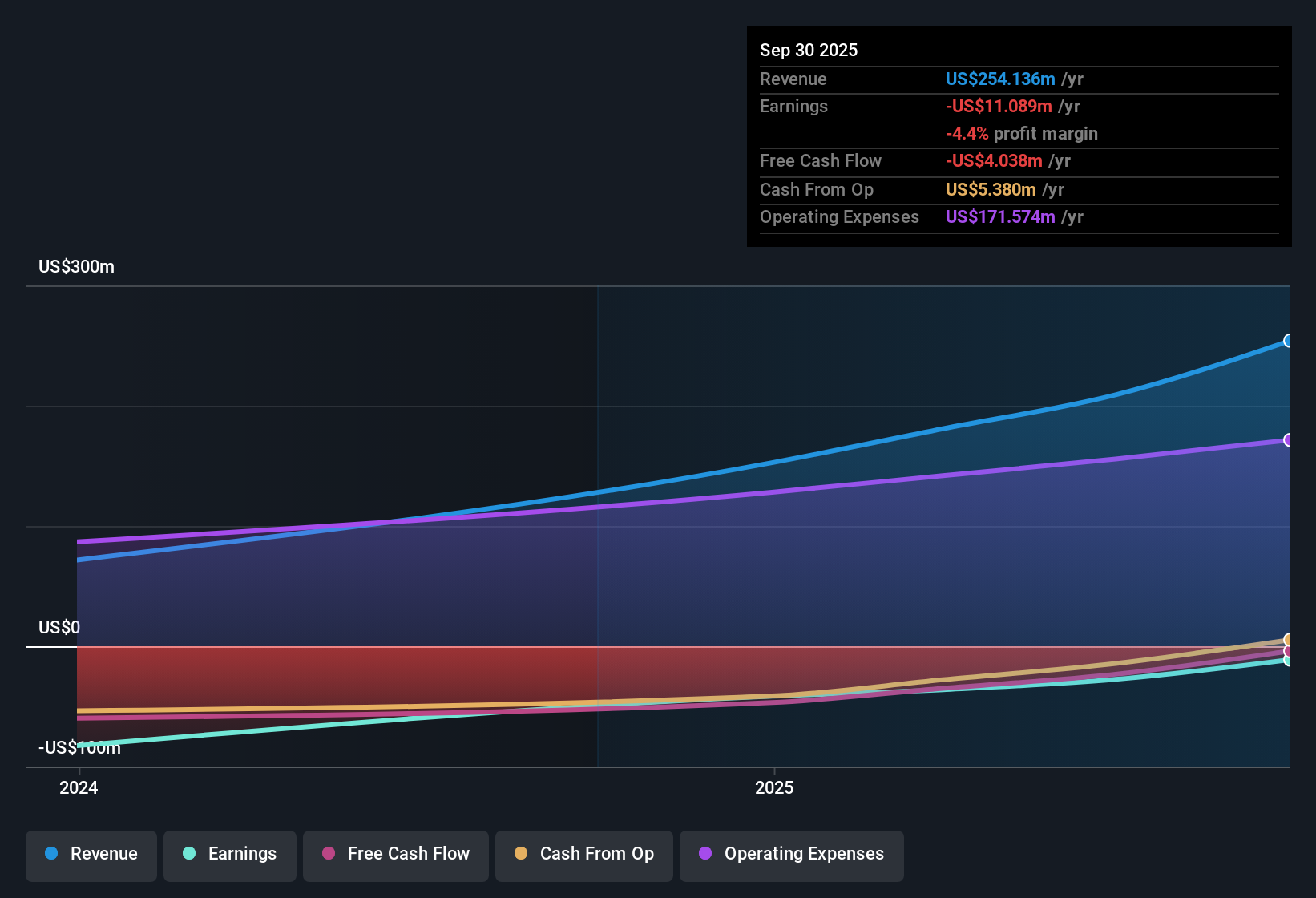

BillionToOne (BLLN) has just put another big quarter on the board, with Q3 2025 revenue at about $62.8 million and Basic EPS of roughly -$0.20, as investors gauge how fast the top line can outrun still negative earnings. The company has seen revenue move from roughly $34.5 million in early 2024 to about $41.7 million later that year and then to $62.8 million in 2025, while Basic EPS shifted from about -$0.76 to -$1.30 and then to -$0.20 over the same stretch, setting up a story where rapid scale is starting to pressure, but not yet repair, margins.

See our full analysis for BillionToOne.With the numbers on the table, the next step is to set this earnings print against the dominant narratives around BillionToOne, highlighting where the growth story, profitability path, and risk profile converge or clash with market expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Revenue Doubles Year on Year

- On a trailing basis, total revenue climbed from $71.7 million in 2023 to $152.6 million in 2024 and then to $209.0 million by Q2 2025, matching the 86.7% year over year growth headline and pointing to a much larger current revenue base than a year ago.

- What stands out for the bullish view is how this revenue ramp lines up with forecasts that call for about 28.4% annual growth ahead and roughly 78.9% annual earnings growth, yet net income over the last twelve months was still a loss of $30.6 million.

- Supporters can point to the shrinking loss from $82.7 million in 2023 to $41.6 million in 2024 and then to $30.6 million by Q2 2025 as evidence that scale is helping the income statement.

- At the same time, the fact that the company remains loss making even with $209.0 million in trailing revenue keeps the bullish case tied to future execution rather than current profitability.

Bulls argue this kind of revenue expansion does not come around often and want to see whether BillionToOne can convert it into durable earnings power over the next few years. 📊 Read the full BillionToOne Consensus Narrative.

Losses Narrow But Persist

- Quarterly net loss improved from $13.2 million in Q3 2024 to $2.1 million in Q2 2025, and trailing Basic EPS moved from about negative $8.45 in 2023 to negative $4.12 in 2024 and then to negative $2.99 by Q2 2025, so the company is still firmly in the red even as the per share drag lessens.

- Critics focusing on a bearish angle note that, despite this progress, the business has not yet crossed into profitability, which keeps execution risk on the table even with forecasts calling for a move into the black within three years.

- The step down in trailing net losses from $82.7 million to $30.6 million matters, but it still represents a sizeable cash drain that must be funded while the company scales.

- Because earnings are negative, the path to the projected 78.9% annual earnings growth becomes central to the story, and any slowdown in revenue or increase in costs would directly challenge that more optimistic outlook.

Rich Valuation And Illiquid Trading

- At a share price of $103.70, BillionToOne sits only slightly below its DCF fair value of about $106.50, yet the stock trades on a 22.5 times Price to Sales multiple compared with 1.3 times for the broader US healthcare space and 5.5 times for peers, underscoring how much future growth is already priced in.

- Bears argue this premium multiple, combined with highly illiquid shares, leaves little room for disappointment even though analysts still see upside to a target of about $137.83.

- The roughly 32.9% gap between the current price and that target reflects optimism, but it is layered on top of an already expensive sales multiple versus the sector.

- Because trading liquidity has been weak over the past three months, any change in sentiment around growth or profitability could translate into sharp price swings as investors try to adjust positions.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on BillionToOne's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

BillionToOne pairs rapid revenue growth with persistent losses, a rich valuation, and illiquid trading. This combination leaves investors heavily exposed to execution risk and downside volatility.

If you want strong growth without paying up for fragile stories, use our these 907 undervalued stocks based on cash flows to zero in on companies where fundamentals better justify the current price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com