Does D1’s Bigger Bet and Rising Aftermarket Mix Change The Bull Case For Flowserve (FLS)?

- Earlier this quarter, New York-based D1 Capital Partners lifted its stake in Flowserve by nearly 5.8 million shares to about 7.5 million, a position valued at roughly US$397.5 million at quarter-end.

- This move came alongside Flowserve reporting consistent operations, expanding margins, stronger cash generation, and a higher mix of aftermarket revenue, underscoring rising confidence in its business quality.

- We’ll now examine how D1’s larger ownership position and Flowserve’s margin and cash flow progress affect the company’s investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Flowserve Investment Narrative Recap

To own Flowserve, you need to believe it can keep turning a complex, project driven business into steadier earnings and cash flow, helped by higher margin aftermarket work. D1 Capital’s larger stake supports the near term catalyst around margin and cash generation, but does not remove the key risk that project delays and competitive bidding could still make revenues and earnings uneven.

Recent quarterly results, with higher net income and improved profit margins, are especially relevant here because they back up the idea that Flowserve is getting better at converting sales into earnings and cash. That progress aligns with the aftermarket mix shift highlighted alongside D1’s move, but it also raises the stakes if integration challenges or tougher project pricing start to weigh on future margin gains.

Yet investors should be aware that rising margins can quickly come under pressure if project approvals slow or pricing competition intensifies...

Read the full narrative on Flowserve (it's free!)

Flowserve's narrative projects $5.3 billion revenue and $620.7 million earnings by 2028. This requires 4.4% yearly revenue growth and about a $329 million earnings increase from $291.6 million today.

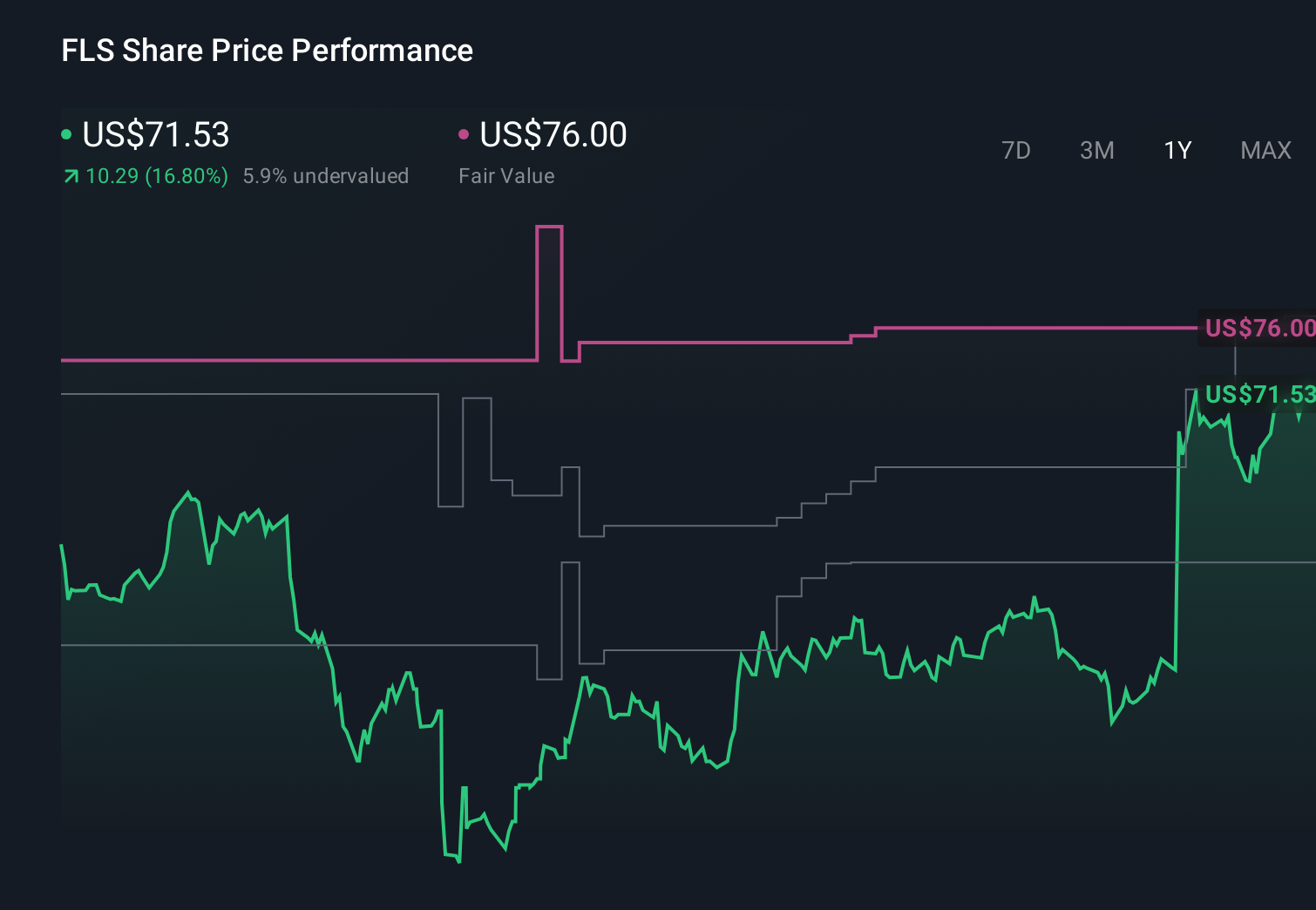

Uncover how Flowserve's forecasts yield a $76.80 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently value Flowserve anywhere between US$60 and US$163.51 per share, showing how far apart individual views can be. As you weigh those opinions, remember that any thesis depends heavily on how you see project approval risks and revenue lumpiness feeding through to Flowserve’s earnings profile over time.

Explore 7 other fair value estimates on Flowserve - why the stock might be worth 18% less than the current price!

Build Your Own Flowserve Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flowserve research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flowserve research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flowserve's overall financial health at a glance.

No Opportunity In Flowserve?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com