Is Lyft Still a Comeback Story After Its 2025 Rally and Recent Pullback?

- Wondering if Lyft at around $20 a share is still a comeback story in the making, or if the easy money has already been made? You are not alone, and that is exactly what we are going to unpack here.

- Despite a sharp pullback over the last week and month, with the stock down 9.8% over 7 days and 16.0% over 30 days, Lyft is still up 48.9% year to date and 36.8% over the past year. This highlights how quickly sentiment around the name can swing.

- Recent headlines have focused on Lyft sharpening its ride-sharing strategy, doubling down on cost efficiency, and leaning further into partnerships to keep drivers and riders on the platform. These moves have helped reshape expectations for its long term profitability. Investors are now wrestling with whether this evolution justifies the stock’s big rebound from its longer term 58.9% slide over five years, or if optimism has gotten ahead of fundamentals.

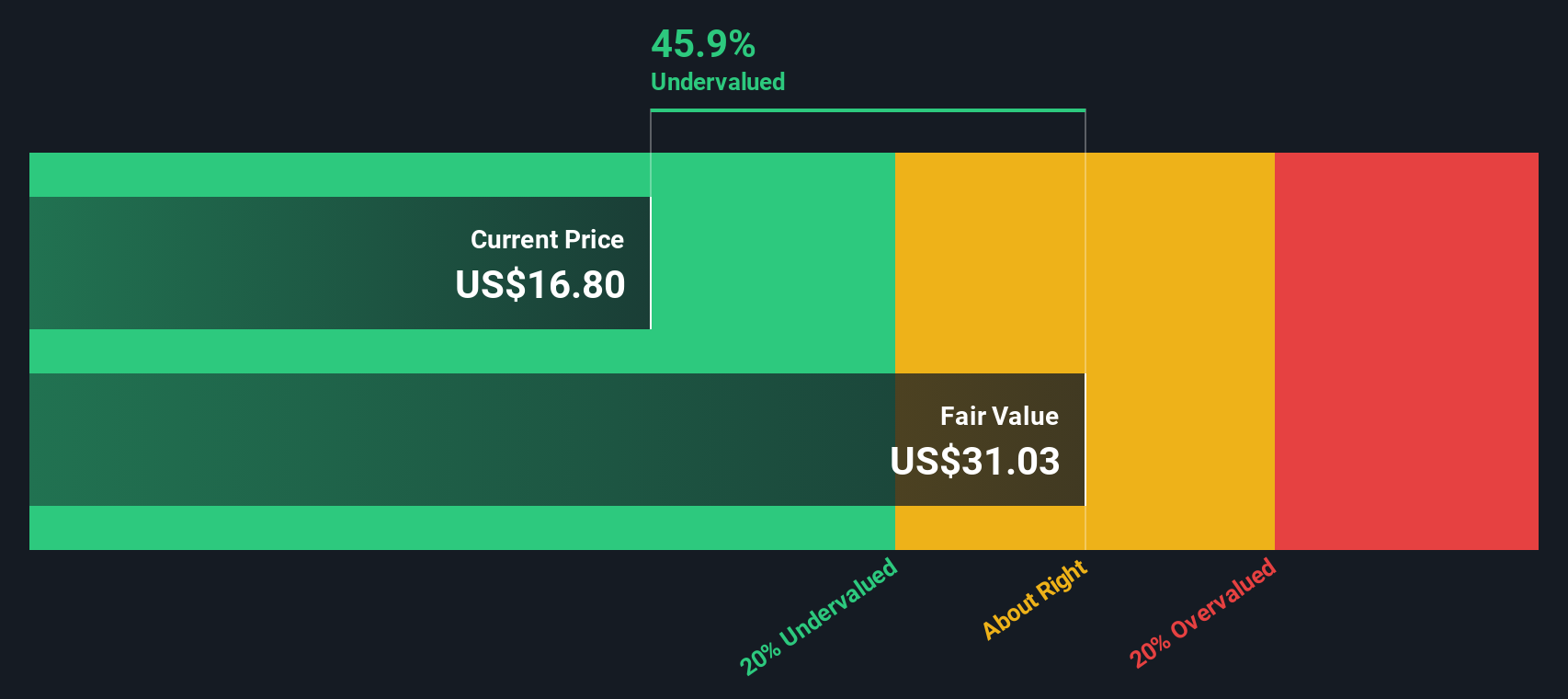

- On our high level valuation checks, Lyft scores a 3/6, suggesting it looks undervalued on some metrics but not convincingly cheap across the board. Next, we will break down what each valuation approach is saying and then circle back to a more holistic way to think about Lyft’s true worth.

Approach 1: Lyft Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting its future cash flows and then discounting them back to today using a required rate of return. For Lyft, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections in $.

Lyft generated trailing twelve month free cash flow of about $958.6 Million, and analysts expect this to rise to around $1.30 Billion by 2028. Beyond the first few years, Simply Wall St extrapolates further growth, with free cash flow projections gradually climbing through 2035 as the business scales and margins improve.

When all those future cash flows are discounted back, the DCF model produces an estimated intrinsic value of roughly $55.97 per share. Compared with the current share price around $20, this implies the stock is about 63.7% undervalued. This indicates investors may be pricing Lyft below its modeled cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lyft is undervalued by 63.7%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Lyft Price vs Earnings

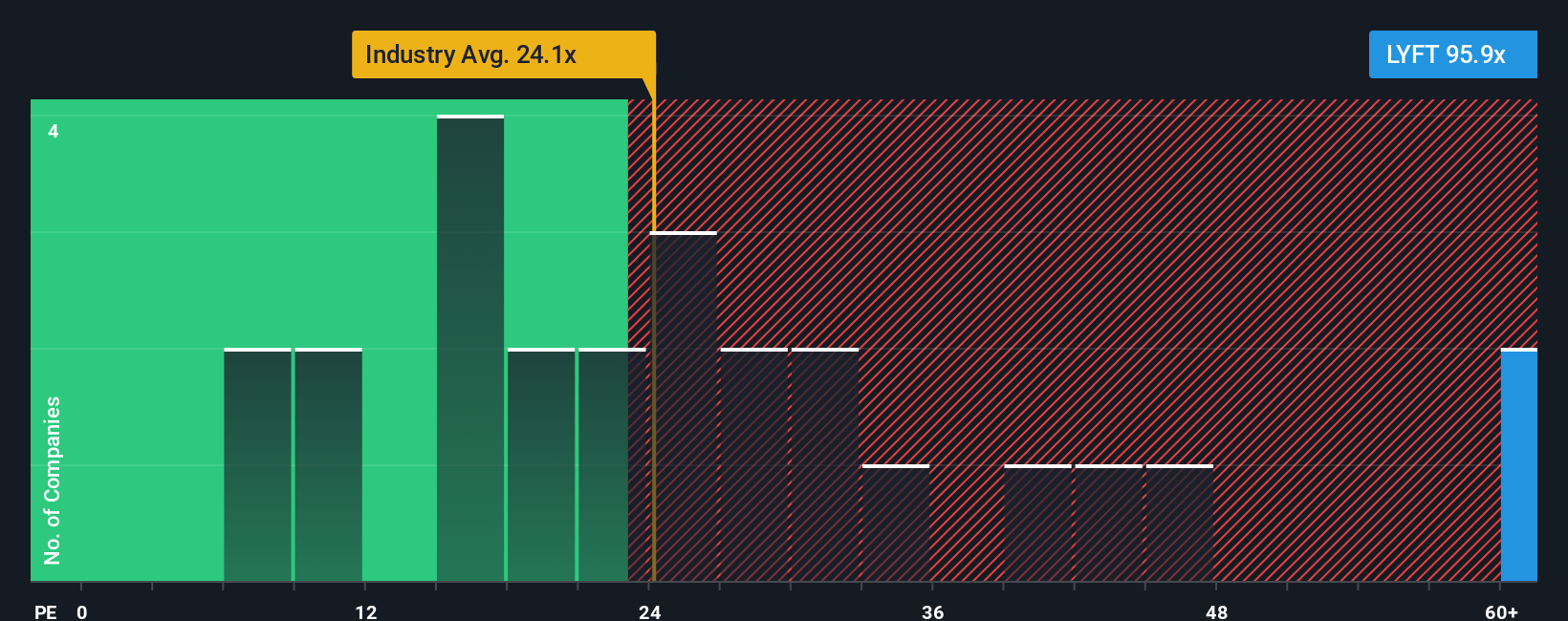

For a company like Lyft that is now generating positive earnings, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of profit. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty warrant a lower multiple.

Lyft currently trades on a PE of about 53.9x, which is well above the broader Transportation industry average of roughly 32.6x and slightly below the peer group average of around 59.5x. At first glance, that suggests the market is already baking in stronger growth and improved profitability versus many traditional transport names.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple Lyft should trade at, given its earnings growth outlook, margins, industry, market cap and specific risks. For Lyft, the Fair Ratio is 21.0x, materially below the current 53.9x. This implies that, once you adjust for those fundamentals, the stock is screening as expensive rather than merely high growth.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lyft Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you attach a story to your numbers by linking your view of Lyft’s business drivers to a structured forecast for revenue, earnings and margins. This then rolls into a Fair Value you can compare with today’s share price to decide whether it looks like a buy or a sell. Because Narratives update automatically as fresh news and earnings arrive, you can instantly see how shifting facts change that fair value. You might lean toward a bullish scenario that assumes strong payoff from autonomous partnerships, international expansion and margin gains that could justify a value closer to the higher end of recent targets near $28. Alternatively, you might take a more cautious stance that stresses competitive and regulatory risks and lands closer to the low end around $10. All of this is available within an accessible tool already used by millions of investors to make more dynamic, transparent decisions.

Do you think there's more to the story for Lyft? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com