How Investors May Respond To Textron (TXT) Revenue Miss Yet EBITDA Beat In Aerospace Downturn

- Textron recently reported a past quarter with revenues up 5% year on year, as its Aviation, Bell and Textron Systems segments all grew, but overall sales came in 1.9% below analyst expectations.

- Despite this revenue shortfall, Textron’s stronger-than-forecast EBITDA points to improving operational efficiency and resilient profitability in a challenging aerospace backdrop.

- We’ll now examine how Textron’s revenue miss but EBITDA beat could influence the existing investment narrative around margin improvement and growth.

Find companies with promising cash flow potential yet trading below their fair value.

Textron Investment Narrative Recap

To own Textron, you generally need to believe in steady execution across aviation, rotorcraft and defense, with gradual margin improvement rather than rapid top line expansion. The latest quarter’s small revenue miss but EBITDA beat does not materially alter that view, and it modestly supports the near term margin improvement catalyst while leaving existing risks around mixed segment performance and cost pressures very much in focus.

Against this backdrop, Textron’s ongoing share repurchase program, which has retired over 27 million shares since mid 2023 for more than US$2.2 billion, feels particularly relevant. It underscores how management is putting excess cash to work at a time when profitability looks resilient, even as investors weigh the impact of weaker Industrial demand and exposure to the more cyclical automotive market.

Yet while margins appear to be holding up, investors should be aware of the risk that Textron’s Industrial and Kautex exposure could...

Read the full narrative on Textron (it's free!)

Textron's narrative projects $16.2 billion revenue and $1.1 billion earnings by 2028. This requires 4.8% yearly revenue growth and an earnings increase of about $300 million from $816.0 million today.

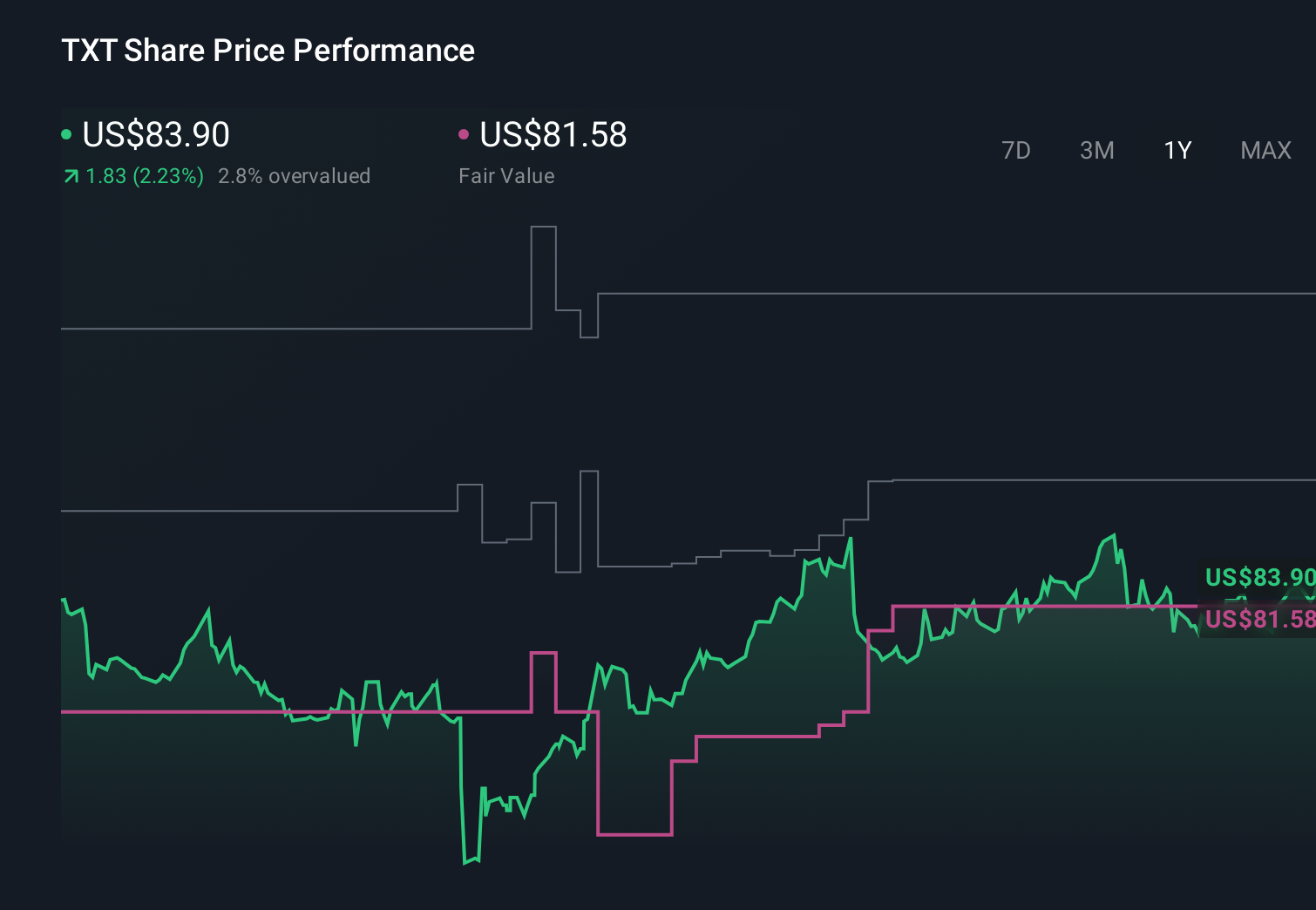

Uncover how Textron's forecasts yield a $92.57 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$73 to US$136 per share, showing how far apart individual views can be. When you set that against the current focus on margin improvement after Textron’s revenue miss and EBITDA beat, it underlines why checking several independent perspectives can be useful before forming an opinion.

Explore 5 other fair value estimates on Textron - why the stock might be worth as much as 60% more than the current price!

Build Your Own Textron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Textron research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Textron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Textron's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com