U-Haul (UHAL): Reassessing Valuation After Fed Rate Cut Lifts Financing‑Sensitive Transport Stocks

The latest move in U-Haul Holding (UHAL) stock is less about company specific headlines and more about macro tailwinds, as the Federal Reserve's rate cut ignited a rally in financing sensitive ground transportation names.

See our latest analysis for U-Haul Holding.

That macro bounce comes after a tougher stretch, with the share price now at $54.40 and a negative year to date share price return contrasting with a still positive five year total shareholder return. This hints that near term momentum is stabilizing after a weaker run.

If U-Haul’s move has you watching how rate shifts ripple through transport and beyond, this could be a good moment to explore fast growing stocks with high insider ownership.

With U-Haul shares still down sharply over the past year but trading at a hefty discount to analyst targets, the key question is simple: is this a mispriced reopening of value, or is future growth already baked in?

Most Popular Narrative: 39.4% Undervalued

With U-Haul Holding’s most followed narrative pointing to a fair value well above the recent $54.40 close, the implied upside leans heavily on improving operations and margins.

The reduction in fleet repair and maintenance costs, aided by newer fleet acquisitions, is expected to improve net margins. This operational efficiency could translate into stronger earnings.

Curious how modest top line growth can still support such a big valuation gap? The key drivers are a significant profit margin reset and a richer future earnings multiple. Want to see which specific earnings and margin upgrades would need to occur for that upside to hold together? Read on to unpack the full playbook behind this fair value call.

Result: Fair Value of $89.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive truck rental pricing and higher operating costs could squeeze margins and weaken the case for a smooth profit recovery and rerating.

Find out about the key risks to this U-Haul Holding narrative.

Another View: Rich on Earnings Today

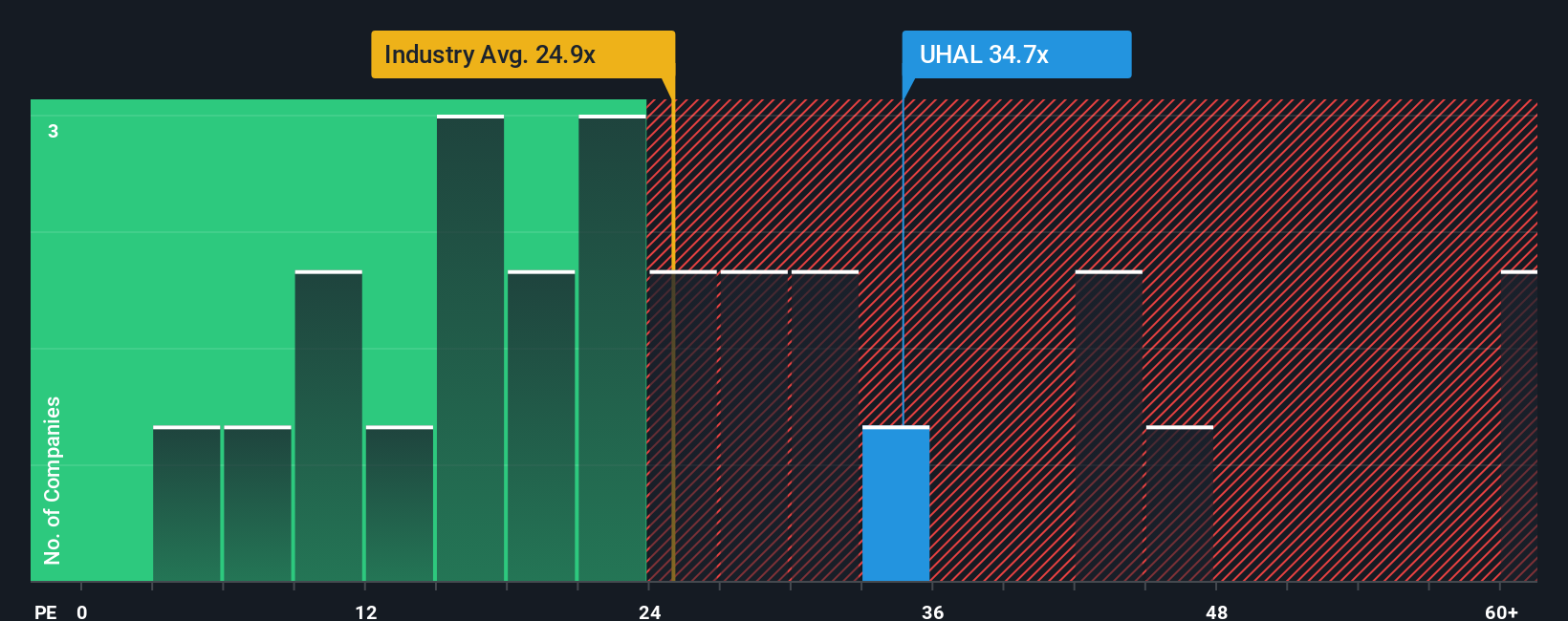

Those analyst targets argue U-Haul is undervalued, but its current price to earnings ratio of 45.8 times looks stretched versus the US transportation average of 30.9 times and peers at 40.1 times. If sentiment cools, could that premium multiple unwind faster than profits recover?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U-Haul Holding Narrative

If you want to dig into the numbers yourself and challenge this view, you can build a personalized story of U-Haul in minutes: Do it your way.

A great starting point for your U-Haul Holding research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunity by tapping into fresh stock ideas on Simply Wall Street to help stay a step ahead of slower investors.

- Explore potential price movements by scanning these 3602 penny stocks with strong financials that pair volatility with solid financial foundations.

- Look into the evolving productivity landscape by targeting these 30 healthcare AI stocks contributing to advancements in diagnostics, treatment pathways, and hospital efficiency.

- Review options for your income strategy by filtering for these 12 dividend stocks with yields > 3% that combine regular payouts with sustainable business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com