2 Defined-Risk Options Strategies to Trade Quarterly Earnings Without Gambling

Earnings season creates some of the biggest — and trickiest — moves in the market. Price gaps, volatility spikes, and rapid reversals are common, which is why many traders turn to options rather than buying or selling stock outright.

But there’s a problem: you can’t predict an earnings result. What you can do, however, is understand the expected move the options market is pricing in. That’s where Barchart’s options tools can give traders a statistical edge.

In Rick Orford’s latest video, he explains exactly how to trade earnings using defined-risk options strategies, with Nvidia (NVDA) as a real-world example.

While most companies won’t start reporting quarterly earnings until January, big reports like Oracle (ORCL) and tonight’s upcoming announcement from Broadcom (AVGO) are still moving markets – so now is a prime time to check out this explainer.

Why Expected Move Matters

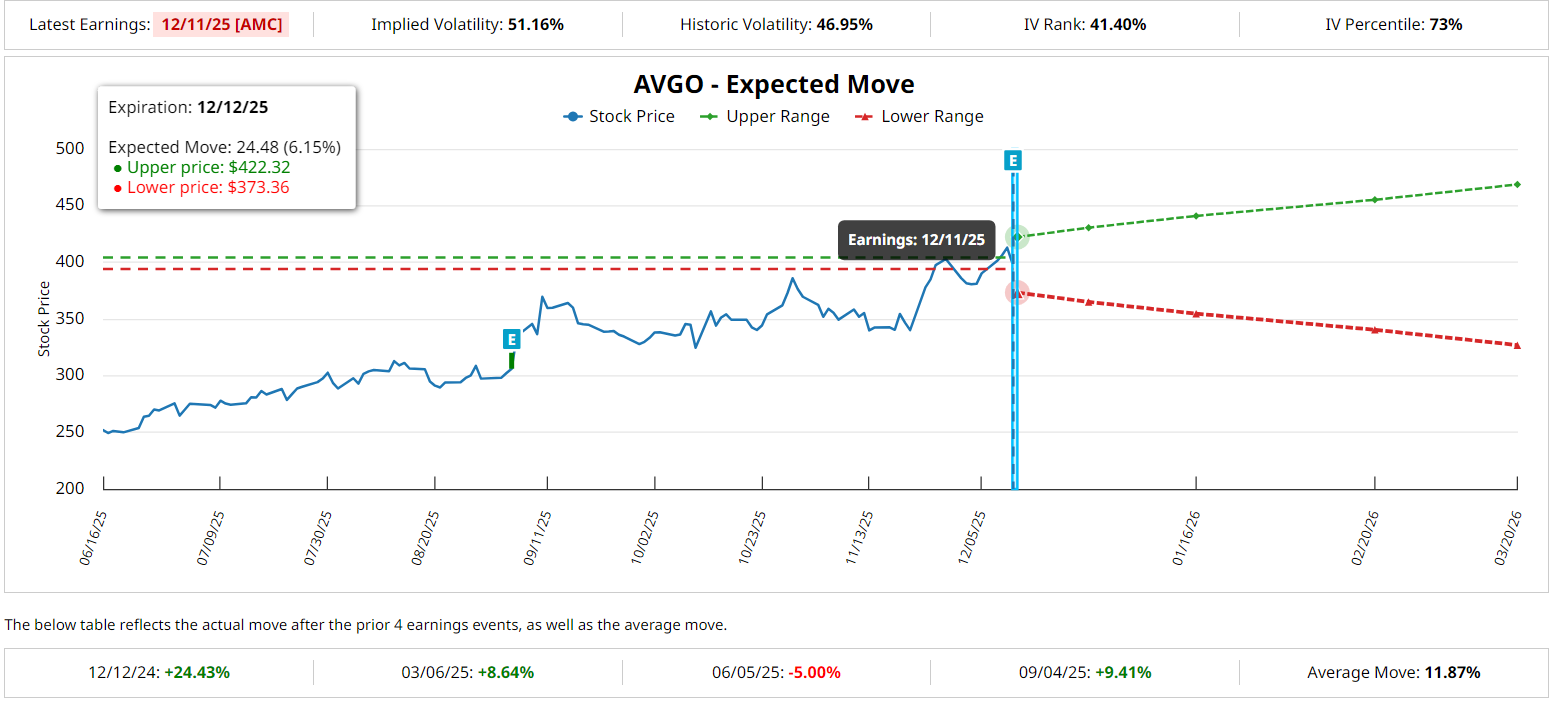

Expected move predicts a probable high and low price range for a stock based on the implied volatility (IV) levels priced into the puts and calls for each expiration date.

For earnings, the expected move is calculated as 85% of the at-the-money straddle premium for the expiration date that falls directly after the quarterly report.

Expected move tells you:

- The size of the stock move the market is pricing in

- Whether premiums are cheap or expensive on a volatility basis

- When risk-defined strategies make sense

You can find expected move:

- On any ticker’s Barchart Profile Page (navigation menu)

- Inside all Barchart Options Screeners within the Profit/Loss chart display

Expected move is the starting point for building smarter trades during earnings season.

The Second Key Metric: Average Earnings Move

Expected move shows what the market is forecasting. On the other hand, average earnings move shows what the stock has done historically, to put those expectations in context.

Barchart tracks the last four post-earnings reactions for every stock. This helps traders compare how the stock usually reacts after earnings, versus what kind of move the market is pricing in now.

For example, traders are pricing in just a 6.15% expected move for Broadcom after today’s post-close earnings, which is much smaller than the stock’s average 11.87% reaction over the past four quarters. This suggests relatively modest expectations for AVGO stock following tonight’s report.

Combining expected move + average earnings move gives you a real advantage.

NVDA Example: Understanding the Earnings Setup

In the clip, Rick highlights AI chip giant Nvidia as his case study:

- Going into the most recent quarterly release, NVDA’s average earnings move was just over 3%.

- The expected move implied a price swing of about 8%, between $186 and $219.

- That’s more than double its historical move — indicating relatively elevated volatility and inflated options premiums.

For investors who already own NVDA shares, Rick lays out a straightforward approach to trade this scenario.

Since the expected move range tops out near $219:

- Sell a $225 covered call (selecting a strike above the range)

- If NVDA stays below $225 at expiration, the call expires worthless

- The (elevated) options premium can be kept as profit, along with the shares

This approach lets traders generate income during high-volatility periods, without taking on directional risk ahead of earnings.

If you don’t own shares but want to add exposure, a cash-secured put is a smarter pre-earnings approach than YOLO’ing into long calls. It works like this:

- Sell a put below the current stock price

- Get paid up front at inflated pre-earnings prices

- If NVDA stays above the strike, 100% of the premium is kept as profit

- If NVDA drops below the strike, the premium decreases effective entry price on the stock

This is how disciplined traders buy high-quality stocks on the dip. And during earnings season, when options premiums are often inflated, the income opportunity can be even greater than usual.

Why These Strategies Work During Earnings Season

There are three reasons why these income strategies work during earnings season:

#1. Volatility can inflate premiums.

The time value component of options can become more expensive than usual ahead of earnings, which benefits option sellers.

#2. Expected move provides a roadmap for price.

While it’s not a guarantee on post-earnings price action, the expected move helps to highlight where the stock might be headed after the announcement. Layer on tools like gamma exposure for higher conviction on key price and pivot points.

#3. Risk-defined options trades reduce emotional decision-making.

These income-based strategies are rules-based, not speculative. Covered calls and cash-secured puts allow you to participate in the event without gambling on the earnings number.

How to Use Barchart Tools to Trade Earnings Smarter

Barchart gives Premier members everything needed to build a complete earnings-season playbook:

- Expected move display on every optionable ticker

- Average earnings move for historical context

- Covered Call Screener

- Naked Put / Cash-Secured Put Screener

- Earnings Calendar

- Options Screeners with profit/loss charts, IV, Greeks, and probability metrics

Whether you’re trading the Magnificent 7 or small-caps around earnings, all of the tools are already built right in.

Bottom Line

You can’t predict an earnings reaction, but you can build earnings trades with a little help from data, probability, and structure.

Data points like expected move and average earnings move give you a clearer picture of market expectations, while strategies like covered calls and cash-secured puts allow you to generate income or accumulate shares without taking unnecessary risks.

Earnings season doesn’t have to be a gamble. To see exactly how Rick sets these trades up using NVDA, watch the full clip:

- Stream Rick Orford’s full earnings season playbook

- Use Barchart’s options screeners to build your earnings trades now

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.