PepsiCo (PEP) Turnaround with Elliott: Reassessing Valuation After Cost Cuts, Price Changes and 2026 Targets

PepsiCo (PEP) just laid out a sweeping turnaround plan with activist investor Elliott that combines price cuts, a leaner US product lineup, and aggressive cost savings, and JPMorgan has already responded by turning more optimistic on the stock.

See our latest analysis for PepsiCo.

The flurry of activism news, refreshed guidance for 2025 and 2026, and even splashy marketing moves like the Mercedes F1 partnership help explain why PepsiCo’s recent 30 day share price return of 4.96% contrasts with its softer 1 year total shareholder return of negative 0.69%. This suggests momentum is only just starting to turn after a sluggish stretch.

If you are weighing PepsiCo’s turnaround against other consumer names, this could be a good moment to scan fast growing stocks with high insider ownership for fresh ideas where conviction and growth are already lining up.

With management calling PepsiCo undervalued and analysts only modestly above today’s price, the setup is finely balanced. So is this activist backed reset a genuine value entry point, or is Wall Street already baking in the rebound?

Most Popular Narrative: 3% Undervalued

With PepsiCo last closing at $149.70 against a narrative fair value near $154, the story leans toward modest upside and hinges on specific growth drivers.

Operational efficiencies from technology investments including AI, ERP systems, and the integration of North American businesses are enabling ongoing multiyear productivity gains, lowering fixed and variable costs, and supporting net margin improvement. (Expected impact: Operating margins and long term earnings.)

Curious how steady top line growth, rising margins, and a richer future earnings multiple can still point to only modest upside? Unpack the full narrative to see which assumptions really carry the valuation lift.

Result: Fair Value of $154.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower adoption of healthier products and execution missteps on aggressive cost cuts could quickly undermine the margin expansion story behind that modest upside.

Find out about the key risks to this PepsiCo narrative.

Another Lens on Value

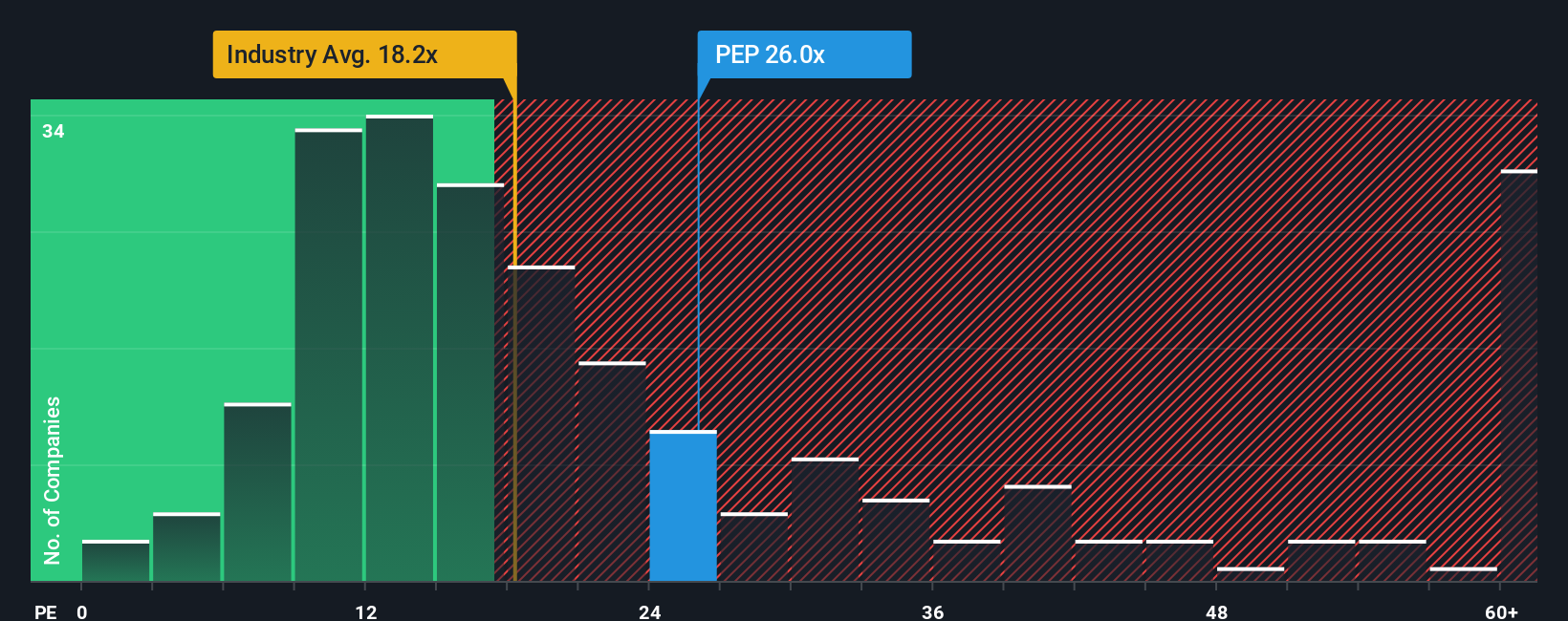

Step away from the narrative fair value and PepsiCo suddenly looks far richer. On a price to earnings ratio of 28.7x, it trades above both peers at 26.3x and the global beverage average at 17.6x, and even above a 26.9x fair ratio that our work suggests the market could drift toward.

That tilt toward the pricey side raises a simple question: if growth stumbles or the activist plan slips, does the multiple compress before the story can catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PepsiCo Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a personalized PepsiCo view in just minutes using Do it your way.

A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunity by scanning focused stock lists that spotlight strong income potential, mispriced growth, and powerful structural trends.

- Capture reliable income streams by zeroing in on these 12 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow.

- Position yourself ahead of the next innovation wave by targeting these 26 AI penny stocks shaping how businesses use intelligent technology.

- Review these 904 undervalued stocks based on cash flows that may be trading below their long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com