Eni (BIT:ENI): Assessing Valuation After Major Konta-1 Gas Discovery Offshore Indonesia

Eni (BIT:ENI) just confirmed a major gas discovery at its Konta-1 well offshore Indonesia, adding sizable new reserves that feed directly into its upstream growth plans and longer term cash flow story.

See our latest analysis for Eni.

Despite the pullback in the past week and month, with 7 day and 30 day share price returns of minus 2.73 percent and minus 3.40 percent respectively, Eni’s year to date share price return of 18.14 percent and 1 year total shareholder return of 28.11 percent suggest underlying momentum is still positive as investors weigh this latest discovery against an already improving multi year total shareholder return profile.

If this discovery has you rethinking your energy exposure, it could be worth exploring aerospace and defense stocks as another way to tap into companies tied to global security and infrastructure themes.

With shares trading at a modest discount to analyst targets and an even steeper gap to some intrinsic value estimates, does Eni still offer mispriced upside here or is the market already discounting its next leg of growth?

Most Popular Narrative Narrative: 3.2% Undervalued

Against Eni’s last close of €15.90, the most followed narrative sees fair value closer to €16.42, hinting at modest upside grounded in disciplined cash flow planning.

The analysts have a consensus price target of €15.33 for Eni based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €17.5, and the most bearish reporting a price target of just €13.5.

Curious what kind of slow top line, widening margins and future earnings multiple can still justify more upside from here? The narrative’s full blueprint might surprise you.

Result: Fair Value of €16.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Versalis losses and delayed Plenitude cash neutrality could pressure margins and cash flows, which may undermine the current undervaluation thesis.

Find out about the key risks to this Eni narrative.

Another Angle on Valuation

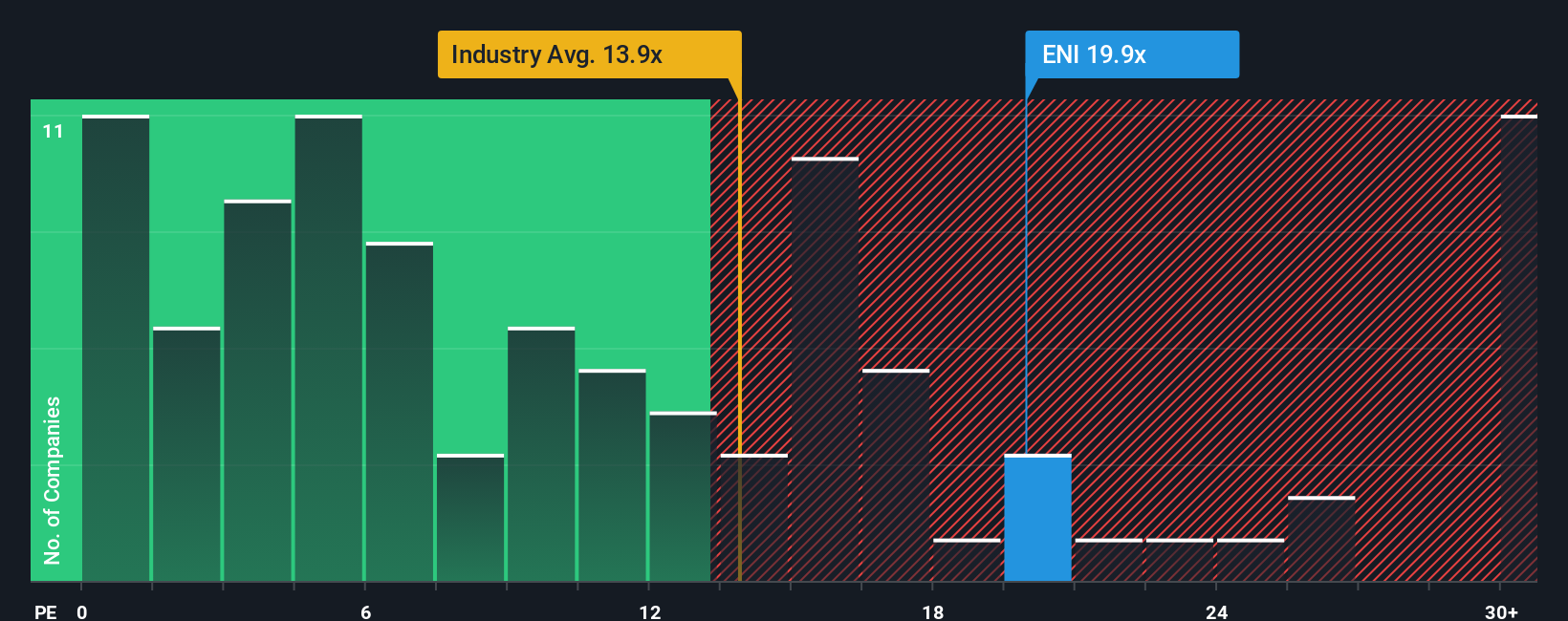

Analysts may see only a slim 3.5 percent discount to their €16.47 price target, but our earnings based ratio work paints a sharper split. Eni trades on 18.6 times earnings, richer than European oil and gas at 11.7 times yet below a 20.7 times fair ratio. This leaves investors to judge if that gap is upside or risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eni Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Eni research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Now is the moment to broaden your opportunity set. You may miss out if you stay on the sidelines while other investors act on focused, data driven stock ideas.

- Capture potential multibaggers early by using these 3603 penny stocks with strong financials targeting companies with strong financial underpinnings rather than pure speculation.

- Position yourself at the frontier of innovation through these 25 AI penny stocks that connect artificial intelligence breakthroughs with real revenue momentum.

- Explore value opportunities via these 904 undervalued stocks based on cash flows, where current prices lag behind underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com