How PSA’s Rent Softness and Aggressive Facility Acquisitions Will Impact Public Storage (PSA) Investors

- Public Storage recently reported an operating update showing that average annual contract rent per square foot for new tenants declined through November 2025, even as it moved to acquire or contract to acquire 88 self-storage facilities for US$949.4 million, adding 6.1 million net rentable square feet this year.

- The company’s latest investor presentation underlines how this expansion of 2,565 stabilized Same Store Facilities and newly acquired properties could influence future revenue drivers in a self-storage sector where pricing and demand appear to be stabilizing.

- We’ll now examine how Public Storage’s accelerating acquisition program, amid early signs of sector stabilization, may reshape its broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Public Storage Investment Narrative Recap

To own Public Storage, you need to believe that long term demand for self storage and the company’s scale can offset near term pricing pressure and cost inflation. The latest update, showing lower new tenant rents but continued acquisitions, does not materially change the key near term catalyst of sector pricing stabilization, nor the main risk around industry oversupply and discounting in competitive markets.

The operating update and recent investor presentation are central here, as they tie the 88-facility, US$949.4 million acquisition push and 6.1 million added rentable square feet directly to future revenue drivers. Together with commentary that storage pricing is starting to stabilize after a period of pressure, these disclosures help frame how new and Same Store assets might perform if move in rates recover while discount driven customer acquisition remains a risk.

But even if pricing is stabilizing, investors should still be aware that heavy use of move in discounts and marketing spend could...

Read the full narrative on Public Storage (it's free!)

Public Storage's narrative projects $5.3 billion revenue and $2.0 billion earnings by 2028. This requires 3.8% yearly revenue growth and a roughly $0.4 billion earnings increase from $1.6 billion today.

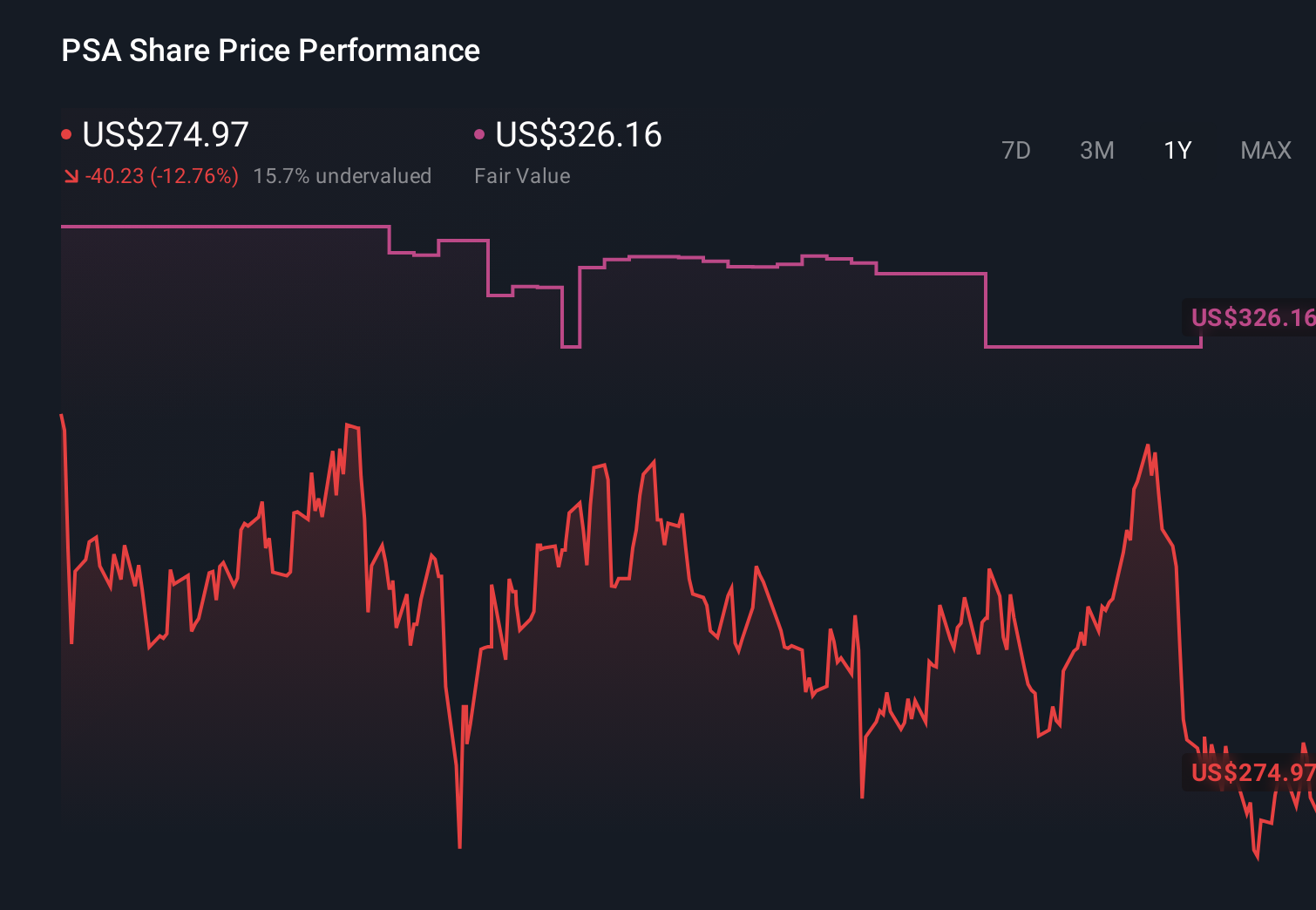

Uncover how Public Storage's forecasts yield a $326.16 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$260 to US$455 per share, showing how far apart individual views can be. You should weigh this spread against the risk that aggressive discounting to drive short term occupancy could strain margins and influence how the business performs if sector demand softens again.

Explore 5 other fair value estimates on Public Storage - why the stock might be worth just $260.01!

Build Your Own Public Storage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Public Storage research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Public Storage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Public Storage's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com