ABN AMRO (ENXTAM:ABN): Revisiting Valuation After Blackstone Risk Transfer Deal and Strong Share Price Momentum

ABN AMRO Bank (ENXTAM:ABN) just struck a major risk transfer deal with Blackstone, shifting first loss exposure on a 2 billion euro corporate loan portfolio. This move directly affects its capital flexibility.

See our latest analysis for ABN AMRO Bank.

The Blackstone deal lands at a time when momentum is clearly building, with ABN AMRO’s 30 day share price return of 9.78 percent feeding into a striking 98.86 percent year to date share price gain and a 118.90 percent one year total shareholder return. This suggests investors are reassessing its risk profile and growth runway.

If this kind of balance sheet reshaping has your attention, it could be a good moment to explore fast growing stocks with high insider ownership as you look for the next compelling opportunity.

With earnings momentum accelerating and a sizable intrinsic value gap still implied by some models, investors now face a crucial question: Is ABN AMRO still mispriced, or is the market already discounting its next leg of growth?

Most Popular Narrative Narrative: 30% Undervalued

With ABN AMRO Bank closing at €29.74 against a narrative fair value near €29.84, the story hinges on modest growth and tighter margins from here.

The analysts have a consensus price target of €24.78 for ABN AMRO Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €29.0, and the most bearish reporting a price target of just €18.5.

Want to see how steady revenue growth, slightly lower margins and a higher future earnings multiple still add up to upside potential? Unpack the full valuation blueprint.

Result: Fair Value of $29.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could be challenged if regulatory capital burdens tighten further or if the digital lag widens, which could compress margins and slow ABN AMRO’s growth trajectory.

Find out about the key risks to this ABN AMRO Bank narrative.

Another Angle on Valuation

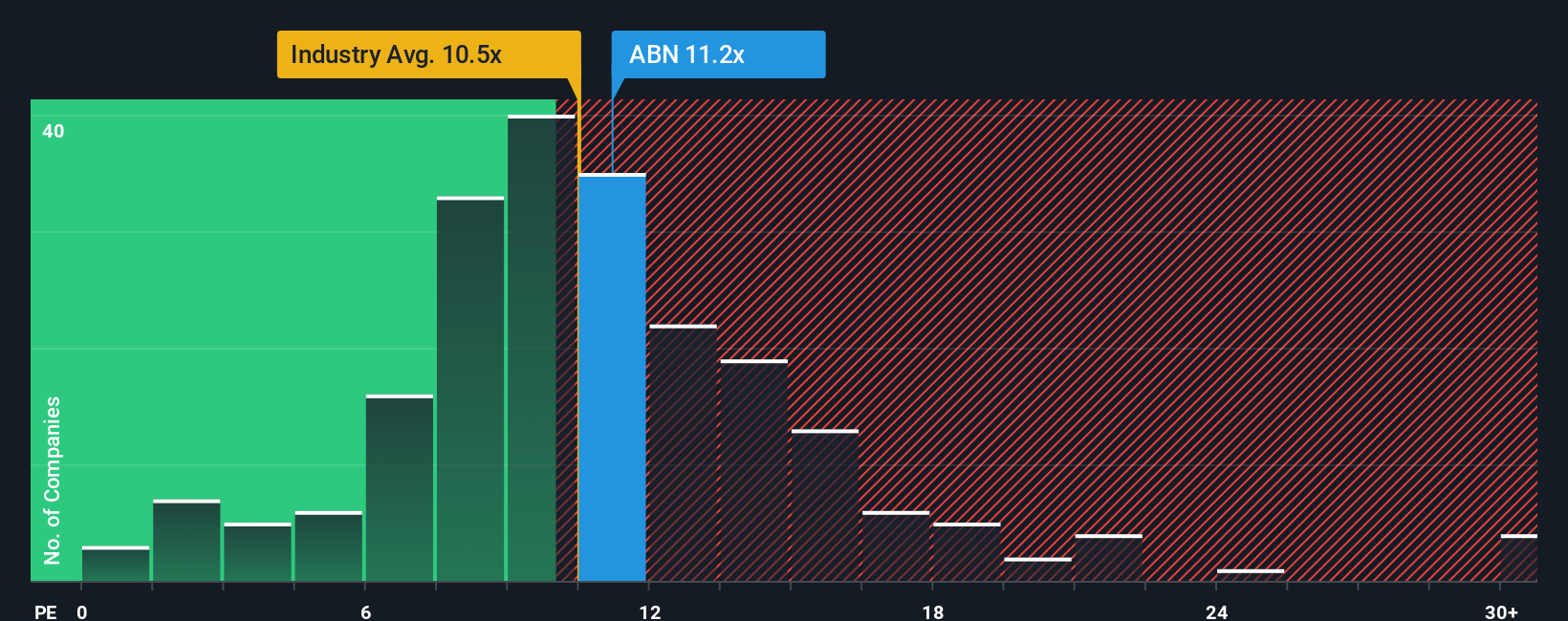

While the narrative fair value suggests ABN AMRO is undervalued, its current price to earnings ratio of 11.5 times looks a touch rich versus the European banks at 10.4 times and even above its own 11.4 times fair ratio. This hints that expectations may already be running hot.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ABN AMRO Bank Narrative

If this perspective does not fully align with your own view, dive into the numbers yourself and craft a fresh storyline in minutes, Do it your way.

A great starting point for your ABN AMRO Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Keep your momentum going by using the Simply Wall St Screener to pinpoint high conviction opportunities before the crowd does, so promising ideas never slip past you.

- Capture potential turnaround stories by scanning these 3607 penny stocks with strong financials that combine low share prices with robust fundamentals and improving business trajectories.

- Position yourself at the forefront of technological change by targeting these 25 AI penny stocks that harness artificial intelligence to scale revenue and reshape entire industries.

- Explore stronger risk reward setups by focusing on these 909 undervalued stocks based on cash flows that trade below their cash flow potential, while broader markets remain slow to react.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com