Nihon Parkerizing (TSE:4095) Has Affirmed Its Dividend Of ¥25.00

Nihon Parkerizing Co., Ltd. (TSE:4095) has announced that it will pay a dividend of ¥25.00 per share on the 30th of June. The dividend yield will be 3.6% based on this payment which is still above the industry average.

Nihon Parkerizing's Payment Could Potentially Have Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last dividend, Nihon Parkerizing is earning enough to cover the payment, but then it makes up 336% of cash flows. This signals that the company is more focused on returning cash flow to shareholders, but it could mean that the dividend is exposed to cuts in the future.

Looking forward, earnings per share could rise by 16.6% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 41%, which is in the range that makes us comfortable with the sustainability of the dividend.

See our latest analysis for Nihon Parkerizing

Nihon Parkerizing Has A Solid Track Record

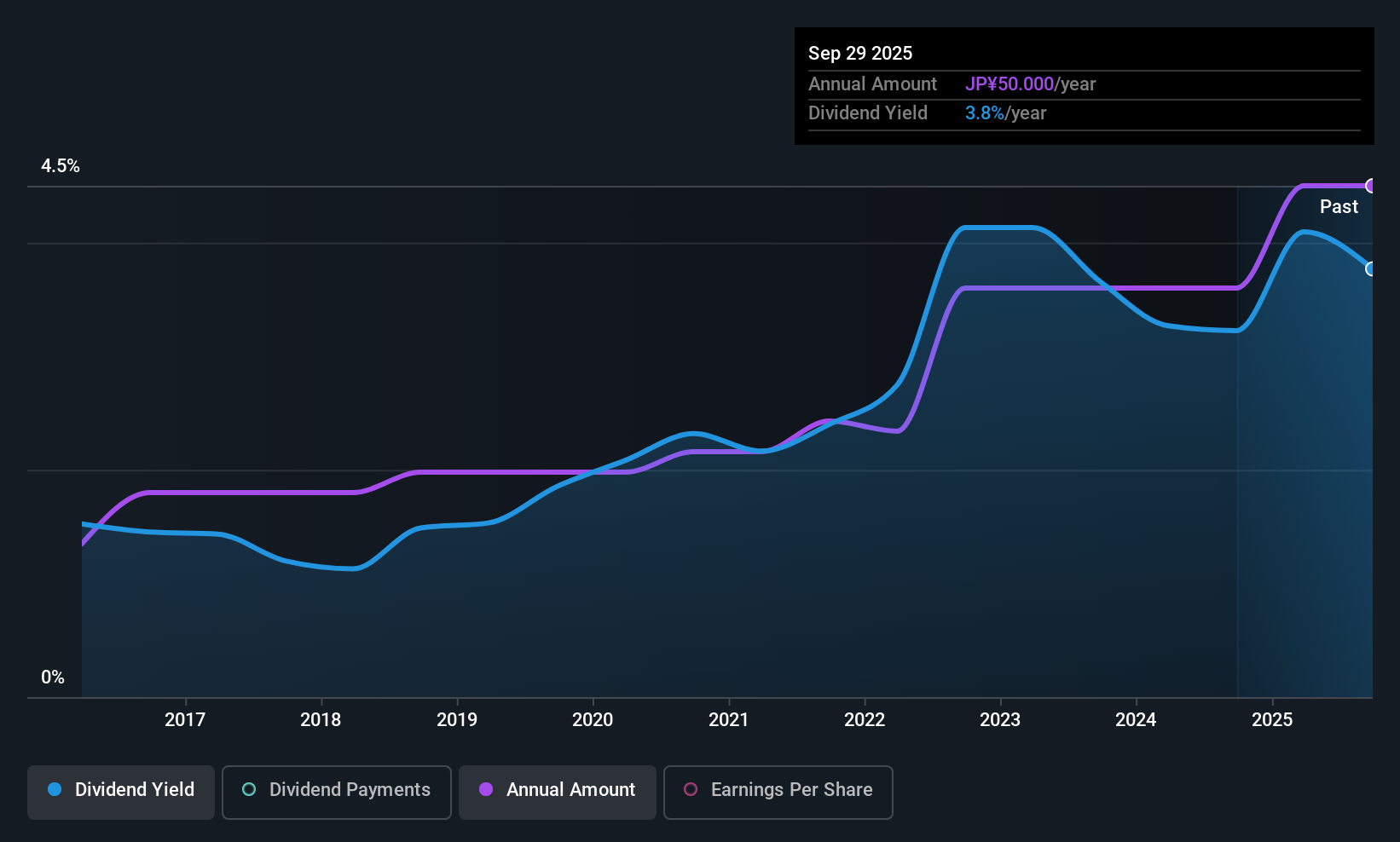

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The annual payment during the last 10 years was ¥15.00 in 2015, and the most recent fiscal year payment was ¥50.00. This implies that the company grew its distributions at a yearly rate of about 13% over that duration. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. Nihon Parkerizing has impressed us by growing EPS at 17% per year over the past five years. While on an earnings basis, this company looks appealing as an income stock, the cash payout ratio still makes us cautious.

Our Thoughts On Nihon Parkerizing's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Nihon Parkerizing that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.